Answered step by step

Verified Expert Solution

Question

1 Approved Answer

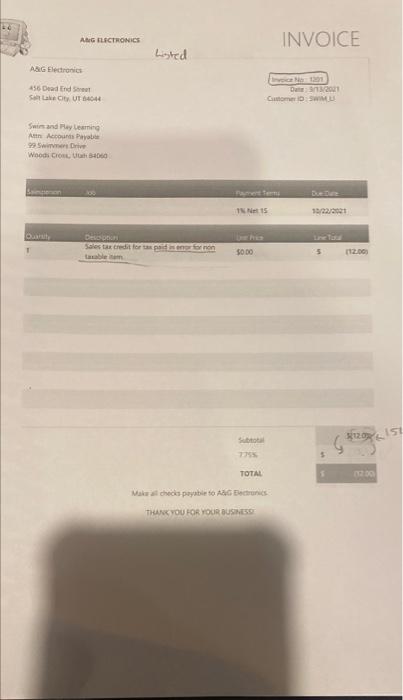

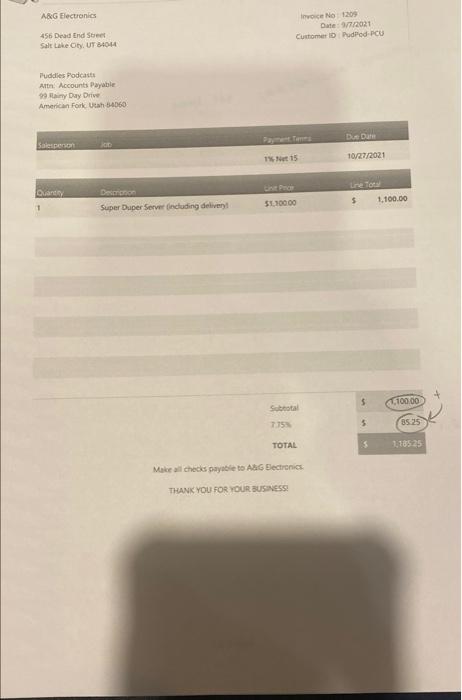

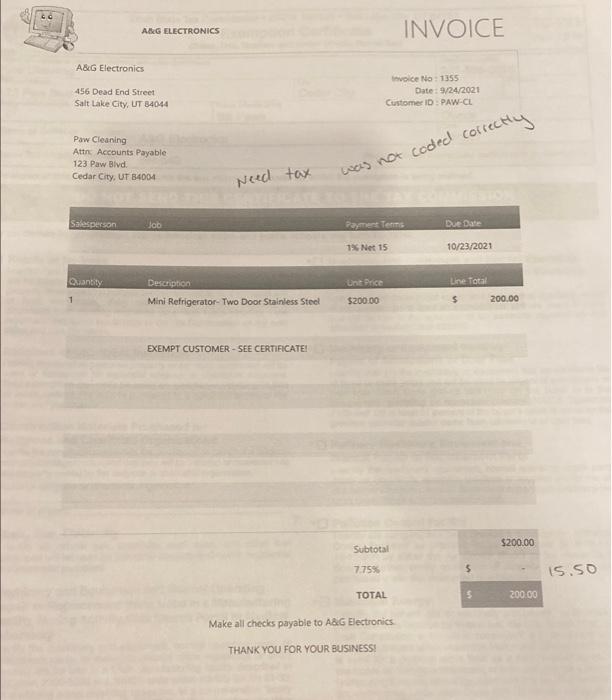

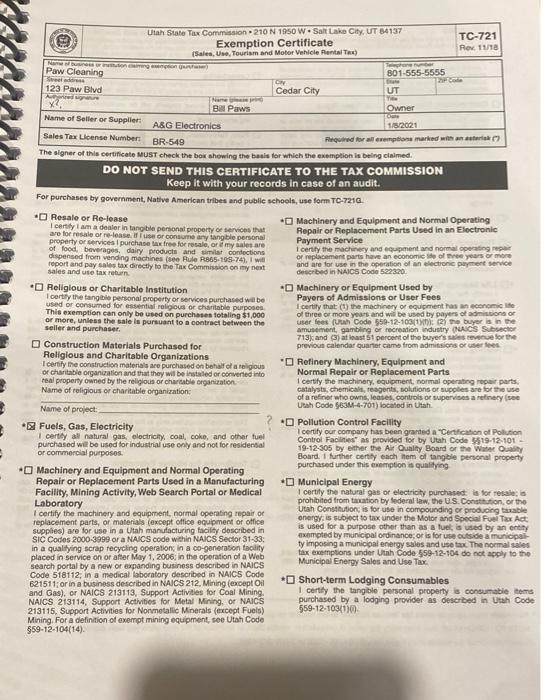

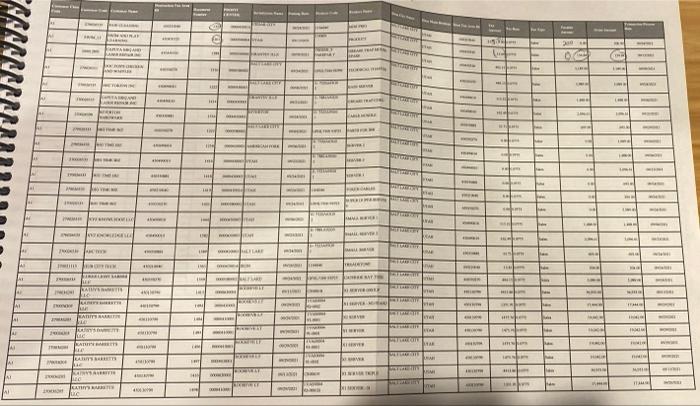

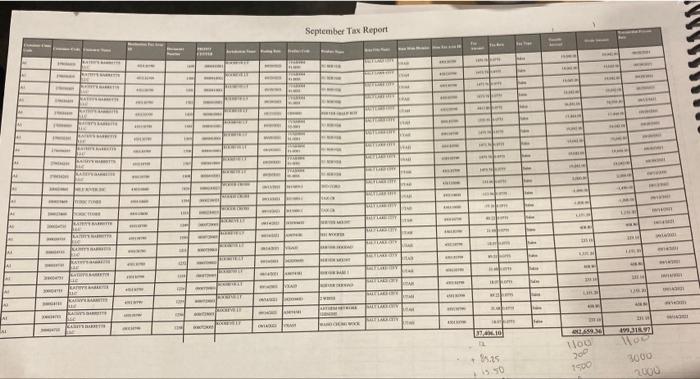

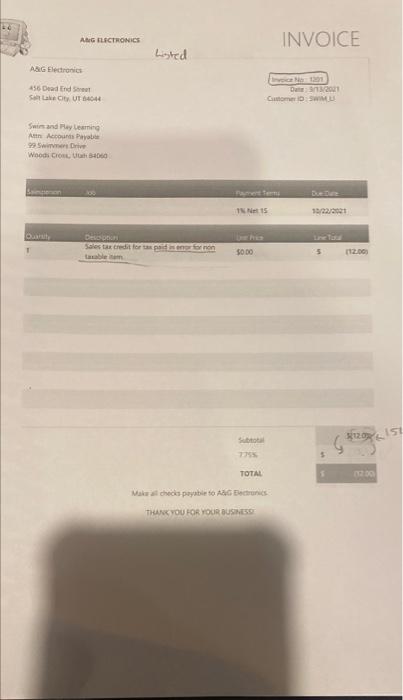

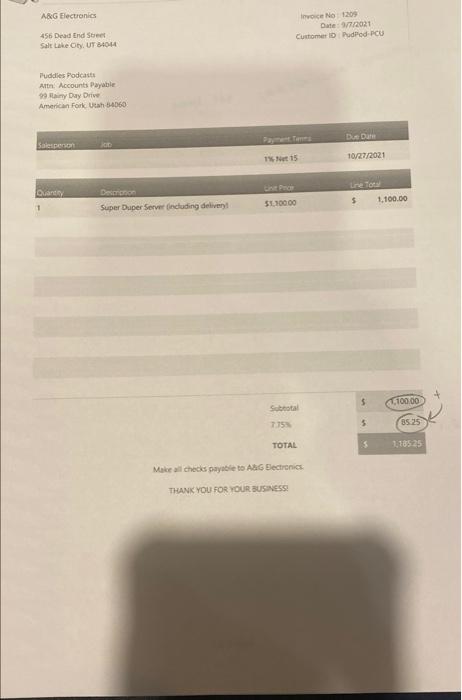

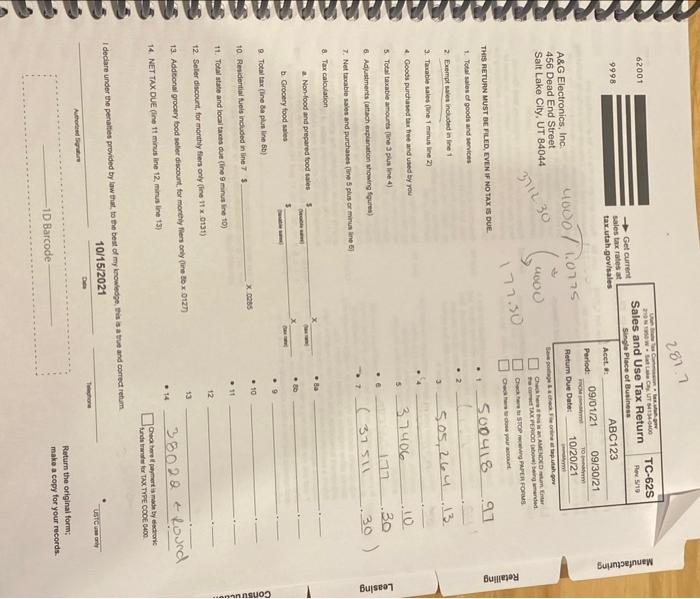

So i got 38022 for my answer can someone verify please? Sales and Use tax. Background A&G Electronics, based in Salt Lake City, Utah, is

So i got 38022 for my answer can someone verify please? Sales and Use tax.

