Question

Smart Kids Company (Smart Kids) is a music learning centre which provides piano, violin, cello and other music lessons for children. Students have to pay

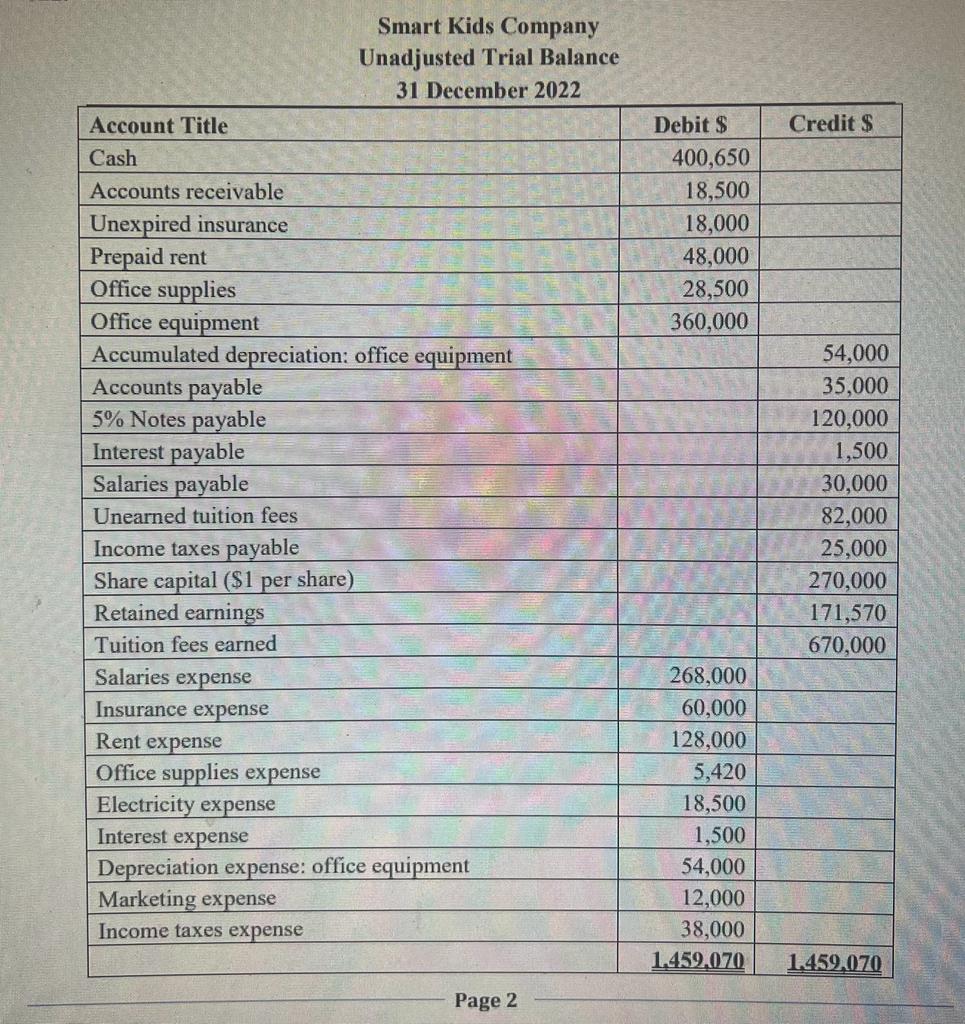

Smart Kids Company (“Smart Kids”) is a music learning centre which provides piano, violin, cello and other music lessons for children. Students have to pay Smart Kids in advance for the lessons and Smart Kids credits its “Unearned tuition fees” account. Adjusting entries are normally performed on a monthly basis. Closing entries are performed annually on 31 December 2022. Below is Smart Kids’s unadjusted trial balance as at 31 December 2022.

Information on adjusting entries:

(1) Office supplies on hand at year end was $20,000.

(2) Salaries earned by Smart Kids’ employees that have not yet been recorded and paid amount to $15,000.

(3) Records show that 80% of unearned tuition fees had been earned as of 31 December 2022.

(4) On 1 September 2022, the Company paid medical insurance premium for its employees six months in advance.

(5) The Company borrowed $120,000 by signing a 3-year notes payable with annual interest rate of 5% on 1 August 2022. Note interest is paid annually at 31 December. No entries were made for (i)the accrued interest of November and December and (ii) the payment of the interest for 2022.

(6) The office equipment was bought on 1 March 2022 with useful life of 5 years and no residual value. The Company adopts straight-line method for depreciation.

(7) On 1 December 2022, the Company signed 1-year rental agreement to rent a new office and paid $48,000 in advance.

(8) On 31 December 2022, the Company declared and paid a dividend of $0.1 per share. No entry has been made.

(9) $8,500 of the accounts receivable was collected on 30 December 2022. No entry has been recorded.

(10) Estimated income taxes expense for the entire year totals $50,000. Taxes are due in the first quarter of the upcoming year.

Required:

(a) Prepare the necessary adjusting journal entries on 31 December 2022 to bring the financial records of Smart Kids Co. up-to-date. Use the account titles given in the Trial Balance or create new accounts where appropriate. Show your workings. Explanations are NOT required

(b) Prepare the income statement for the year ended 31 December 2022, showing breakdown of items under the captions of Revenues, Expenses, Profit before Taxes, Profit after Taxes.

(c) Prepare the statement of financial position as of 31 December 2022, showing breakdown of items under the captions of Total Assets, Total Liabilities, Total Shareholders’ Equity and Total Liabilities & Shareholders’ Equity.

(d) Record its year-end closing journal entries. Explanations are NOT required.

Account Title Cash Accounts receivable Unexpired insurance Prepaid rent Office supplies Office equipment Accumulated depreciation: office equipment Accounts payable 5% Notes payable Interest payable Salaries payable Unearned tuition fees Income taxes payable Share capital ($1 per share) Retained earnings Tuition fees earned Salaries expense Insurance expense Smart Kids Company Unadjusted Trial Balance 31 December 2022 Rent expense Office supplies expense Electricity expense Interest expense Depreciation expense: office equipment Marketing expense Income taxes expense Page 2 Debit $ 400,650 18,500 18,000 48,000 28,500 360,000 268,000 60,000 128,000 5,420 18,500 1,500 54,000 12,000 38,000 1.459,070 Credit $ 54,000 35,000 120,000 1,500 30,000 82,000 25,000 270,000 171,570 670,000 1.459,070

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Adjusting Journal Entries as of 31 December 2022 1 Adjust Office Supplies Debit Office Supplies Expense 8500 Credit Office Supplies 8500 2 Recognize ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started