Answered step by step

Verified Expert Solution

Question

1 Approved Answer

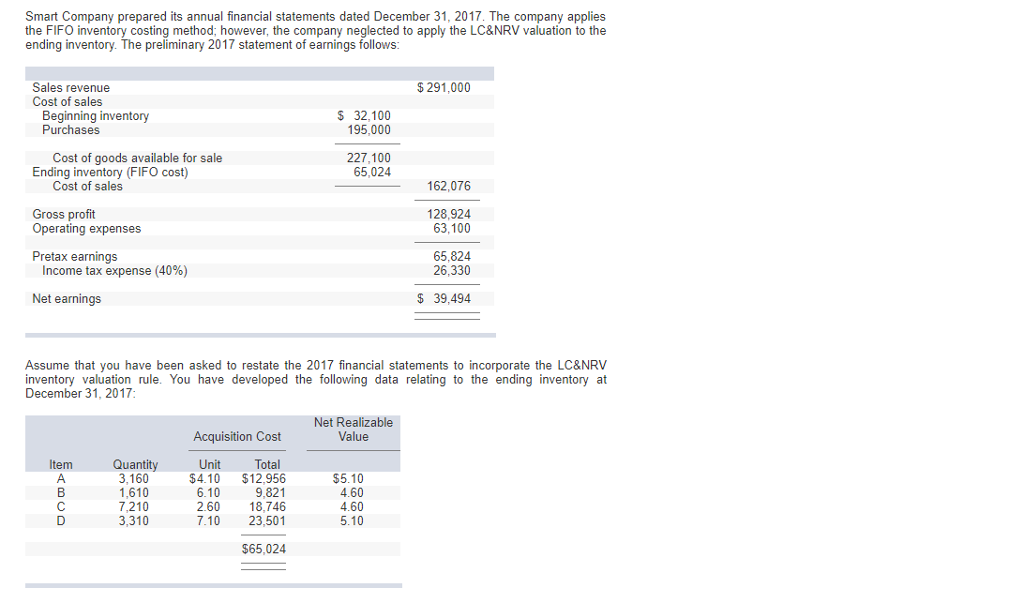

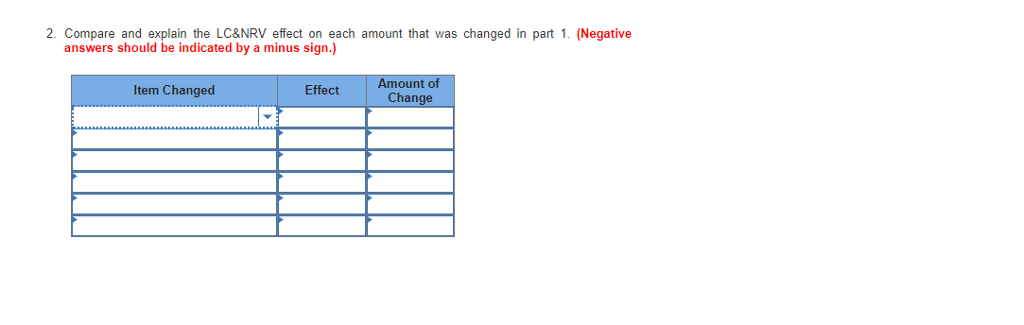

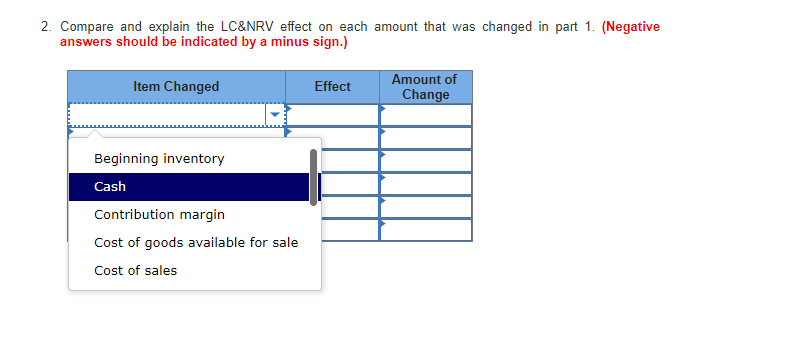

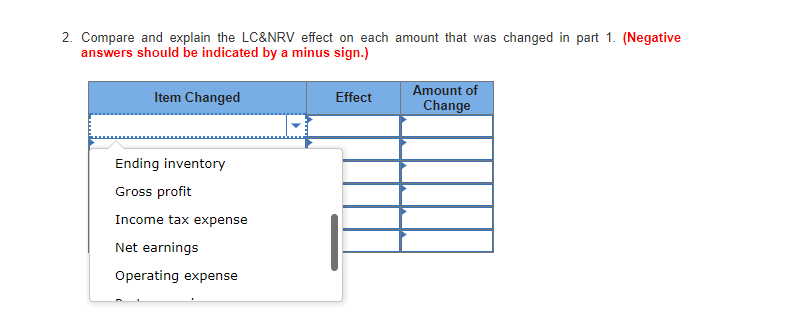

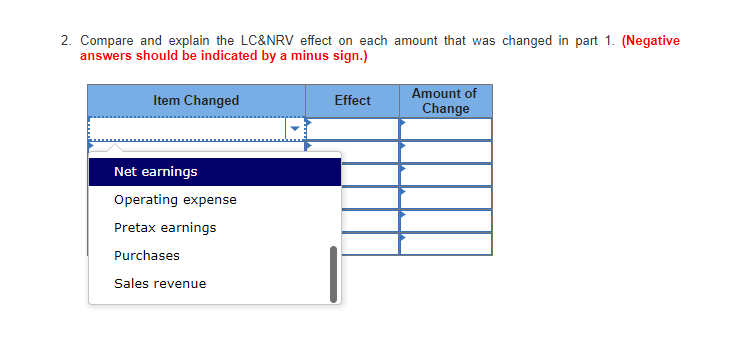

Smart Company prepared its annual financial statements dated December 31, 2017. The company applies the FIFO inventory costing method; however, the company neglected to apply

