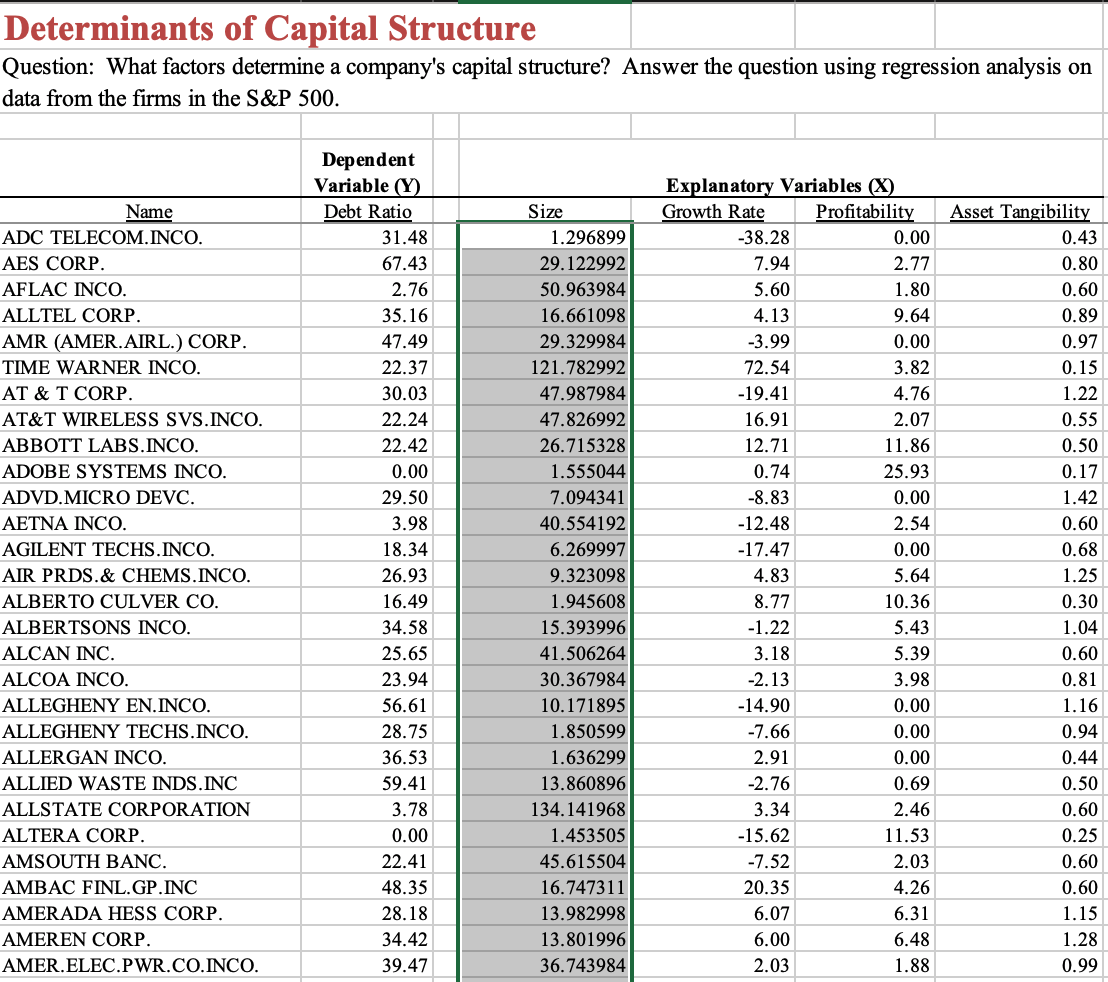

So here are 3 screen shots from a workbook. I'm not sure how to figure out these questions that are asked given the data. what is the process for completing these questions? Thanks!

