Answered step by step

Verified Expert Solution

Question

1 Approved Answer

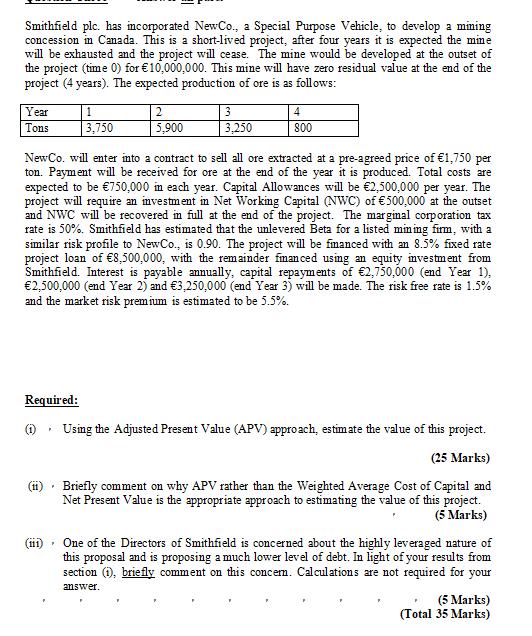

Smithfield plc. has incorporated NewCo., a Special Purpose Vehicle, to develop a mining concession in Canada. This is a short-lived project, after four years

Smithfield plc. has incorporated NewCo., a Special Purpose Vehicle, to develop a mining concession in Canada. This is a short-lived project, after four years it is expected the mine will be exhausted and the project will cease. The mine would be developed at the outset of the project (time 0) for 10,000,000. This mine will have zero residual value at the end of the project (4 years). The expected production of ore is as follows: Year 1 Tons 3,750 Required: (11) 2 5,900 New Co. will enter into a contract to sell all ore extracted at a pre-agreed price of 1,750 per ton. Payment will be received for ore at the end of the year it is produced. Total costs are expected to be 750,000 in each year. Capital Allowances will be 2,500,000 per year. The project will require an investment in Net Working Capital (NWC) of 500,000 at the outset and NWC will be recovered in full at the end of the project. The marginal corporation tax rate is 50%. Smithfield has estimated that the unlevered Beta for a listed mining firm, with a similar risk profile to NewCo., is 0.90. The project will be financed with an 8.5% fixed rate project loan of 8,500,000, with the remainder financed using an equity investment from Smithfield. Interest is payable annually, capital repayments of 2,750,000 (end Year 1), 2,500,000 (end Year 2) and 3,250,000 (end Year 3) will be made. The risk free rate is 1.5% and the market risk premium is estimated to be 5.5%. P 3 3,250 4 800 Using the Adjusted Present Value (APV) approach, estimate the value of this project. (25 Marks) Briefly comment on why APV rather than the Weighted Average Cost of Capital and Net Present Value is the appropriate approach to estimating the value of this project. (5 Marks) (111) One of the Directors of Smithfield is concerned about the highly leveraged nature of this proposal and is proposing a much lower level of debt. In light of your results from section (1), briefly comment on this concern. Calculations are not required for your answer. (5 Marks) (Total 35 Marks)

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Using the Adjusted Present Value APV approach we can estimate the value of the project as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started