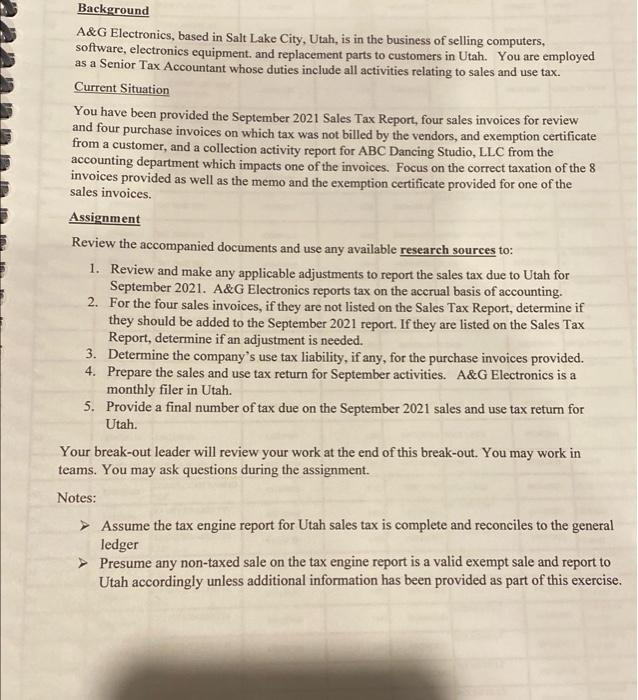

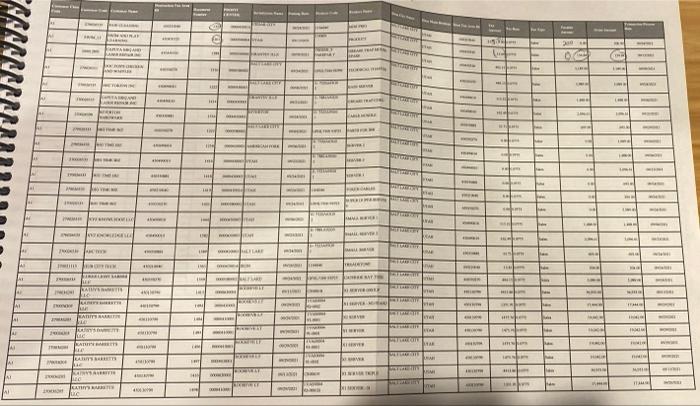

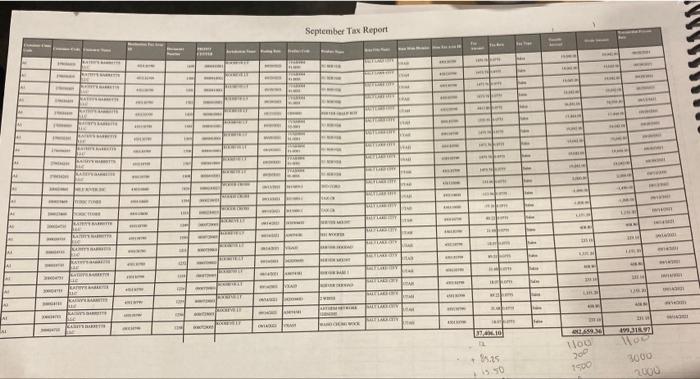

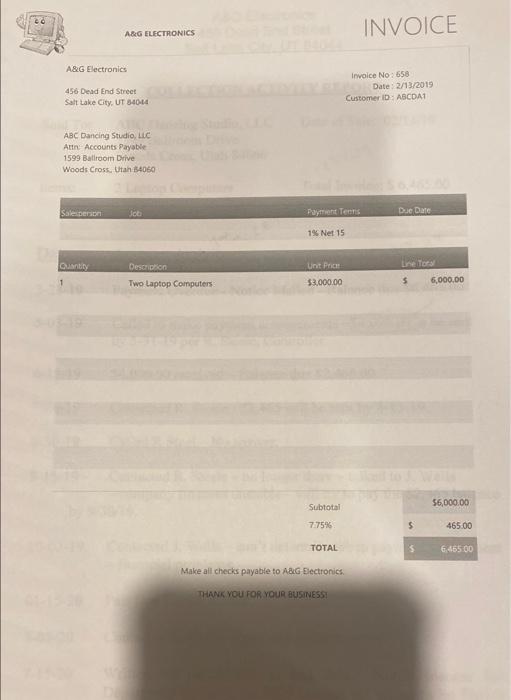

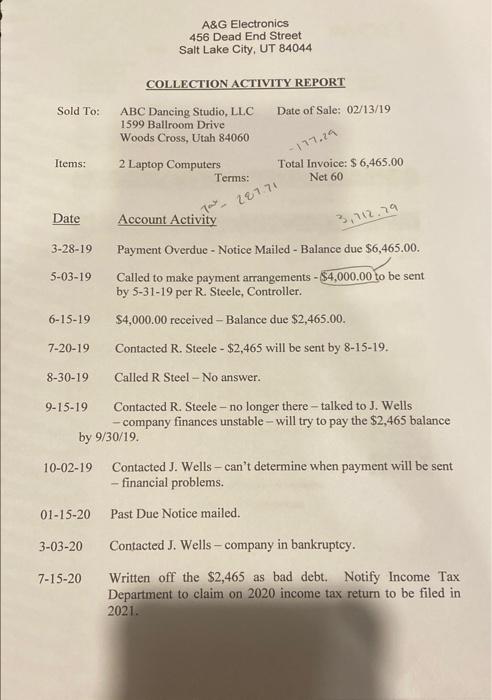

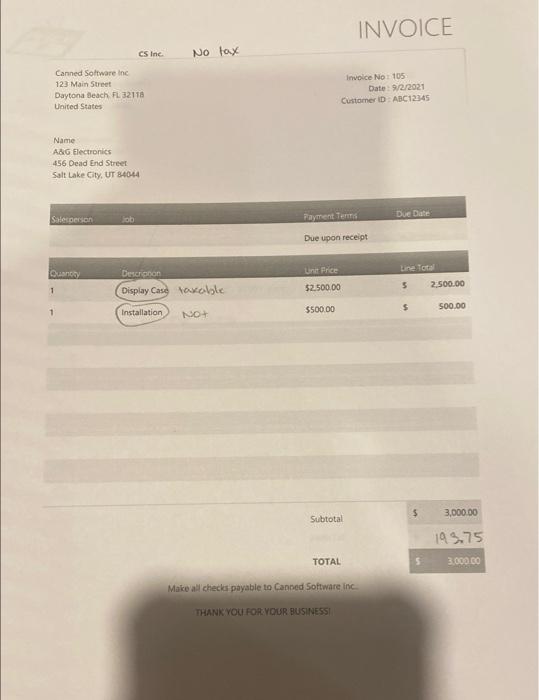

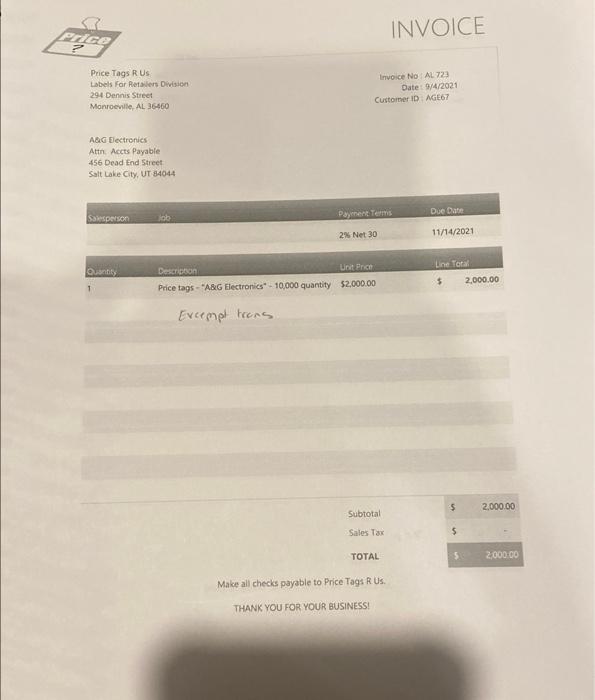

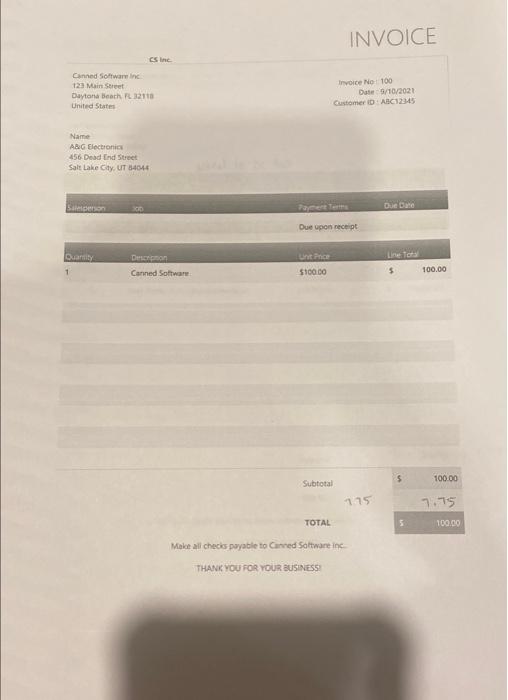

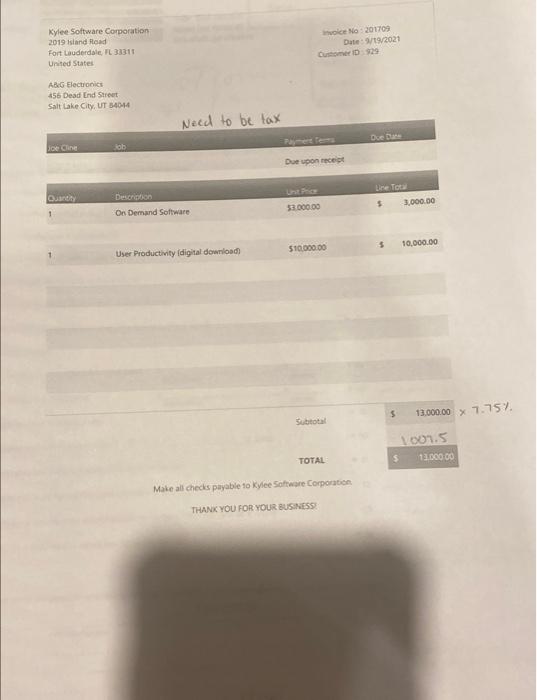

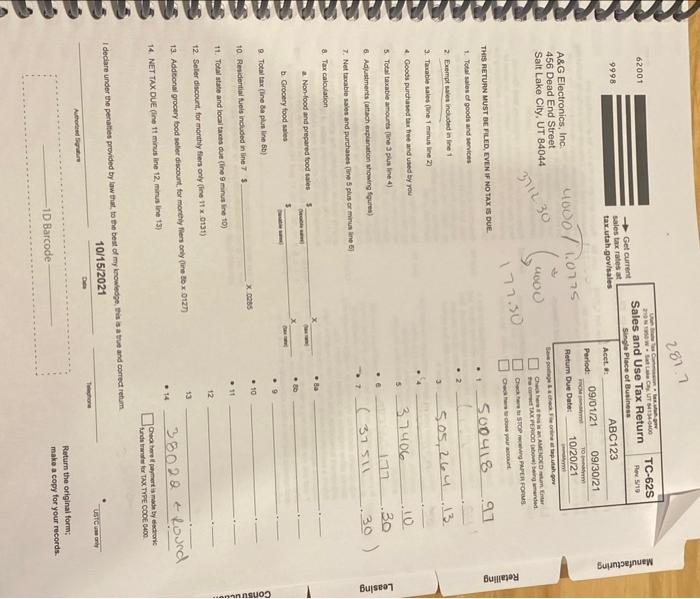

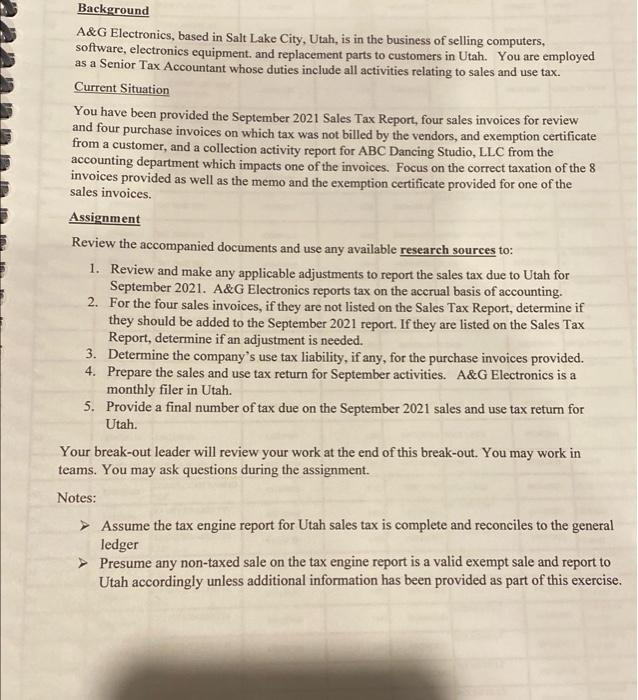

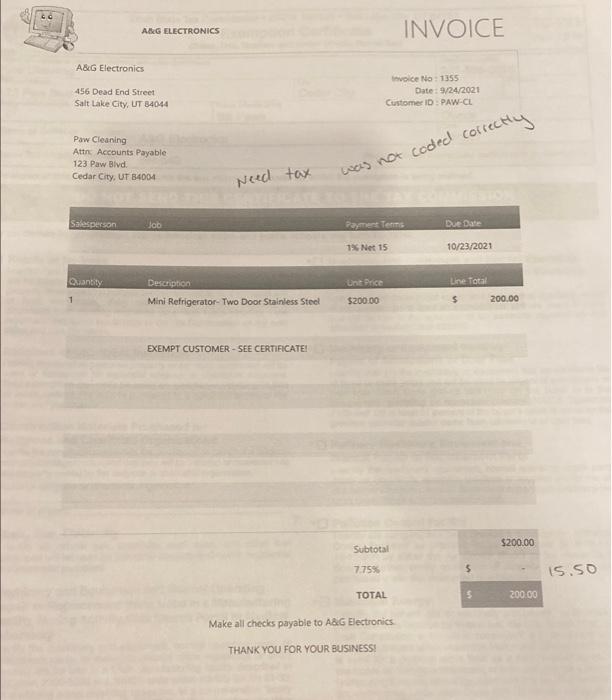

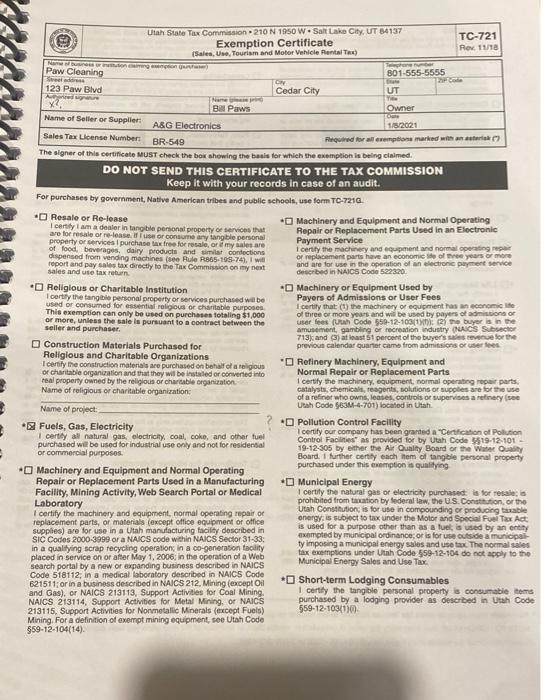

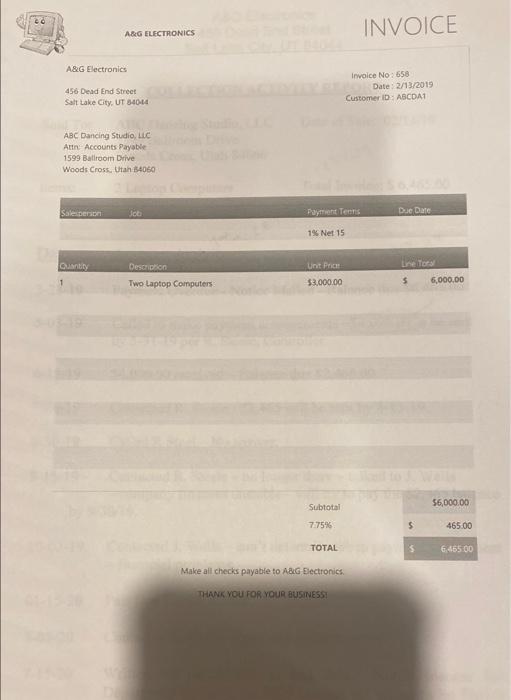

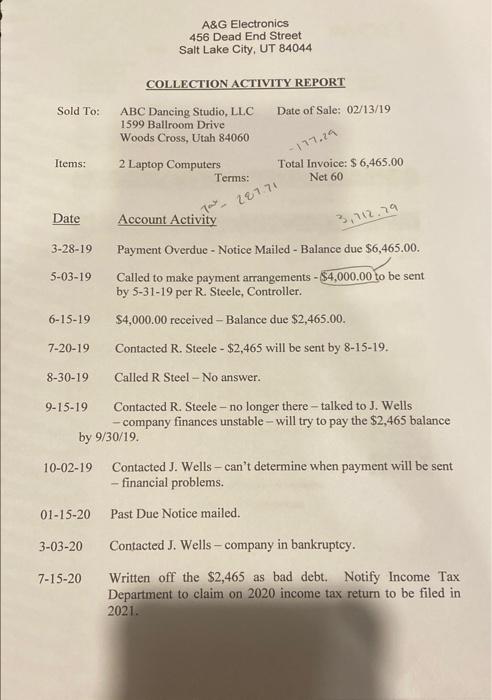

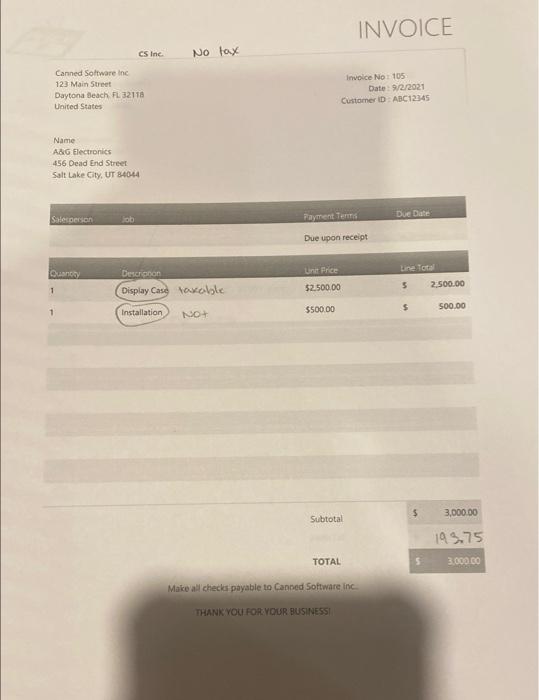

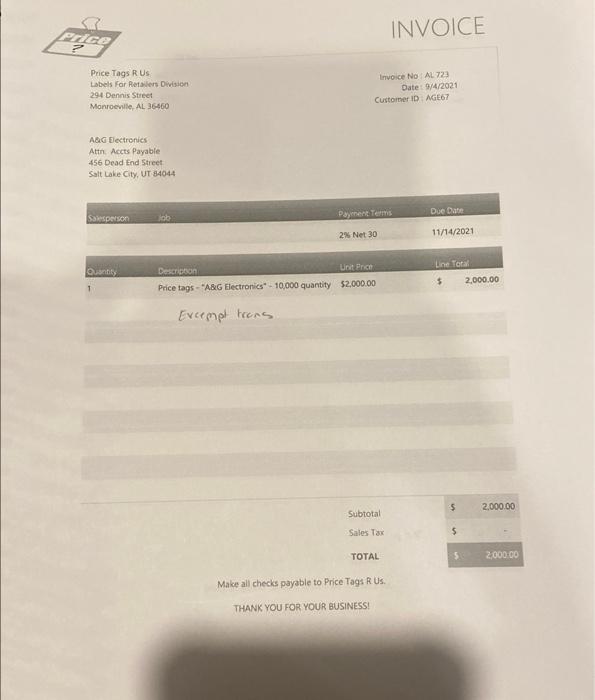

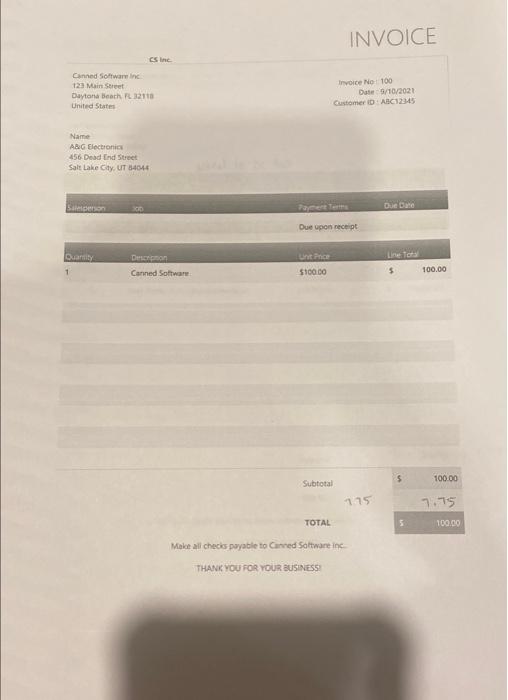

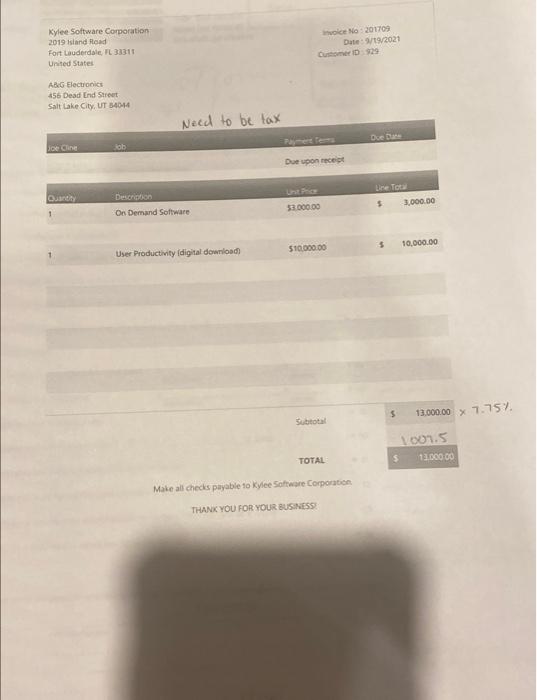

Background A&G Electronics, based in Salt Lake City, Utah, is in the business of selling computers, software, electronics equipment, and replacement parts to customers in Utah. You are employed as a Senior Tax Accountant whose duties include all activities relating to sales and use tax. Current Situation You have been provided the September 2021 Sales Tax Report, four sales invoices for review and four purchase invoices on which tax was not billed by the vendors, and exemption certificate from a customer, and a collection activity report for ABC Dancing Studio, LLC from the accounting department which impacts one of the invoices. Focus on the correct taxation of the 8 invoices provided as well as the memo and the exemption certificate provided for one of the sales invoices Assignment Review the accompanied documents and use any available research sources to: 1. Review and make any applicable adjustments to report the sales tax due to Utah for September 2021. A&G Electronics reports tax on the accrual basis of accounting. 2. For the four sales invoices, if they are not listed on the Sales Tax Report, determine if they should be added to the September 2021 report. If they are listed on the Sales Tax Report, determine if an adjustment is needed. 3. Determine the company's use tax liability, if any, for the purchase invoices provided. 4. Prepare the sales and use tax return for September activities. A&G Electronics is a monthly filer in Utah. 5. Provide a final number of tax due on the September 2021 sales and use tax return for Utah. Your break-out leader will review your work at the end of this break-out. You may work in teams. You may ask questions during the assignment. Notes: Assume the tax engine report for Utah sales tax is complete and reconciles to the general ledger Presume any non-taxed sale on the tax engine report is a valid exempt sale and report to Utah accordingly unless additional information has been provided as part of this exercise. AI IND EEE CAT TER HI BMW SA JAI LABUS w KIRI ! LE ml ! MATTER WE 41 be HER HI WP NA WIN LE Wul TY JE www AR NEW THE - w 1911 DC - il September Tax Report w ET w w ET w w w ww 1 GEM AR 41 REN wel w . Thou 25 30 3000 3.50 1500 | 2000 ANG ELECTRONICS INVOICE Listed Adic Electronics 456 Dead End Set SALUT 3201 Como SWM Swindly Learning An Accounts Payo 99 Swine Drive Woods C 400 Its Descu Sales tax credono forno SO DO 5 112 120x2151 TOTAL 13 Maka check payabito AG Denis THANK YOU FOR YOUR BUSINESS A&G Electronics Inice NO 1209 Date: 9/7/2021 Customer PudPod PCU 456 Dead End Street Salt Lake Oy, UT 84044 Puddles Podcasts Alte Accounts Payable any Day Drive American Fork Utah 64060 Due Date Salesperson Payment 115 10/27/2021 Le To Duary 1 Decor Super Duper Server (including delivery $110000 1,100.00 $ 100.00 Subtotal 7.15 5 85 25 TOTAL 178525 Make all checs payable to ABG Blectronics THANK YOU FOR YOUR BUSINESS ABG ELECTRONICS INVOICE A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 voice No: 1355 Date: 9/24/2021 Customer ID : PAW-CL Paw Cleaning Att Accounts Payable 123 Paw Blvd Cedar City, UT 84004 Need tax was not coded correctly Salesperson Job Payment Terms Due Date 