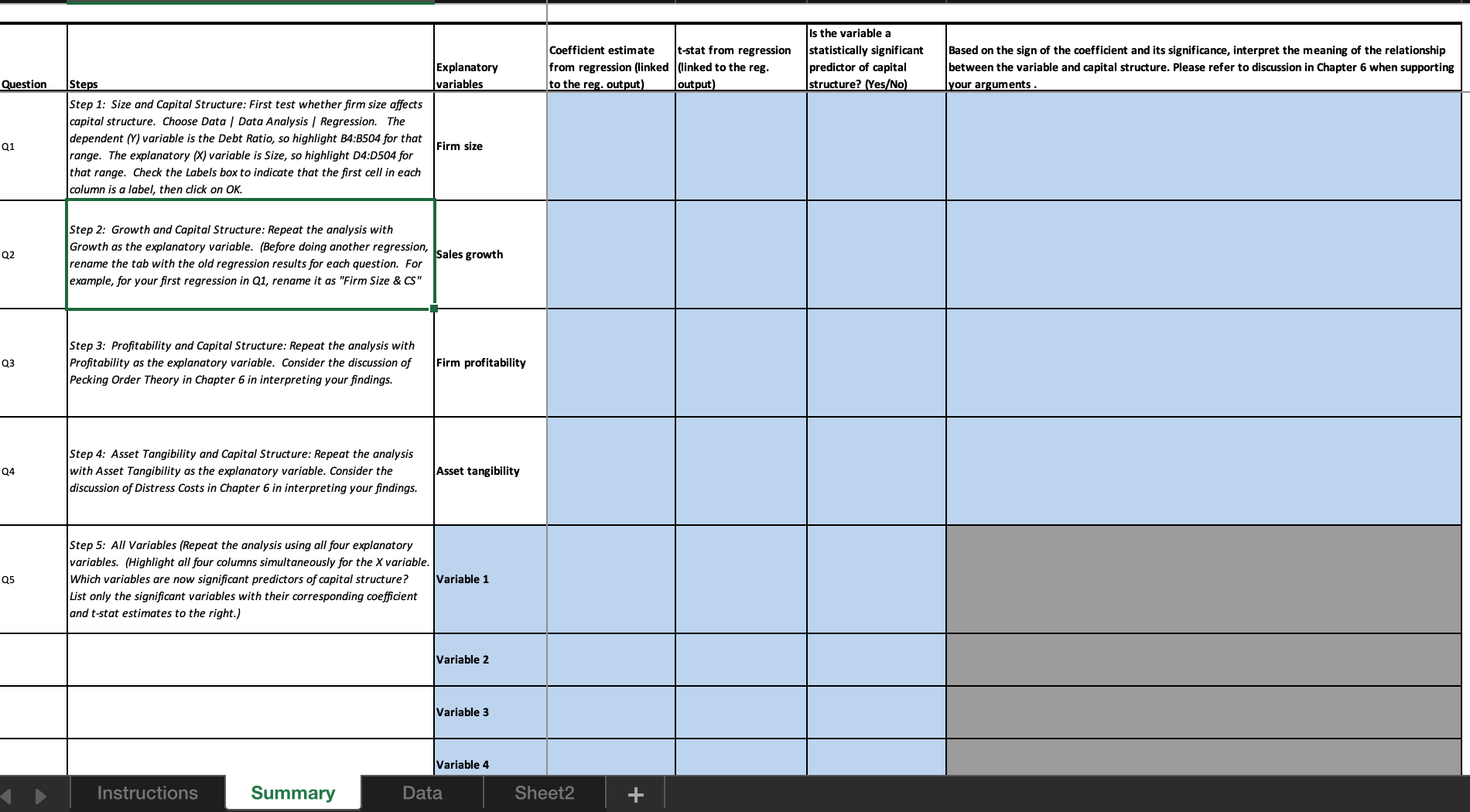

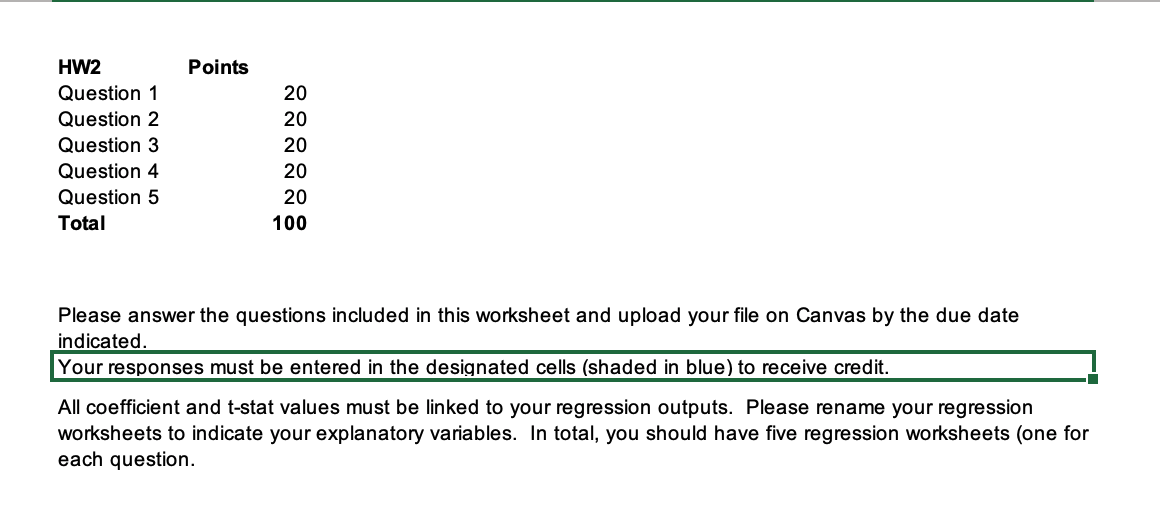

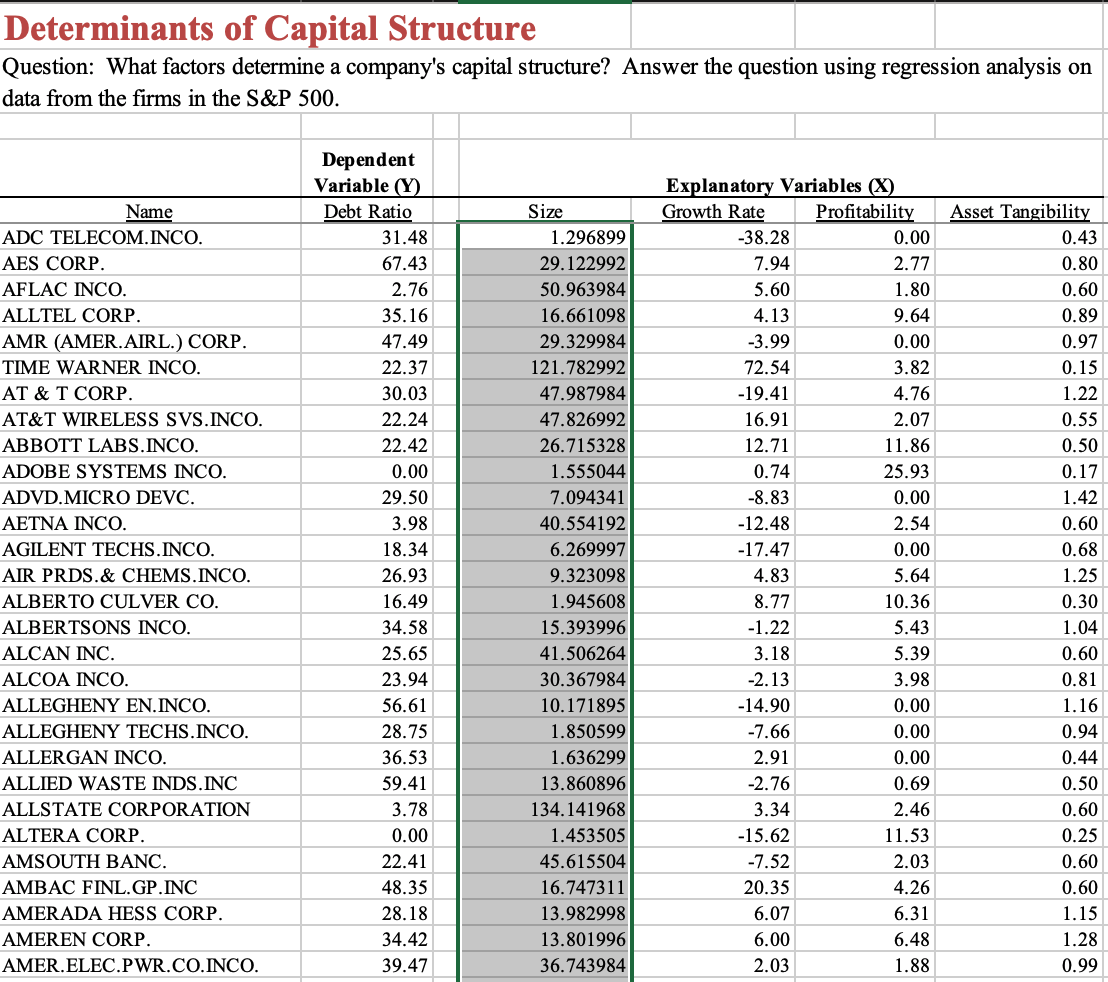

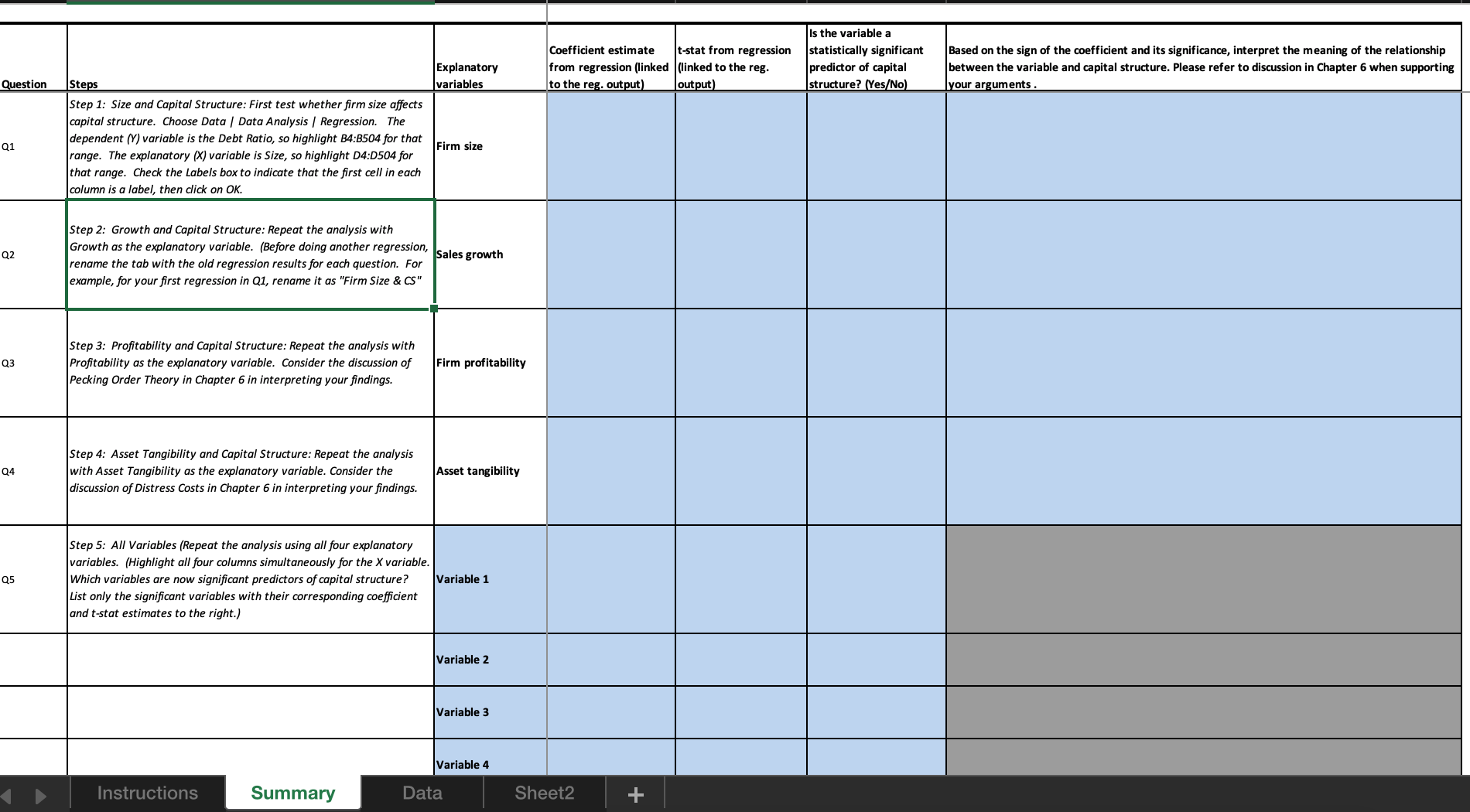

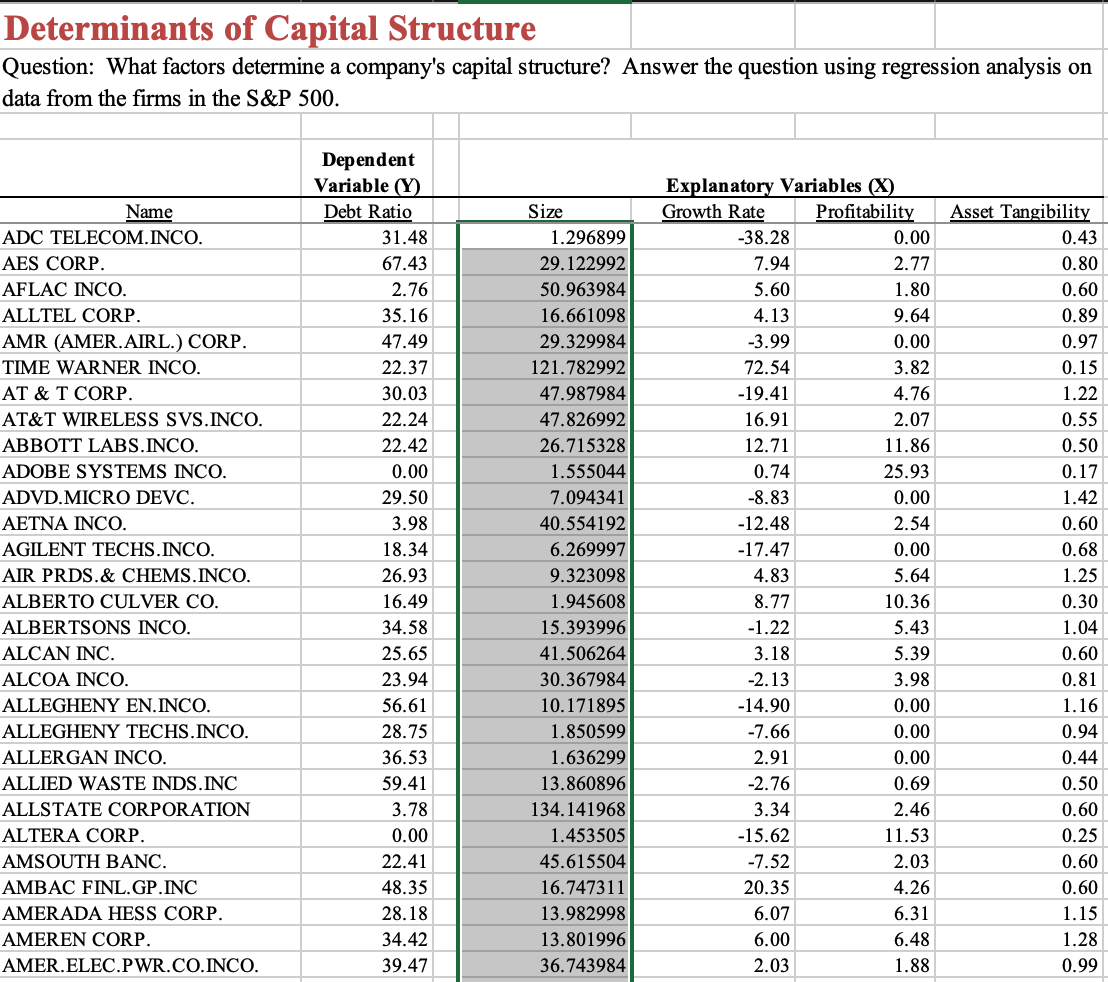

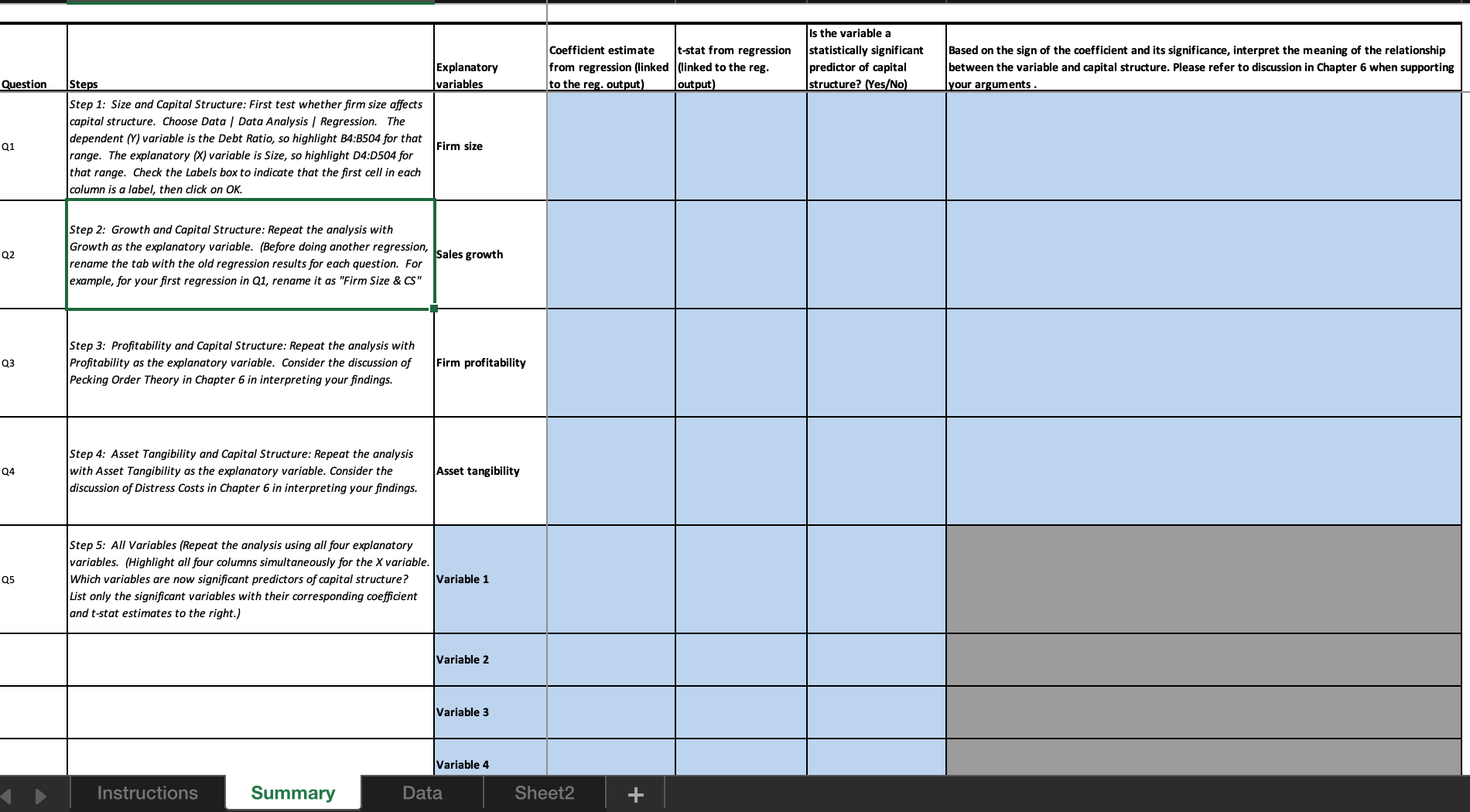

Is the variable a Coefficient estimate t-stat from regression statistically significant Based on the sign of the coefficient and its significance, interpret the meaning of the relationship Explanatory from regression (linked (linked to the reg. predictor of capital between the variable and capital structure. Please refer to discussion in Chapter 6 when supporting Question Steps variables to the reg. output output structure? (Yes/No) your arguments . Step 1: Size and Capital Structure: First