Question

Smart Ltd is a business selling small electronic gadgets to the public and to other companies in bulk that started operating on 1 July 2019.

Smart Ltd is a business selling small electronic gadgets to the public and to other companies in bulk that started operating on 1 July 2019. The following information is available at the end of the first financial period of operation (i.e. on 30 June 2020):

- Total sales made and recognised as revenues were $730,000, out of which $438,000 was received in cash by 30 June 2020. The cost of inventory sold was not yet recognised as an expense.

- A customer that owes the company $5,840 was experiencing financial difficulties and Smart Ltd recognised during the period that is doubtful that the amount can be collected. At 30 June 2020, Smart Ltd received news that the customer won’t be able to pay the amount owed and further estimated that another amount of $67,160 may not be collectable.

- Purchases of inventory during the period amounted to $489,100. A physical stocktake at 30 June 2020 revealed that Smart Ltd still has on hand inventory that the company originally purchased for $63,600.

- Smart Ltd only has delivery vehicles as non-current assets. Those were purchased on 1 July 2019 for $124,100 and are expected to be used in the business for 3 years, after which they will be sold for $1,100 in cash. Smart Ltd uses the straight-line method of depreciation for those vehicles. One of those delivery vehicles originally purchased for $21,097 (expected residual value of $187) was sold at 30 June 2020 for $5,970.

- Smart Ltd incurred $14,600 rent expense, $14,454 electricity and gas expense, $35,989 vehicles running costs and $116,800 wages expense. All of these were recognised as expenses already, with the exception of $1,217 in rent that is still recognised as a prepayment and $2,246 wages not yet recognised.

Assume that the following opening balances existed in the balance sheet for Smart Ltd at the beginning of the current period:

Account name | Opening balance |

|---|---|

Cash | $41500 |

Inventory | $48725 |

Accounts receivable | $67000 |

Accounts payable | $58500 |

Share capital | $59500 |

Retained earnings | ? |

There are no dividends declared for the current period and no reserve accounts under equity.

Required:

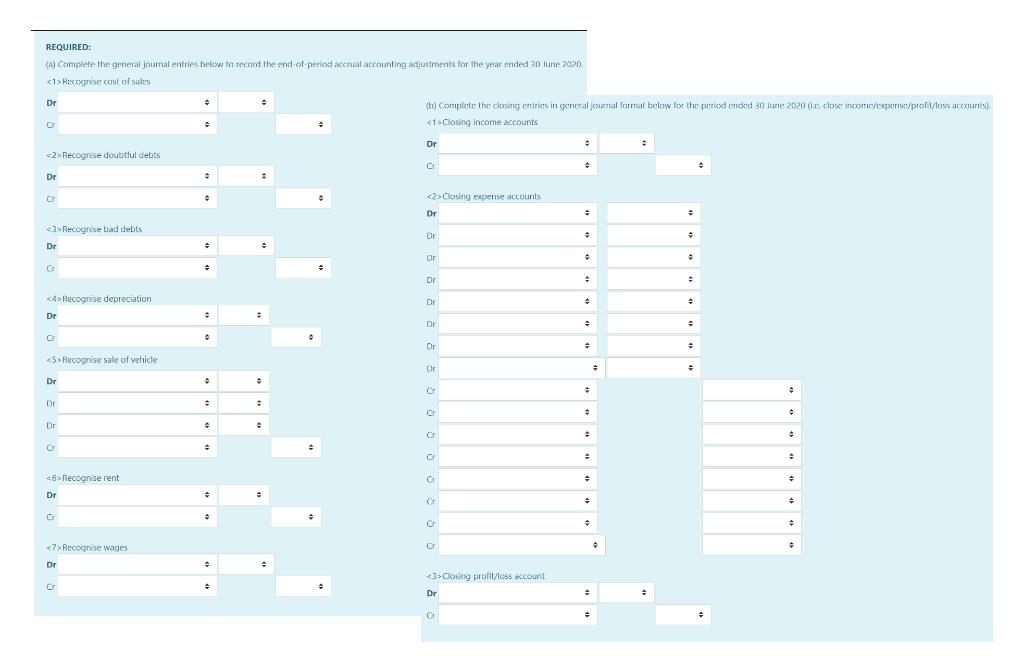

REQUIRED: (a) Complete the general journal erntries below to record the end-of-peried accrual accounting acdjustments for the year ended 30 lune 2020. Recoxgnise cost of sakes Dr (b) Complete the ckosing entries in general journal format below for the pericod ended 30 lune 2n20 (ie. close incomc/expense/profit/lnss accounts) Cr Closing income accounts Dr Recognise doubtful debts Cr Dr Cr Closing expense accounts Dr Recognise bad debts Dr Dr Dr. Dr Recognise depreciation Dr Dr Dr Cr Dr Recognise sale of vehicle Dr Dr Dr Cr Dr Cr Cr Cr Recognise rent Dr Cr Recognise wages Dr Closing profit/loss account Cr Dr

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Dr Cost of Goods Sold 473625 Cr Inventory 473625 4872548910063600 2 Dr All...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started