1% Net 15 10/23/2021 Quantity Line Total Description Mini Refrigerator. Two Door Stainless Steel Unit Price $200.00 1 $ 200.00 EXEMPT CUSTOMER - SEE CERTIFICATE! $200.00 Subtotal 7.75% ISSO TOTAL 5 200.00 Make all checks payable to A&G Electronics THANK YOU FOR YOUR BUSINESS! CNY Utah State Tax Commission 210 N 1950 W.Salt Lake City, UT 84137 TC-721 Exemption Certificate Rev. 11/18 (Sales, Use Tourism and Motor Vehicle Rental Tex) a wong Paw Cleaning 801-555-5555 3rd 123 Paw Blvd Cedar City UT Nare BA Paws Owner Name of Seller or Supplier A&G Electronics 1/8/2021 Sales Tax License Numbers BR-549 Frequired for all emption marked with an The signer of this certificate MUST check the box showing the basis for which the exemption is being claimed. DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION Keep it with your records in case of an audit. For purchases by government, Native American tribes and public schools, use form TC-7210 Resale or Release Machinery and Equipment and Normal Operating I certy i am a dealer intangibile personal property of services that are for resale or release use or consume any tangible personal Repair or Replacement Parts Used in an Electronic property or services I purchase tax free for resale, or mysales are Payment Service of food, beverages, dairy products and similat confections I certify the machinery and equipment and normal operating dispensed from vending machines ( Rule R865-195-74), I will or replacement parts have an economics of the years of more report and pay sales tax directly to the Tax Commission on my next and are for use in the operation of an electronic payment service sales and use tax return described in NAICS Code 522320 Religious or Charitable Institution * Machinery or Equipment Used by I certify the tangible personal property or services purchased will be Payers of Admissions or User Fees used or consumed for essential religious or charitable purposes I certy that (1) the machinery or equipment has an economice This exemption can only be used on purchases totaling $1,000 of three or more years and will be used by payers of admissions or or more, unless the sale is pursuant to a contract between the user fees futh Code 550-12-103113 (2the buyer is in the seller and purchaser amusement, gambling or recreation Industry NCS Subsector 713) and at last 5 percent of the buyer's revenue for the Construction Materials Purchased for previous calendar Quarter came from admissions or users Religious and Charitable Organizations I certify the construction materials are purchased on behalf of a religious Refinery Machinery, Equipment and or charitable organization and that they will be stated or converted into Normal Repair or Replacement Parts real property owned by the religious or charitable organization 1 certify the machinery, equipment, normal operating repor parts. Name of religious or charitable organization catalysts, chemicals, reagents, solutions or supplies are for the use of a refiner who owns, leates controls or supervis a refinery (see Name of project: Utah Code G63M-4-701) located in Utah * Fuels, Gas, Electricity Pollution Control Facility I certify our company has been granted a "Certification of Pollution Icerty all natural as, electric coal, coke, and other fuel Control Facilities as provided for by Utah Code 119-12-101 purchased will be used for industrial use only and not for residential 19-12-305 by either the Air Quality Board of the Water Quality or commercial purposes. Board. I further cotty each them of tangible personal property purchased under this exemption is qualifying *Machinery and Equipment and Normal Operating Repair or Replacement Parts Used in a Manufacturing Municipal Energy Facility, Mining Activity, Web Search Portal or Medical certify the natural gas or electricity purchased is for resales Laboratory prohibited from taxation by federal law, the U.S. Constitution, or the Utah Constitution is for use in compounding of