Question

SNAP share price is currently $320. The continuously-compounded riskfree rate of interest is 10% pa. SNAP does not pay dividends. You notice that forward

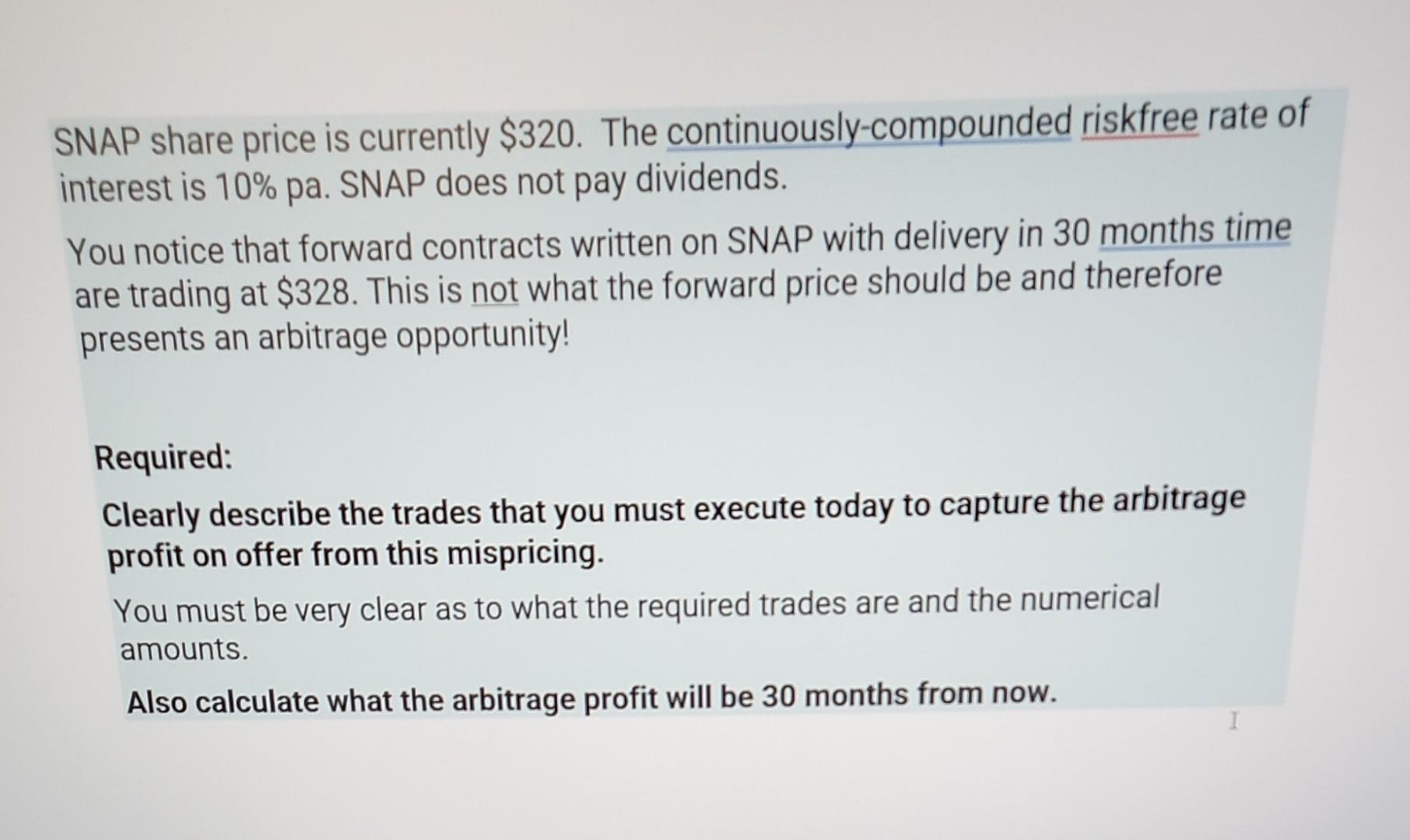

SNAP share price is currently $320. The continuously-compounded riskfree rate of interest is 10% pa. SNAP does not pay dividends. You notice that forward contracts written on SNAP with delivery in 30 months time are trading at $328. This is not what the forward price should be and therefore presents an arbitrage opportunity! Required: Clearly describe the trades that you must execute today to capture the arbitrage profit on offer from this mispricing. You must be very clear as to what the required trades are and the numerical amounts. Also calculate what the arbitrage profit will be 30 months from now. I

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Ans Forward contracts are the type of derivatives whose value is derived from a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App