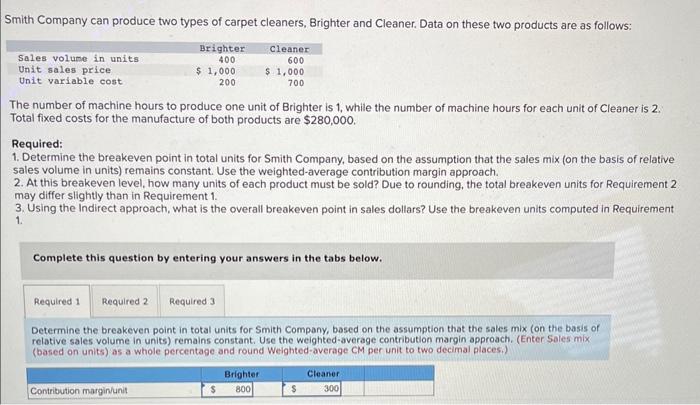

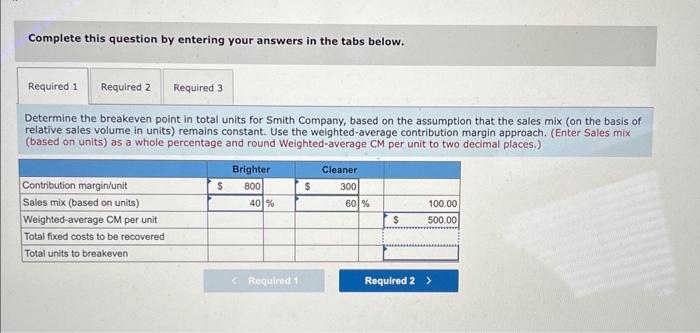

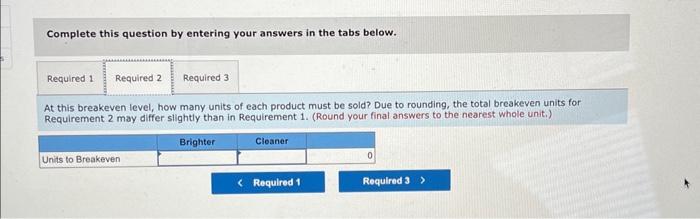

Smith Company can produce two types of carpet cleaners, Brighter and Cleaner. Data on these two products are as follows: The number of machine hours to produce one unit of Brighter is 1, while the number of machine hours for each unit of Cleaner is 2. Total fixed costs for the manufacture of both products are $280,000. Required: 1. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted-average contribution margin approach. 2. At this breakeven level, how many units of each product must be sold? Due to rounding, the total breakeven units for Requirement 2 may differ slightly than in Requirement 1. 3. Using the Indirect approach, what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requirement 1. Complete this question by entering your answers in the tabs below. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted-average contribution margin approach. (Enter Sales mix (based on units) as a whole percentage and round Weighted-average CM per unit to two decimal places.) Complete this question by entering your answers in the tabs below. At this breakeven level, how many units of each product must be sold? Due to rounding, the total breakeven units for Requirement 2 may differ slightly than in Requirement 1. (Round your final answers to the nearest whole unit.) Complete this question by entering your answers in the tabs below. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted-average contribution margin approach. (Enter Sales mix (based on units) as a whole percentage and round Weighted-average CM per unit to two decimal places.) Complete this question by entering your answers in the tabs below. Using the Indirect approach, what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requirement 1, (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) Smith Company can produce two types of carpet cleaners, Brighter and Cleaner. Data on these two products are as follows: The number of machine hours to produce one unit of Brighter is 1, while the number of machine hours for each unit of Cleaner is 2. Total fixed costs for the manufacture of both products are $280,000. Required: 1. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted-average contribution margin approach. 2. At this breakeven level, how many units of each product must be sold? Due to rounding, the total breakeven units for Requirement 2 may differ slightly than in Requirement 1. 3. Using the Indirect approach, what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requirement 1. Complete this question by entering your answers in the tabs below. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted-average contribution margin approach. (Enter Sales mix (based on units) as a whole percentage and round Weighted-average CM per unit to two decimal places.) Complete this question by entering your answers in the tabs below. At this breakeven level, how many units of each product must be sold? Due to rounding, the total breakeven units for Requirement 2 may differ slightly than in Requirement 1. (Round your final answers to the nearest whole unit.) Complete this question by entering your answers in the tabs below. Determine the breakeven point in total units for Smith Company, based on the assumption that the sales mix (on the basis of relative sales volume in units) remains constant. Use the weighted-average contribution margin approach. (Enter Sales mix (based on units) as a whole percentage and round Weighted-average CM per unit to two decimal places.) Complete this question by entering your answers in the tabs below. Using the Indirect approach, what is the overall breakeven point in sales dollars? Use the breakeven units computed in Requirement 1, (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.)