Snow Corporation acquired all of the outstanding $10 par voting common stock of Lannister, Inc., on January 1, Year 2, in exchange for 50,000 shares

Snow Corporation acquired all of the outstanding $10 par voting common stock of Lannister, Inc., on January 1, Year 2, in exchange for 50,000 shares of its $10 par voting common stock. On December 31, Year 1, Snow's common stock had a closing market price of $15 per share on a national stock exchange. Both companies continued to operate as separate business entities maintaining separate accounting records with years ending December 31.

- At the acquisition date, the fair value of Lannister's machinery exceeded its carrying amount by $54,000. The excess will be amortized over the estimated average remaining life of 6 years. The fair values of all of Lannister's other assets and liabilities were equal to their carrying amounts.

- On July 1, Year 2, Snow sold a warehouse facility to Lannister for $129,000 cash. At the date of sale, Snow's carrying amounts were $33,000 for the land and $66,000 for the undepreciated cost of the building. Lannister allocated the $129,000 purchase price to the land for $43,000 and to the building for $86,000. Lannister is depreciating the building over its estimated 5-year remaining useful life by the straight-line method with no salvage value.

- During Year 2, Snow purchased merchandise from Lannister at an aggregate invoice price of $180,000, which included a 100% markup on Lannister's cost. At December 31, Year 2, Snow owed Lannister $75,000 on these purchases, and $36,000 of the merchandise purchased remained in Snow's inventory.

- At December 31, Year 2, Lannister paid $40,000 in dividends on its common stock.

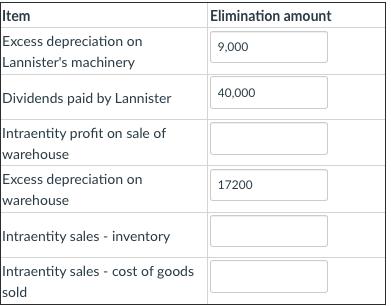

Calculate Snow's eliminations for consolidation using the information above. Enter the appropriate amounts in the designated cells below.

Item Excess depreciation on Lannister's machinery Dividends paid by Lannister Intraentity profit on sale of warehouse Excess depreciation on warehouse Intraentity sales inventory Intraentity sales - cost of goods sold Elimination amount 9,000 40,000 17200

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 sale price of warehouse Less Carrying value of warehouse 33000 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started