test whether firm size affects capital structure. Choose Data | Data Analysis | Regression. The Q1 dependent (Y) variable is the Debt Ratio, so highlight B4:8504 for that range. The explanatory (X) variable is Size, so highlight D4:D504 for Firm size that range. Check the Labels box to indicate that the first cell in each column is a label, then click on OK. Step 2: Growth and Capital Structure: Repeat the analysis with Q2 Growth as the explanatory variable. (Before doing another regression, Sales growth rename the tab with the old regression results for each question. For example, for your first regression in Q1, rename it as "Firm Size & CS" Step 3: Profitability and Capital Structure: Repeat the analysis with Q3 Profitability as the explanatory variable. Consider the discussion of Firm profitability Pecking Order Theory in Chapter 6 in interpreting your findings. Step 4: Asset Tangibility and Capital Structure: Repeat the analysis Q4 with Asset Tangibility as the explanatory variable. Consider the Asset tangibility discussion of Distress Costs in Chapter 6 in interpreting your findings. Step 5: All Variables (Repeat the analysis using all four explanatory variables. (Highlight all four columns simultaneously for the X variable. Q5 Which variables are now significant predictors of capital structure? Variable 1 List only the significant variables with their corresponding coefficient and t-stat estimates to the right.) Variable 2 Variable 3 Variable 4 Instructions Summary