Smith Ltd is a small company established in Exeter some years ago. Over the last couple of years, the company has been facing tough competition

Project A requires an initial capital investment of £160,000 with an expected economic life of five years, and no residual value at the end of the five-year period. Annual accounting profit after depreciation is expected to be £40,000 over the economic life of the project.

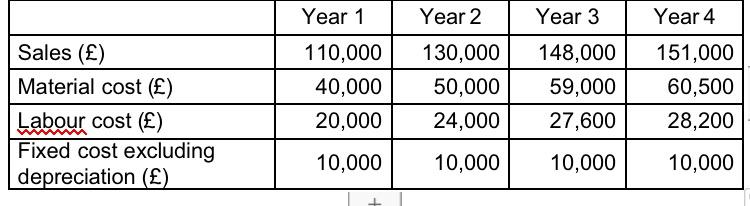

Project B requires an initial capital investment of £80,000 with an expected economic life of four years, and no residual value at the end of the four-year period. Expected sales and costs are summarised in the table below:

The information below is relevant for both projects:

The information below is relevant for both projects:

All sales are expected to be cash sales, and all costs are expected to be paid for in cash as and when incurred.

Depreciation is charged on a straight-line basis over the economic life of each project.

Depreciation is the only adjustment difference between accounting profit and cash flows for each project.

Required:

(a)

(i) Calculate for each project the payback period (Assume that cash flows will occur evenly throughout the year).

(ii) Advise the management of Smith limited as to which to which project to select in (a) (i) above.

(b)

(i) Calculate the NPV of Project B using a cost of capital of 9%. (Assume that all cash flows occur at the year-end).

(ii) Comment on the viability of the project.

(c) For Project B: calculate the breakeven point in sales revenue for year 3.

(d) In the third year of Project B, 700 units of the product were budgeted to be produced and sold.

(i) Calculate for the third year the unit cost of the product under marginal costing and absorption costing.

(ii) What would be the impact of the difference in unit costs calculated in (d) (i) on the year-end profit under the two costing methods?

(iii) If the production exceeds sales, explain which method would expect to show the higher profit, marginal costing or absorption costing.

Sales () Material cost () Labour cost () Fixed cost excluding depreciation () Year 1 Year 2 110,000 130,000 40,000 50,000 20,000 24,000 10,000 10,000 Year 3 148,000 59,000 27,600 10,000 Year 4 151,000 60,500 28,200 10,000

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer a i To calculate the payback period for each project we need to determine the time it takes for the initial investment to be recovered from the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started