Answered step by step

Verified Expert Solution

Question

1 Approved Answer

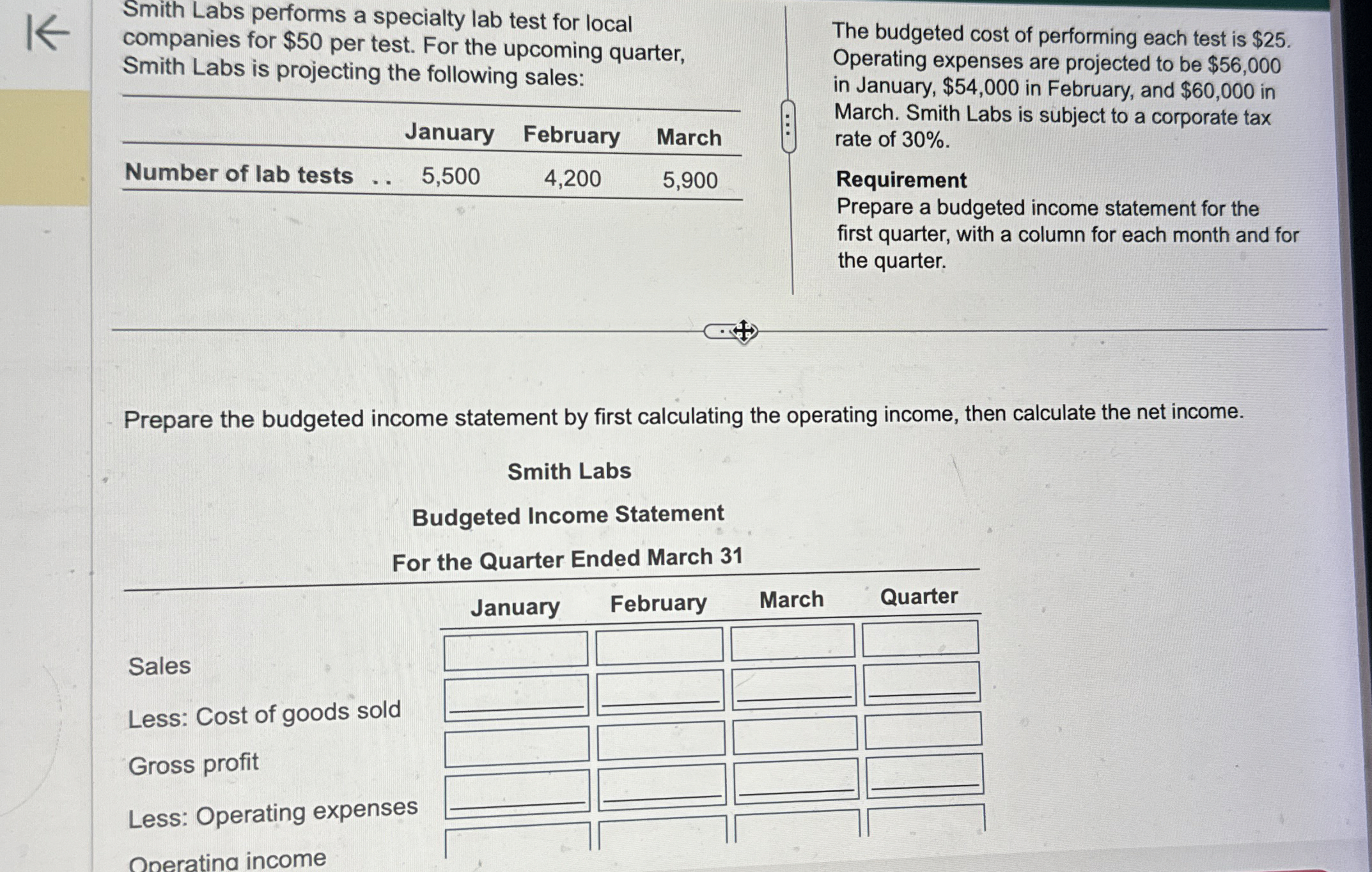

Smith Labs performs a specialty lab test for local companies for $ 5 0 per test. For the upcoming quarter, Smith Labs is projecting the

Smith Labs performs a specialty lab test for local companies for $ per test. For the upcoming quarter, Smith Labs is projecting the following sales:

tableJanuary,February,March,Number of lab tests,dots,

The budgeted cost of performing each test is $ Operating expenses are projected to be $ in January, $ in February, and $ in March. Smith Labs is subject to a corporate tax rate of

Requirement

Prepare a budgeted income statement for the first quarter, with a column for each month and for the quarter.

Prepare the budgeted income statement by first calculating the operating income, then calculate the net income.

Smith Labs

Budgeted Income Statement

For the Quarter Ended March

Sales

Less: Cost of goods sold

Gross profit

Less: Operating expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started