producing table I certify the machinery and equipment, normal operating repair or onergy is subject to tax under the Motor and Special Fuel Tax Act replacement parts, or materials concept office equipment or office is used for a purpose other than as a fuel is used by any supplies) are for use in a Utah manufacturing facility described in exempled by municipal ordinance; or is for use outside a municipal SIC Codes 2000-3999 or a NAICS code within NAICS Sector 31-33 ty imposing a municipal energy sales and use tax. The normal sales in a qualifying scrap recycling operation in a co-generation facility tax exemptions under Utah Code 559-12-104 do not apply to the placed in service on or after May 1, 2006, in the operation of a Web Municipal Energy Sales and Use Tax Search portal by a new or expanding business described in NAICS Code 518112, in a medical laboratory described in NAICS Code 621511:or in a business described in NAICS 212. Mining (except Oil * Short-term Lodging Consumables and Gas), or NAICS 213113, Support Activities for Coal Mining, I certify the tangible personal property is consumables NAICS 213114. Support Activities for Metal Mining, or NAICS purchased by a lodging provider as described in Utah Code 213115. Support Activities for Nonmetalic Minerals (except Fuels) 559-12-1031) Mining for a definition of exempt mining equipment, see Utah Code $59-12-104(14) . INVOICE A&G ELECTRONICS A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 Invoice No : 650 Date: 2/13/2019 Customer ID : ABCDA1 ABC Dancing Studio, LLC An Accounts Payable 1599 Ballroom Drive Woods Cross, Utah 14050 Salesperson Job Payment Teens Due Date 1% Net 15 Quantity unt Price Description Two Laptop Computers The Toral 5 6,000.00 $3,000.00 $6,000.00 Subtotal 7.75% $ 465.00 TOTAL 3 6465.00 Make all checks payable to A&G Electronics THANK YOU FOR YOUR BUSINESS! A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 COLLECTION ACTIVITY REPORT Sold To: Date of Sale: 02/13/19 ABC Dancing Studio, LLC 1599 Ballroom Drive Woods Cross, Utah 84060 2 Laptop Computers Terms: -177.29 Items: Total Invoice: $6,465.00 Net 60 Table 28771 Date Account Activity 3,112.79 3-28-19 5-03-19 Payment Overdue - Notice Mailed - Balance due $6,465.00. Called to make payment arrangements - $4,000.00 to be sent by 5-31-19 per R. Steele, Controller. $4,000.00 received - Balance due $2,465.00. Contacted R. Steele - $2,465 will be sent by 8-15-19. 6-15-19 7-20-19 8-30-19 Called R Steel - No answer. 9-15-19 Contacted R. Steele- no longer there-talked to J. Wells company finances unstable - will try to pay the $2,465 balance by 9/30/19. 10-02-19 Contacted J. Wells - can't determine when payment will be sent -financial problems. 01-15-20 Past Due Notice mailed. 3-03-20 7-15-20 Contacted J. Wells - company in bankruptcy. Written off the $2,465 as bad debt. Notify Income Tax Department to claim on 2020 income tax return to be filed in 2021. INVOICE CS Inc No tax Canned Software Inc 123 Main Street Daytona Beach FL 32118 United States Invoice No: 105 Date: 9/2/2021 Customer ID : ABC12345 Name A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 Saterson Due Date ob Payment Terms Due upon receipt Line Total Duny Descronon Display Case fowolle Lint Price $2.500.00 5 2.500.00 $ Installation $500.00 500.00 NO $ 3,000.00 Subtotal 199.75 TOTAL 5 3.000.00 Make all check payable to Canned Software inc THANK YOU FOR YOUR BUSINESS INVOICE 2 Price Tags RUS Labels For Retailers Division 294 Dennis Street Monroevile, AL 36460 Invoice NO AL 722 Date: 9/4/2021 Customer ID AGE67 AQG Electronics Att. Accts Payable 456 Dead End Street Salt Lake City, UT 84044 Salesperson Payment Tenis Due Date 2% Net 30 11/14/2021 Quantity Description Unit Price Price tags - "A&G Electronics - 10,000 quantity $2,000.00 Line Total $ 2,000.00 1 Excempt trons $ 2,000.00 Subtotal Sales Tax $ TOTAL 5 2000.00 Make all checks payable to Price Tags R Us THANK YOU FOR YOUR BUSINESS! INVOICE Csinc Canned