Question: Smart Touch Learning began operations on December 1 by receiving $25,100 cash and furniture of a fair value of $10,900 from James Miller. The business

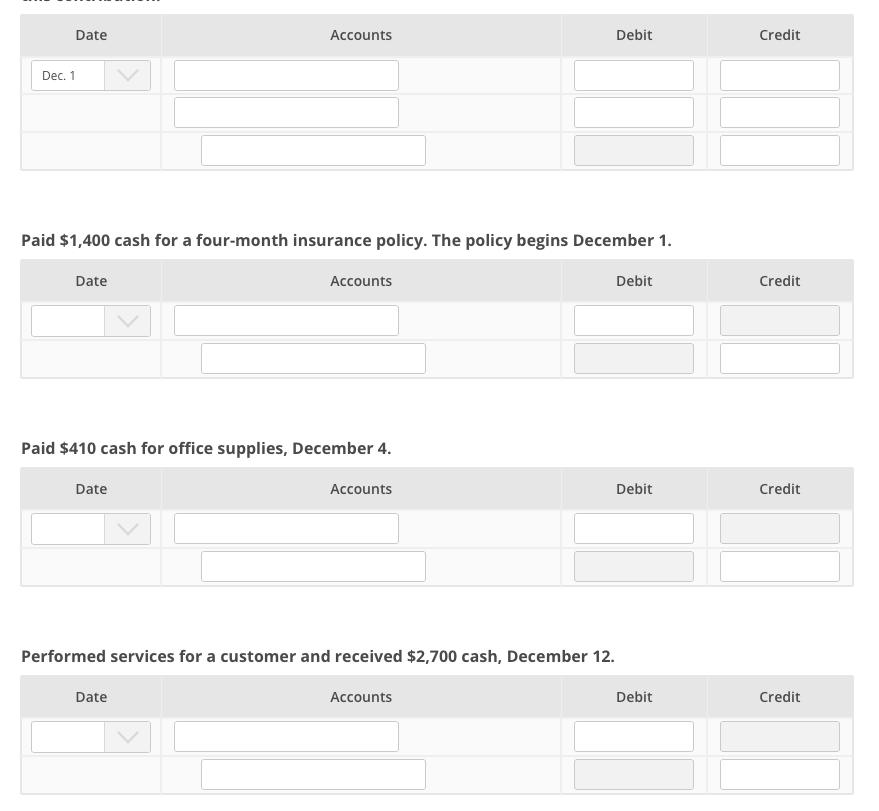

Smart Touch Learning began operations on December 1 by receiving $25,100 cash and furniture of a fair value of $10,900 from James Miller. The business issued Miller shares of common stock in exchange for this contribution.

