Question

Snow Me Now Liquidating Partnerships Prior to liquidating their partnership, Perkins and Gentry had capital accounts of $34,000 and $51,000, respectively. Prior to liquidation,

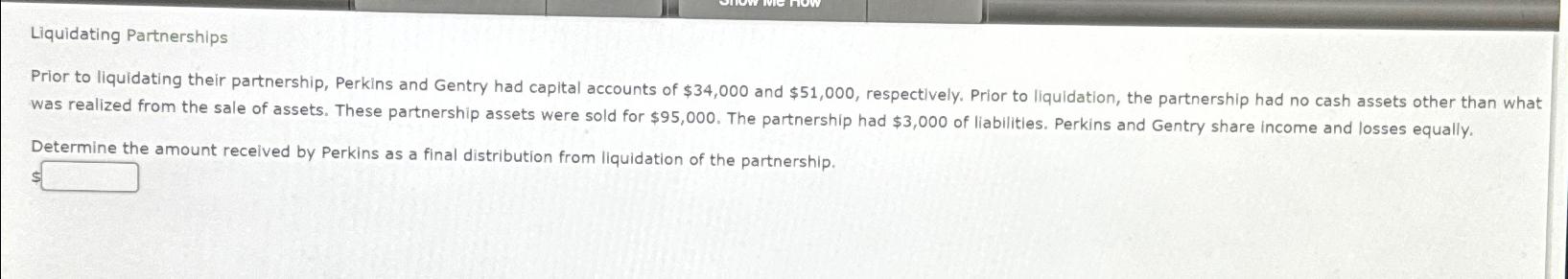

Snow Me Now Liquidating Partnerships Prior to liquidating their partnership, Perkins and Gentry had capital accounts of $34,000 and $51,000, respectively. Prior to liquidation, the partnership had no cash assets other than what was realized from the sale of assets. These partnership assets were sold for $95,000. The partnership had $3,000 of liabilities. Perkins and Gentry share income and losses equally. Determine the amount received by Perkins as a final distribution from liquidation of the partnership.

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The image displays a question about a partnership between Perkins and Gentry that is being liquidate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider

28th Edition

1337902683, 978-1337902687

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App