Software in 123 Main Street Daytona Beach R32118 United States Invice No 100 Date9/10/2021 Customer ABC1235 Name ABG Electronic 456 Dead End Street Salt Lake City, UT 84044 Seson Due Date Due upon receipt Duantity (Una Pince Line tota Desmon Canned Software 100.00 $100.00 5 Subtotal 100.00 775 7.75 TOTAL 5 100.00 Make all checks payable to Canned Software Inc THANK YOU FOR YOUR BUSINESSE Kylee Software Corporation 2019 Island Road Fort Lauderdale, FL 33311 United States No: 201709 Dute: 19/2021 ABG Electronics 456 Dead End Street Salt Lake City, UT 84044 Need to be tax Due Dame Joe Cine Rob Due upon receipt Quy Descriton On Demand Software Line Toca $ 3,000.00 53.000.00 $ 10,000.00 510.000.00 User Productivity digital download 5 13.000,00 1.75% Subtotal 10015 $ 12.000.00 TOTAL Make all checks payable 10 Kylee Software Corporation THANK YOU FOR YOUR BUSINESS 281.7 62001 Get current sales tax rates tax utah.govisales 9998 www.UT34-0100 TC-625 Sales and Use Tax Return 5/19 Single Place of Business Acet: ABC123 Period: 09/01/21 09/30/21 FROM TO Return Due Date: 10/20/21 Manufacturing youthorns A&G Electronics, Inc. 456 Dead End Street Salt Lake City, UT 84044 Good 3712 30 South AMENDED PERIOD being made Check STO PAPER FORMS Chow you 177.50 Retailing THIS RETURN MUST BE FILED, EVEN IF NO TAX IS DUE 1. Total sales of goods and Services 500418 .91 2 2 Empties included in line 1 3 505,264 13 3. Taxable sales (line 1 minus line 29 .4 4 Goods purchased tax free and used by you 5 37406 12 (37511 10 .30 5. Total taxable amounts in plus in 4) 6. Adjustments (attach explanation showing figures) Leasing .30) 7. Nettable sales and purchases in 5 plus minus line) & Tax calculation Ba a Non-food and prepared food sales . b Grocery food sales 9 Total tax in Ba plus line 51 10 xos Consuu 10. Residential fuels included in line 3 10 11. To state and locales dueline usine 10) 12 13 12 Seler discount for monthly flers only line 11 x 0131 13. Additional grocery food seller discount for morelly Tiers only (ne 30 x 0127) 14. NET TAX DUE (ir tt minus ine 12 minus line 13) 14 35022 e Round Oro pade tydedronic urder or TAX TYPE CODE 6400 I declare under the penalties provided by law that, to the best of my knowledge this is a true and correct retum 10/15/2021 AS To USTCW Return the original forms make a copy for your records -1D Barcode Background A&G Electronics, based in Salt Lake City, Utah, is in the business of selling computers, software, electronics equipment, and replacement parts to customers in Utah. You are employed as a Senior Tax Accountant whose duties include all activities relating to sales and use tax. Current Situation You have been provided the September 2021 Sales Tax Report, four sales invoices for review and four purchase invoices on which tax was not billed by the vendors, and exemption certificate from a customer, and a collection activity report for ABC Dancing Studio, LLC from the accounting department which impacts one of the invoices. Focus on the correct taxation of the 8 invoices provided as well as the memo and the exemption certificate provided for one of the sales invoices Assignment Review the accompanied documents and use any available research sources to: 1. Review and make any applicable adjustments to report the sales tax due to Utah for September 2021. A&G Electronics reports tax on the accrual basis of accounting. 2. For the four sales invoices, if they are not listed on the Sales Tax Report, determine if they should be added to the September 2021 report. If they are listed on the Sales Tax Report, determine if an adjustment is needed. 3. Determine the company's use tax liability, if any, for the purchase invoices provided. 