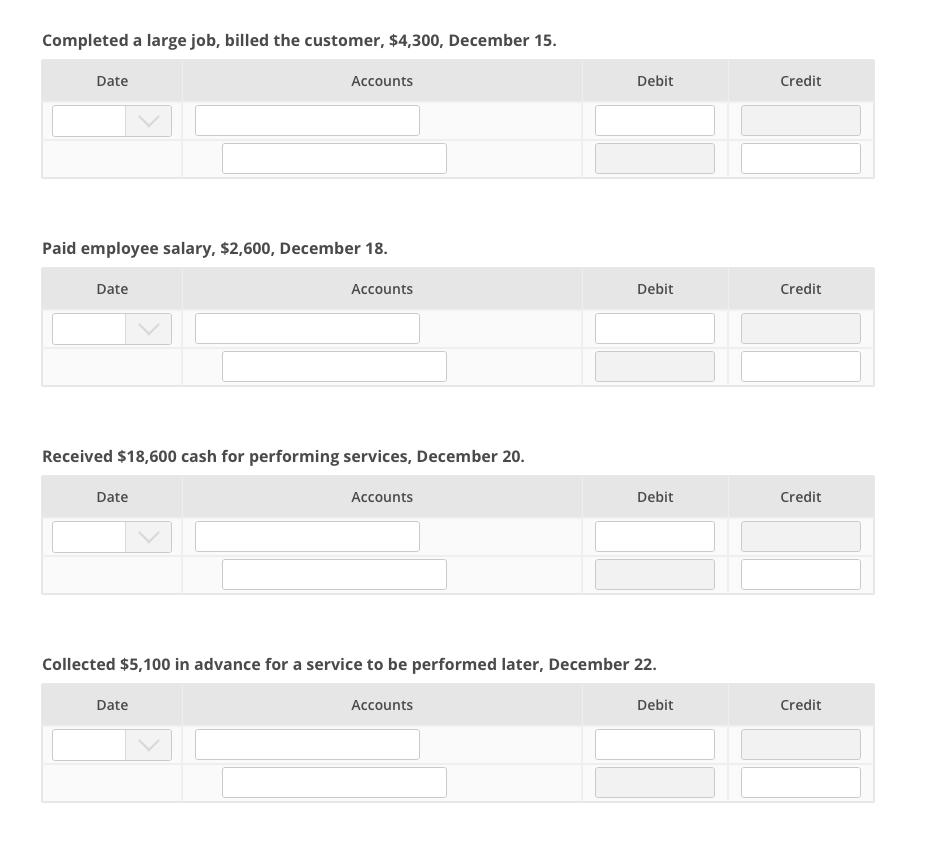

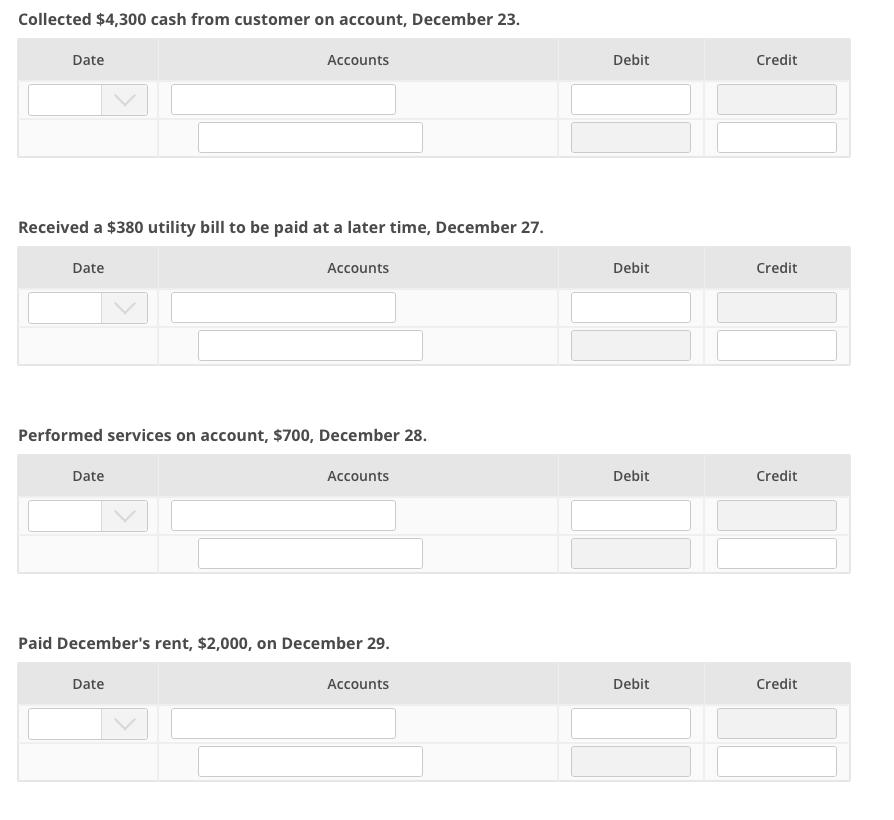

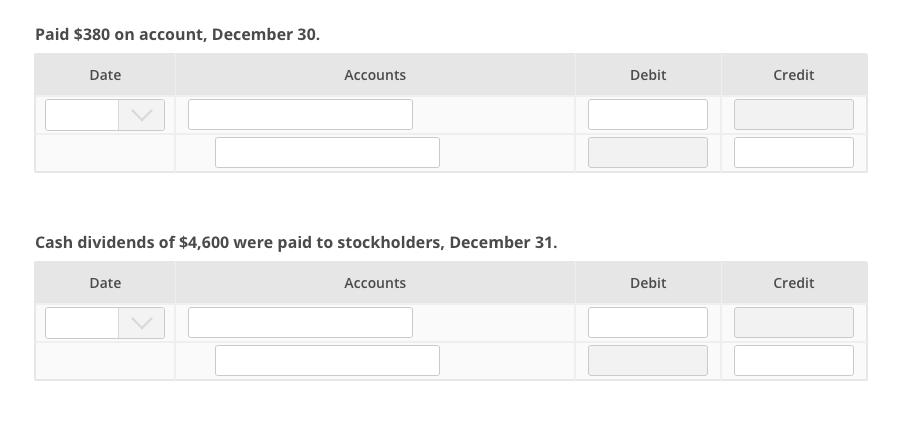

Date Accounts Debit Credit Dec. 1 Paid $1,400 cash for a four-month insurance policy. The policy begins December 1. Date Accounts Debit Credit Paid $410 cash for office supplies, December 4. Date Accounts Debit Credit Performed services for a customer and received $2,700 cash, December 12. Date Accounts Debit Credit

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Date Accounts Debit Credit Dec 01 Cash 26400 Furniture 9100 ... View full answer

Get step-by-step solutions from verified subject matter experts