Data Sheet2 +HW2 Points Question 1 20 Question 2 20 Question 3 20 Question 4 20 Question 5 20 Total 100 Please answer the questions included in this worksheet and upload your file on Canvas by the due date indicated. Your responses must be entered in the designated cells (shaded in blue) to receive credit. All coefficient and t-stat values must be linked to your regression outputs. Please rename your regression worksheets to indicate your explanatory variables. In total, you should have five regression worksheets (one for each question.Determinants of Capital Structure Question: What factors determine a company's capital structure? Answer the question using regression analysis on data from the firms in the S&P 500. Dependent Variable (Y) Name Explanatory Variables (X) Debt Ratio Size Growth Rate ADC TELECOM. INCO. Profitability 31.48 Asset Tangibility 1.296899 AES CORP. 38.28 0.00 67.43 29.122992 0.43 7.94 AFLAC INCO. 2.77 0.80 2.76 50.963984 ALLTEL CORP. 5.60 1.80 0.60 35.16 16.661098 4.13 AMR (AMER.AIRL.) CORP. 9.64 0.89 47.49 29.329984 -3.99 TIME WARNER INCO. 0.00 0.97 22.37 121.782992 AT & T CORP 72.54 3.82 30.03 47.987984 0.15 AT&T WIRELESS SVS.INCO. -19.41 4.76 22.24 1.22 47.826992 16.91 ABBOTT LABS.INCO. 2.07 0.55 22.42 26.715328 12.71 ADOBE SYSTEMS INCO. 11.86 0.50 0.00 1.555044 ADVD.MICRO DEVC 0.74 25.93 29.50 7.094341 0.17 -8.83 AETNA INCO. 0.00 1.42 3.98 40.554192 -12.48 AGILENT TECHS. INCO. 2.54 18.34 0.60 6.269997 AIR PRDS. & CHEMS.INCO. -17.47 0.00 26.93 9.323098 