4. Prepare the sales and use tax return for September activities. A&G Electronics is a monthly filer in Utah. 5. Provide a final number of tax due on the September 2021 sales and use tax return for Utah. Your break-out leader will review your work at the end of this break-out. You may work in teams. You may ask questions during the assignment. Notes: Assume the tax engine report for Utah sales tax is complete and reconciles to the general ledger Presume any non-taxed sale on the tax engine report is a valid exempt sale and report to Utah accordingly unless additional information has been provided as part of this exercise. AI IND EEE CAT TER HI BMW SA JAI LABUS w KIRI ! LE ml ! MATTER WE 41 be HER HI WP NA WIN LE Wul TY JE www AR NEW THE - w 1911 DC - il September Tax Report w ET w w ET w w w ww 1 GEM AR 41 REN wel w . Thou 25 30 3000 3.50 1500 | 2000 ANG ELECTRONICS INVOICE Listed Adic Electronics 456 Dead End Set SALUT 3201 Como SWM Swindly Learning An Accounts Payo 99 Swine Drive Woods C 400 Its Descu Sales tax credono forno SO DO 5 112 120x2151 TOTAL 13 Maka check payabito AG Denis THANK YOU FOR YOUR BUSINESS A&G Electronics Inice NO 1209 Date: 9/7/2021 Customer PudPod PCU 456 Dead End Street Salt Lake Oy, UT 84044 Puddles Podcasts Alte Accounts Payable any Day Drive American Fork Utah 64060 Due Date Salesperson Payment 115 10/27/2021 Le To Duary 1 Decor Super Duper Server (including delivery $110000 1,100.00 $ 100.00 Subtotal 7.15 5 85 25 TOTAL 178525 Make all checs payable to ABG Blectronics THANK YOU FOR YOUR BUSINESS ABG ELECTRONICS INVOICE A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 voice No: 1355 Date: 9/24/2021 Customer ID : PAW-CL Paw Cleaning Att Accounts Payable 123 Paw Blvd Cedar City, UT 84004 Need tax was not coded correctly Salesperson Job Payment Terms Due Date 1% Net 15 10/23/2021 Quantity Line Total Description Mini Refrigerator. Two Door Stainless Steel Unit Price $200.00 1 $ 200.00 EXEMPT CUSTOMER - SEE CERTIFICATE! $200.00 Subtotal 7.75% ISSO TOTAL 5 200.00 Make all checks payable to A&G Electronics THANK YOU FOR YOUR BUSINESS! CNY Utah State Tax Commission 210 N 1950 W.Salt Lake City, UT 84137 TC-721 Exemption Certificate Rev. 11/18 (Sales, Use Tourism and Motor Vehicle Rental Tex) a wong Paw Cleaning 801-555-5555 3rd 123 Paw Blvd Cedar City UT Nare BA Paws Owner Name of Seller or Supplier A&G Electronics 1/8/2021 Sales Tax License Numbers BR-549 Frequired for all emption marked with an The signer of this certificate MUST check the box showing the basis for which the exemption is being claimed. DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION Keep it with your records in case of an audit. For purchases by government, Native American tribes and public schools, use form TC-7210 Resale or Release Machinery and Equipment and Normal Operating I certy i am a dealer intangibile personal property of services that are for resale or release use or consume any tangible personal Repair or Replacement Parts Used in an Electronic property or services I purchase tax free for resale, or mysales are Payment Service of food, beverages, dairy products and similat confections I certify the machinery and equipment and normal operating dispensed from vending machines ( Rule R865-195-74), I will or replacement parts have an economics of the years of more report and pay sales tax directly to the Tax Commission on my next and are for use in the operation of an electronic payment service sales and use tax return described in NAICS Code 522320 Religious or Charitable Institution * Machinery or Equipment Used by I certify the tangible personal property or services purchased will be Payers of Admissions or User Fees used or consumed for essential religious or charitable purposes I certy that (1) the machinery or equipment has an economice This exemption can only be used on purchases totaling $1,000 of three or more years and will be used by payers of admissions or or more, unless the sale is pursuant to a contract between the user fees futh Code 550-12-103113 (2the buyer is in the seller and purchaser amusement, gambling or recreation Industry NCS Subsector 713) and at last 5 percent of the buyer's revenue for the Construction Materials Purchased