Question

Smithen Company, a wholesale distributor, has been operating for only a few months. The company sells three productssinks, mirrors, and vanities. Budgeted sales by product

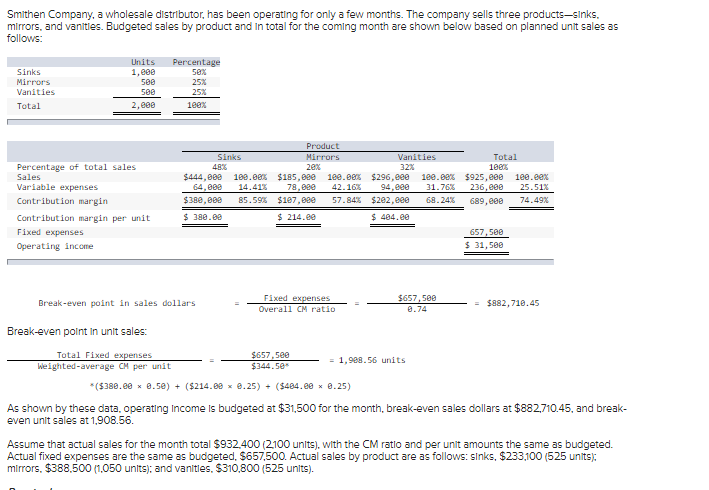

Smithen Company, a wholesale distributor, has been operating for only a few months. The company sells three productssinks, mirrors, and vanities. Budgeted sales by product and in total for the coming month are shown below based on planned unit sales as follows: Units Percentage Sinks 1,000 50 % Mirrors 500 25 % Vanities 500 25 % Total 2,000 100 % Product Sinks Mirrors Vanities Total Percentage of total sales 48 % 20 % 32 % 100 % Sales $ 444,000 100.00 % $ 185,000 100.00 % $ 296,000 100.00 % $ 925,000 100.00 % Variable expenses 64,000 14.41 % 78,000 42.16 % 94,000 31.76 % 236,000 25.51 % Contribution margin $ 380,000 85.59 % $ 107,000 57.84 % $ 202,000 68.24 % 689,000 74.49 % Contribution margin per unit $ 380.00 $ 214.00 $ 404.00 Fixed expenses 657,500 Operating income $ 31,500 Break-even point in sales dollars = Fixed expenses = $657,500 = $882,710.45 Overall CM ratio 0.74 Break-even point in unit sales: Total Fixed expenses = $657,500 = 1,908.56 units Weighted-average CM per unit $344.50* *($380.00 0.50) + ($214.00 0.25) + ($404.00 0.25) As shown by these data, operating income is budgeted at $31,500 for the month, break-even sales dollars at $882,710.45, and break-even unit sales at 1,908.56. Assume that actual sales for the month total $932,400 (2,100 units), with the CM ratio and per unit amounts the same as budgeted. Actual fixed expenses are the same as budgeted, $657,500. Actual sales by product are as follows: sinks, $233,100 (525 units); mirrors, $388,500 (1,050 units); and vanities, $310,800 (525 units).

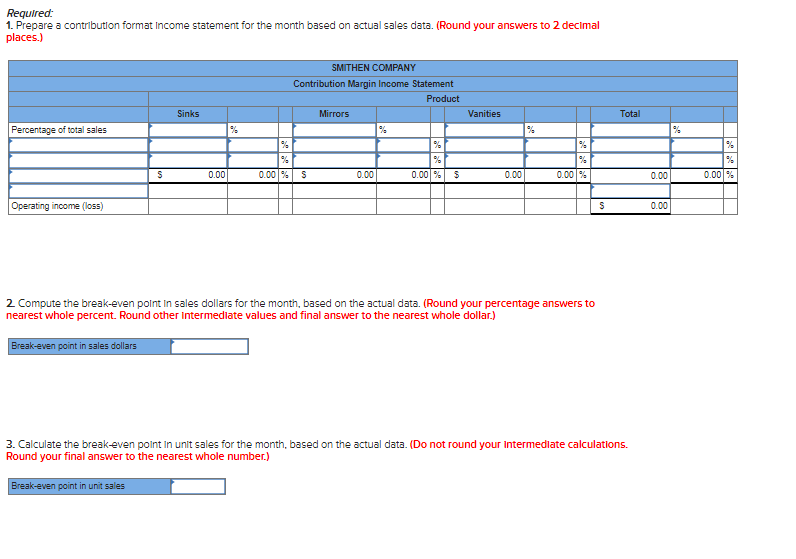

Required: 1. Prepare a contribution format Income statement for the month based on actual sales data. (Round your answers to 2 decimal places.) 2 Compute the break-even point In sales dollars for the month, based on the actual data. (Round your percentage answers to nearest whole percent. Round other intermedlate values and final answer to the nearest whole dollar.) 3. Calculate the breakeven point in unit sales for the month, based on the actual data. (Do not round your intermedlate calculations. Round your final answer to the nearest whole number.) Smithen Company, a wholesale distributor, has been operating for only a few months. The company sells three products-sinks, mirrors, and vanitles. Budgeted sales by product and in total for the coming month are shown below based on planned unit sales as follows: break-even point in unit saies: Total Fixed expenses Weighted-average CM per unit =$344.50$$657,500=1,998.56 units ($380.000.50)+($214.600.25)+($464.000.25) As shown by these data, operating Income is budgeted at $31,500 for the month, break-even sales dollars at $882,710.45, and breakeven unit sales at 1,908.56. Assume that actual sales for the month total $932,400 (2100 unlts), with the CM ratlo and per unit amounts the same as budgeted. Actual fixed expenses are the same as budgeted, $657,500. Actual sales by product are as follows: sinks, $233,100 (525 units): mirrors, $388,500 (1,050 units); and vanitles, $310,800 (525 units)

Required: 1. Prepare a contribution format Income statement for the month based on actual sales data. (Round your answers to 2 decimal places.) 2 Compute the break-even point In sales dollars for the month, based on the actual data. (Round your percentage answers to nearest whole percent. Round other intermedlate values and final answer to the nearest whole dollar.) 3. Calculate the breakeven point in unit sales for the month, based on the actual data. (Do not round your intermedlate calculations. Round your final answer to the nearest whole number.) Smithen Company, a wholesale distributor, has been operating for only a few months. The company sells three products-sinks, mirrors, and vanitles. Budgeted sales by product and in total for the coming month are shown below based on planned unit sales as follows: break-even point in unit saies: Total Fixed expenses Weighted-average CM per unit =$344.50$$657,500=1,998.56 units ($380.000.50)+($214.600.25)+($464.000.25) As shown by these data, operating Income is budgeted at $31,500 for the month, break-even sales dollars at $882,710.45, and breakeven unit sales at 1,908.56. Assume that actual sales for the month total $932,400 (2100 unlts), with the CM ratlo and per unit amounts the same as budgeted. Actual fixed expenses are the same as budgeted, $657,500. Actual sales by product are as follows: sinks, $233,100 (525 units): mirrors, $388,500 (1,050 units); and vanitles, $310,800 (525 units) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started