Answered step by step

Verified Expert Solution

Question

1 Approved Answer

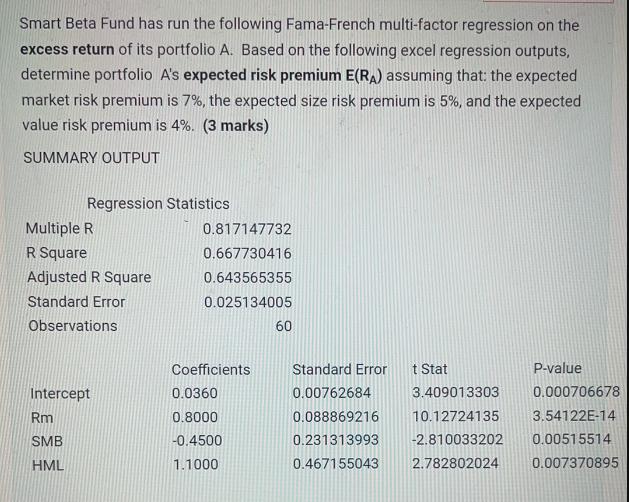

Smart Beta Fund has run the following Fama-French multi-factor regression on the excess return of its portfolio A. Based on the following excel regression

Smart Beta Fund has run the following Fama-French multi-factor regression on the excess return of its portfolio A. Based on the following excel regression outputs, determine portfolio A's expected risk premium E(RA) assuming that: the expected market risk premium is 7%, the expected size risk premium is 5%, and the expected value risk premium is 4%. (3 marks) SUMMARY OUTPUT Regression Statistics Multiple R 0.817147732 R Square 0.667730416 Adjusted R Square 0.643565355 Standard Error 0.025134005 Observations 60 Coefficients Standard Error t Stat P-value Intercept 0.0360 0.00762684 3.409013303 0.000706678 Rm 0.8000 0.088869216 10.12724135 3.54122E-14 SMB -0.4500 0.231313993 -2.810033202 0.00515514 HML 1.1000 0.467155043 2.782802024 0.007370895

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine portfolio As expected risk premium ERA we can use th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started