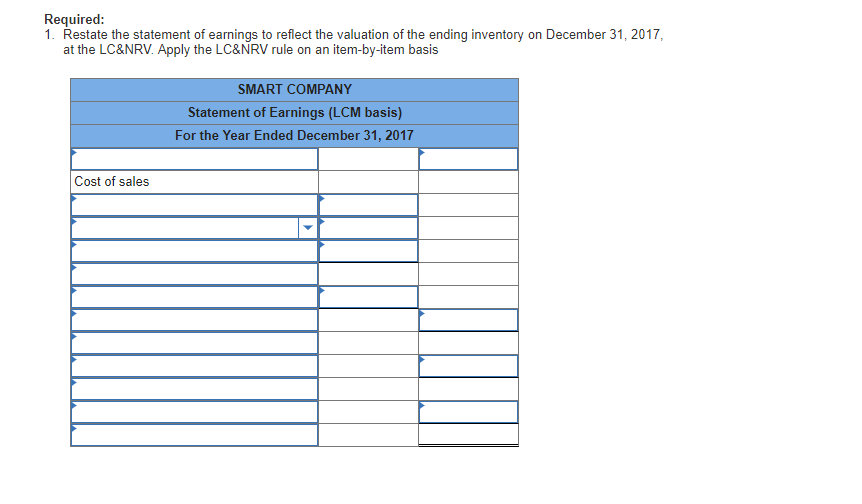

Smart Company prepared its annual financial statements dated December 31, 2017. The company applies the FIFO inventory costing method; however, the company neglected to apply the LC&NRV valuation to the ending inventory. The preliminary 2017 statement of earnings follows:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started