So I'm doing this accounting work and for some reason it's just not all balancing out. I would appreciate some clarifaction of where I went wrong and how to fix it.

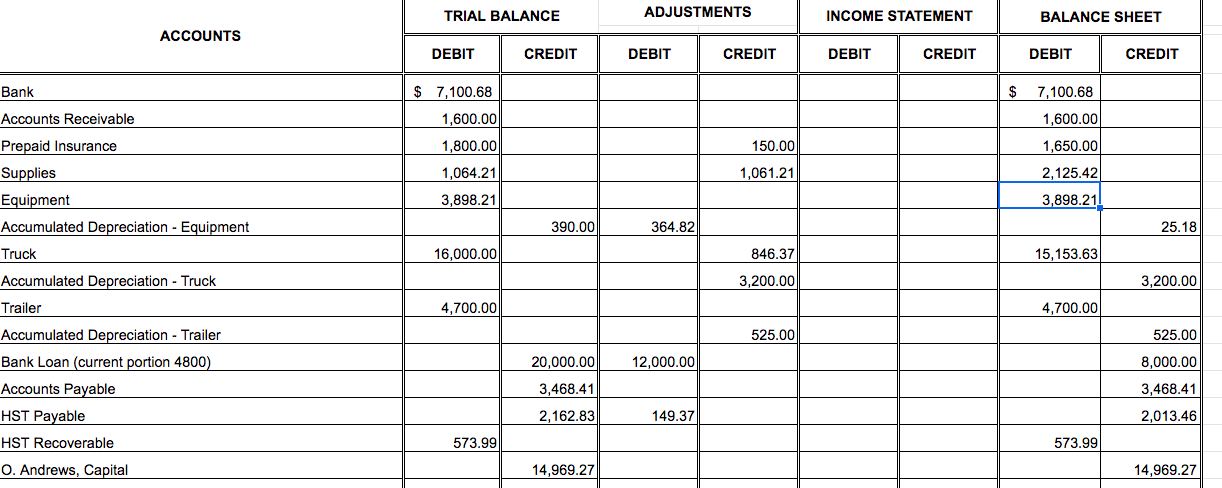

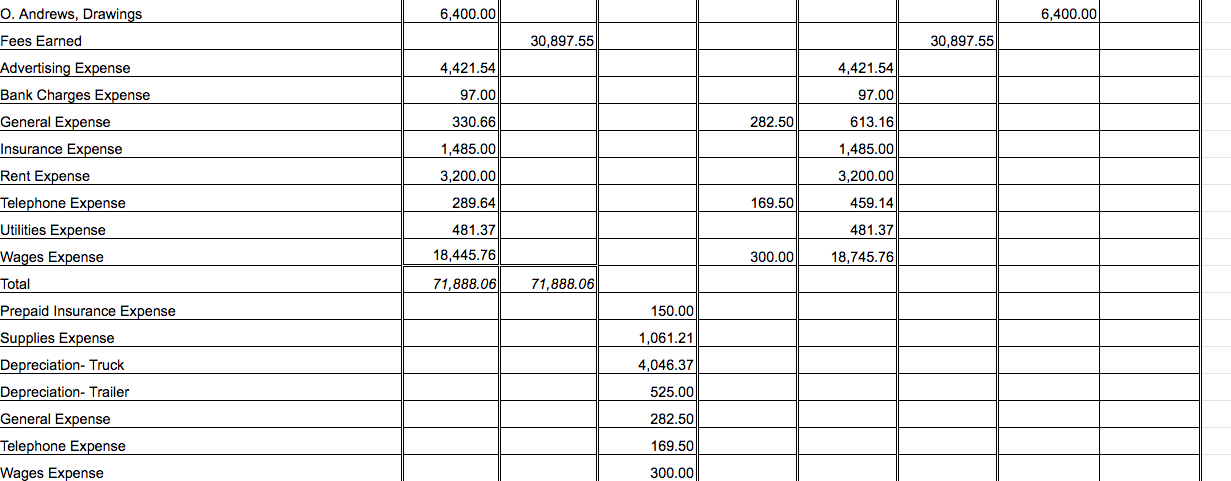