for previous calendar Quarter came from admissions or users Religious and Charitable Organizations I certify the construction materials are purchased on behalf of a religious Refinery Machinery, Equipment and or charitable organization and that they will be stated or converted into Normal Repair or Replacement Parts real property owned by the religious or charitable organization 1 certify the machinery, equipment, normal operating repor parts. Name of religious or charitable organization catalysts, chemicals, reagents, solutions or supplies are for the use of a refiner who owns, leates controls or supervis a refinery (see Name of project: Utah Code G63M-4-701) located in Utah * Fuels, Gas, Electricity Pollution Control Facility I certify our company has been granted a "Certification of Pollution Icerty all natural as, electric coal, coke, and other fuel Control Facilities as provided for by Utah Code 119-12-101 purchased will be used for industrial use only and not for residential 19-12-305 by either the Air Quality Board of the Water Quality or commercial purposes. Board. I further cotty each them of tangible personal property purchased under this exemption is qualifying *Machinery and Equipment and Normal Operating Repair or Replacement Parts Used in a Manufacturing Municipal Energy Facility, Mining Activity, Web Search Portal or Medical certify the natural gas or electricity purchased is for resales Laboratory prohibited from taxation by federal law, the U.S. Constitution, or the Utah Constitution is for use in compounding of producing table I certify the machinery and equipment, normal operating repair or onergy is subject to tax under the Motor and Special Fuel Tax Act replacement parts, or materials concept office equipment or office is used for a purpose other than as a fuel is used by any supplies) are for use in a Utah manufacturing facility described in exempled by municipal ordinance; or is for use outside a municipal SIC Codes 2000-3999 or a NAICS code within NAICS Sector 31-33 ty imposing a municipal energy sales and use tax. The normal sales in a qualifying scrap recycling operation in a co-generation facility tax exemptions under Utah Code 559-12-104 do not apply to the placed in service on or after May 1, 2006, in the operation of a Web Municipal Energy Sales and Use Tax Search portal by a new or expanding business described in NAICS Code 518112, in a medical laboratory described in NAICS Code 621511:or in a business described in NAICS 212. Mining (except Oil * Short-term Lodging Consumables and Gas), or NAICS 213113, Support Activities for Coal Mining, I certify the tangible personal property is consumables NAICS 213114. Support Activities for Metal Mining, or NAICS purchased by a lodging provider as described in Utah Code 213115. Support Activities for Nonmetalic Minerals (except Fuels) 559-12-1031) Mining for a definition of exempt mining equipment, see Utah Code $59-12-104(14) . INVOICE A&G ELECTRONICS A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 Invoice No : 650 Date: 2/13/2019 Customer ID : ABCDA1 ABC Dancing Studio, LLC An Accounts Payable 1599 Ballroom Drive Woods Cross, Utah 14050 Salesperson Job Payment Teens Due Date 1% Net 15 Quantity unt Price Description Two Laptop Computers The Toral 5 6,000.00 $3,000.00 $6,000.00 Subtotal 7.75% $ 465.00 TOTAL 3 6465.00 Make all checks payable to A&G Electronics THANK YOU FOR YOUR BUSINESS! A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 COLLECTION ACTIVITY REPORT Sold To: Date of Sale: 02/13/19 ABC Dancing Studio, LLC 1599 Ballroom Drive Woods Cross, Utah 84060 2 Laptop Computers Terms: -177.29 Items: Total Invoice: $6,465.00 Net 60 Table 28771 Date Account Activity 3,112.79 3-28-19 5-03-19 Payment Overdue - Notice Mailed - Balance due $6,465.00. Called to make payment arrangements - $4,000.00 to be sent by 5-31-19 per R. Steele, Controller. $4,000.00 received - Balance due $2,465.00. Contacted R. Steele - $2,465 will be sent by 8-15-19. 