0.68 4.83 ALBERTO CULVER CO. 5.64 16.49 1.945608 1.25 ALBERTSONS INCO. 8.77 10.36 0.30 34.58 15.393996 ALCAN INC. -1.22 5.43 25.65 1.04 41.506264 3.18 ALCOA INCO. 5.39 0.60 23.94 30.367984 3.98 ALLEGHENY EN.INCO. 2.13 0.8 56.61 10.171895 ALLEGHENY TECHS. INCO. -14.90 0.00 28.75 1.16 1.850599 -7.66 0.00 ALLERGAN INCO 0.94 36.53 1.636299 ALLIED WASTE INDS.INC 2.91 0.00 59.41 13.860896 0.44 ALLSTATE CORPORATION -2.76 0.69 3.78 134.141968 0.50 3.34 ALTERA CORP 2.46 0.00 0.60 1.453505 AMSOUTH BANC. -15.62 11.53 0.25 22.41 45.615504 AMBAC FINL. GP.INC -7.52 2.03 48.35 16.747311 0.60 20.35 AMERADA HESS CORP. 4.26 0.60 28.18 13.982998 6.07 AMEREN CORP. 6.31 1.15 34.42 13.801996 6.00 AMER. ELEC.PWR. CO.INCO. 6.48 1.28 39.47 36.743984 2.03 1.88 0.99