6-15-19 7-20-19 8-30-19 Called R Steel - No answer. 9-15-19 Contacted R. Steele- no longer there-talked to J. Wells company finances unstable - will try to pay the $2,465 balance by 9/30/19. 10-02-19 Contacted J. Wells - can't determine when payment will be sent -financial problems. 01-15-20 Past Due Notice mailed. 3-03-20 7-15-20 Contacted J. Wells - company in bankruptcy. Written off the $2,465 as bad debt. Notify Income Tax Department to claim on 2020 income tax return to be filed in 2021. INVOICE CS Inc No tax Canned Software Inc 123 Main Street Daytona Beach FL 32118 United States Invoice No: 105 Date: 9/2/2021 Customer ID : ABC12345 Name A&G Electronics 456 Dead End Street Salt Lake City, UT 84044 Saterson Due Date ob Payment Terms Due upon receipt Line Total Duny Descronon Display Case fowolle Lint Price $2.500.00 5 2.500.00 $ Installation $500.00 500.00 NO $ 3,000.00 Subtotal 199.75 TOTAL 5 3.000.00 Make all check payable to Canned Software inc THANK YOU FOR YOUR BUSINESS INVOICE 2 Price Tags RUS Labels For Retailers Division 294 Dennis Street Monroevile, AL 36460 Invoice NO AL 722 Date: 9/4/2021 Customer ID AGE67 AQG Electronics Att. Accts Payable 456 Dead End Street Salt Lake City, UT 84044 Salesperson Payment Tenis Due Date 2% Net 30 11/14/2021 Quantity Description Unit Price Price tags - "A&G Electronics - 10,000 quantity $2,000.00 Line Total $ 2,000.00 1 Excempt trons $ 2,000.00 Subtotal Sales Tax $ TOTAL 5 2000.00 Make all checks payable to Price Tags R Us THANK YOU FOR YOUR BUSINESS! INVOICE Csinc Canned Software in 123 Main Street Daytona Beach R32118 United States Invice No 100 Date9/10/2021 Customer ABC1235 Name ABG Electronic 456 Dead End Street Salt Lake City, UT 84044 Seson Due Date Due upon receipt Duantity (Una Pince Line tota Desmon Canned Software 100.00 $100.00 5 Subtotal 100.00 775 7.75 TOTAL 5 100.00 Make all checks payable to Canned Software Inc THANK YOU FOR YOUR BUSINESSE Kylee Software Corporation 2019 Island Road Fort Lauderdale, FL 33311 United States No: 201709 Dute: 19/2021 ABG Electronics 456 Dead End Street Salt Lake City, UT 84044 Need to be tax Due Dame Joe Cine Rob Due upon receipt Quy Descriton On Demand Software Line Toca $ 3,000.00 53.000.00 $ 10,000.00 510.000.00 User Productivity digital download 5 13.000,00 1.75% Subtotal 10015 $ 12.000.00 TOTAL Make all checks payable 10 Kylee Software Corporation THANK YOU FOR YOUR BUSINESS 281.7 62001 Get current sales tax rates tax utah.govisales 9998 www.UT34-0100 TC-625 Sales and Use Tax Return 5/19 Single Place of Business Acet: ABC123 Period: 09/01/21 09/30/21 FROM TO Return Due Date: 10/20/21 Manufacturing youthorns A&G Electronics, Inc. 456 Dead End Street Salt Lake City, UT 84044 Good 3712 30 South AMENDED PERIOD being made Check STO PAPER FORMS Chow you 177.50 Retailing THIS RETURN MUST BE FILED, EVEN IF NO TAX IS DUE 1. Total sales of goods and Services 500418 .91 2 2 Empties included in line 1 3 505,264 13 3. Taxable sales (line 1 minus line 29 .4 4 Goods purchased tax free and used by you 5 37406 12 (37511 10 .30 5. Total taxable amounts in plus in 4) 6. Adjustments (attach explanation showing figures) Leasing .30) 7. Nettable sales and purchases in 5 plus minus line) & Tax calculation Ba a Non-food and prepared food sales . b Grocery food sales 9 Total tax in Ba plus line 51 10 xos Consuu 10. Residential fuels included in line 3 10 11. To state and locales dueline usine 10) 12 13 12 Seler discount for monthly flers only line 11 x 0131 13. Additional grocery food seller discount for morelly Tiers only (ne 30 x 0127) 14. NET TAX DUE (ir tt minus ine 12 minus line 13) 14 35022 e Round Oro pade tydedronic urder or TAX TYPE CODE 6400 I declare under the penalties provided by law that, to the best of my knowledge this is a true and correct retum 10/15/2021 AS To USTCW Return the original forms make a copy for your records -1D Barcode

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started