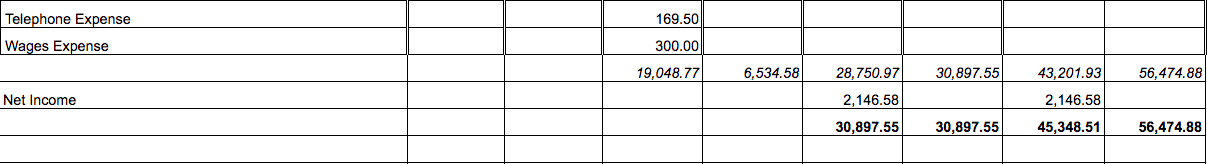

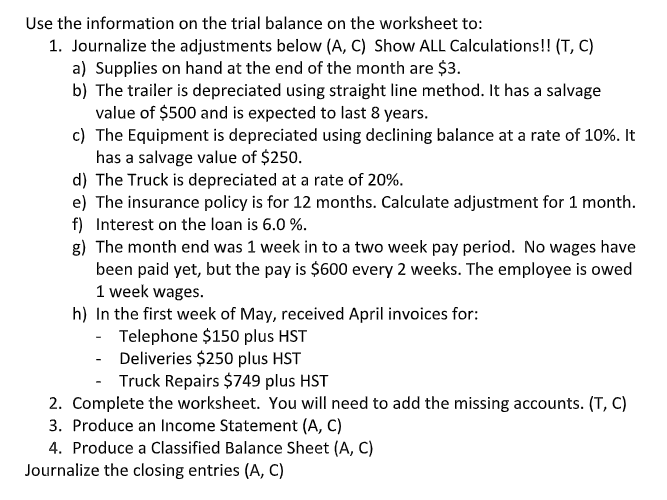

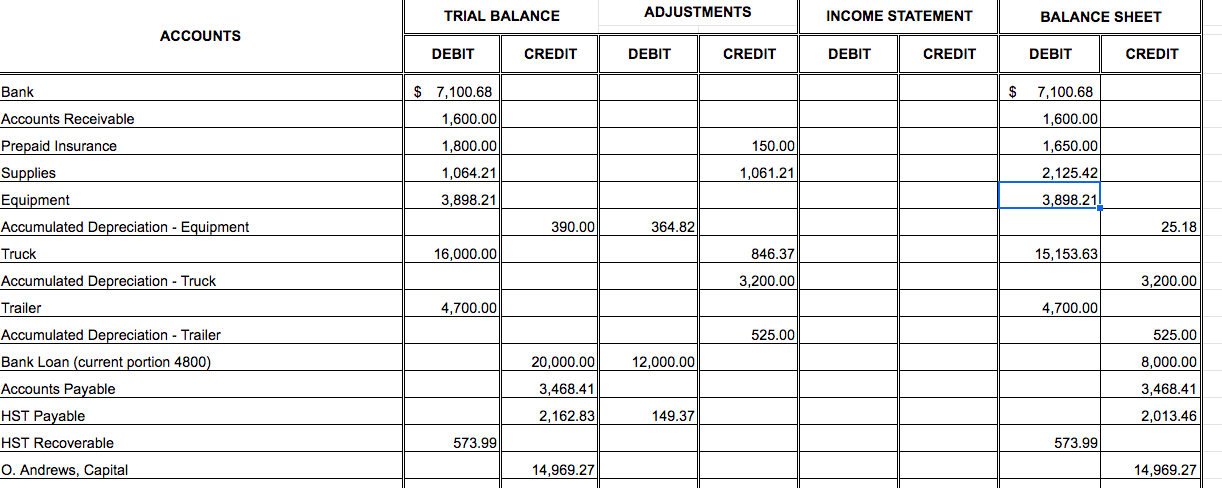

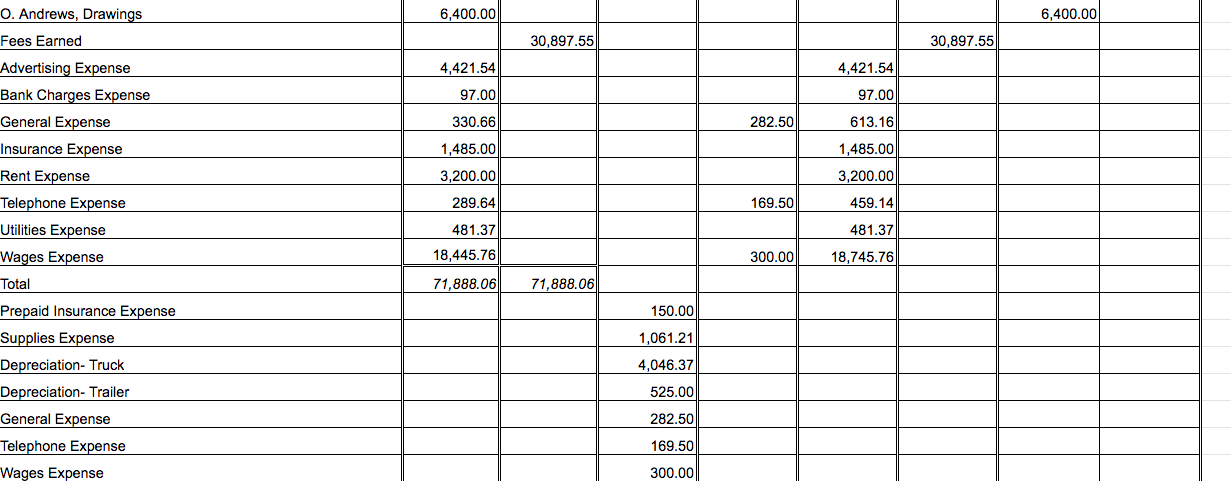

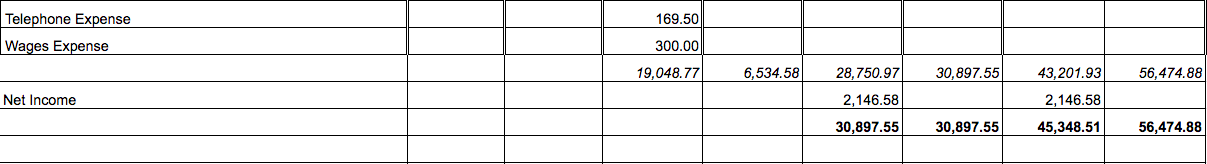

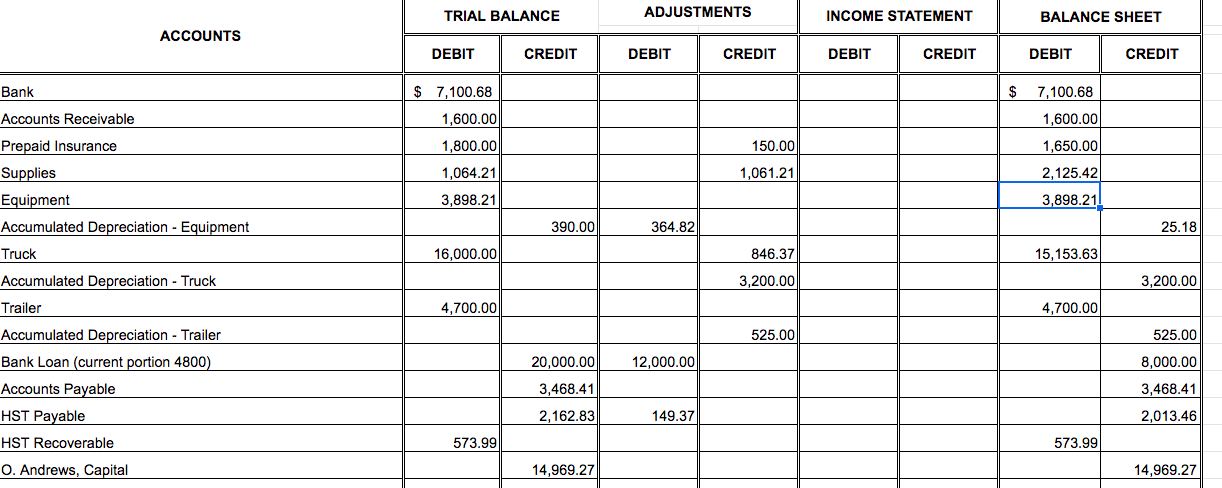

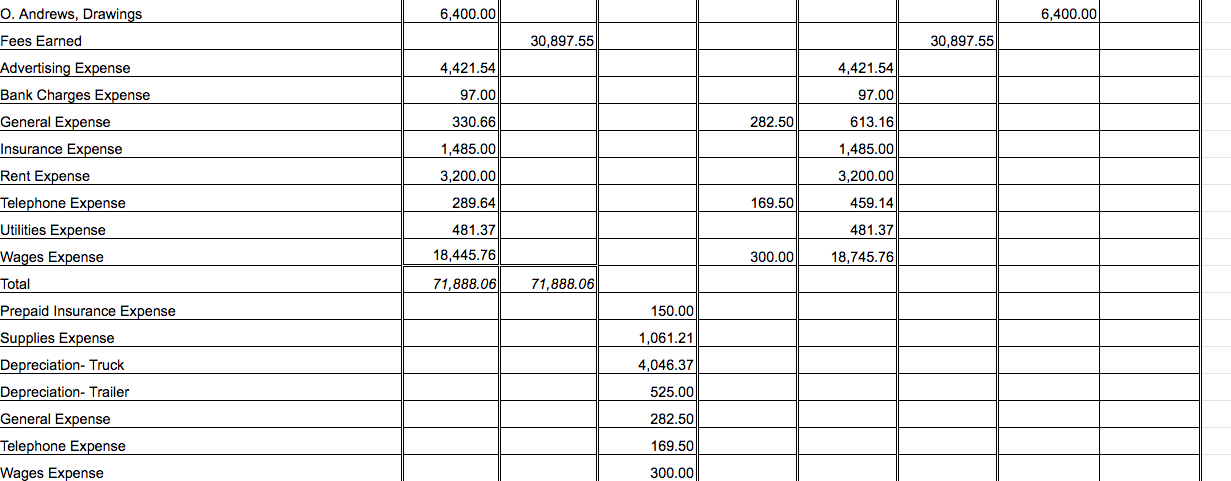

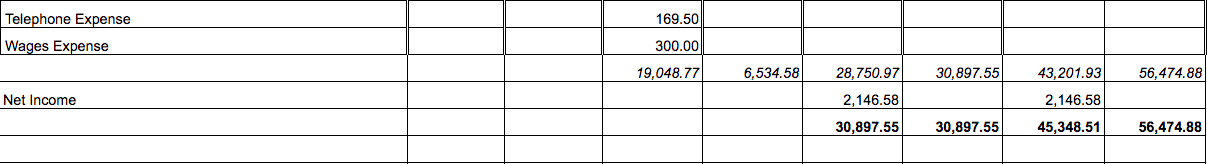

Use the information on the trial balance on the worksheet to: 1. Journalize the adjustments below (A, C) Show ALL Calculations!! (T, C) a) Supplies on hand at the end of the month are $3. b) The trailer is depreciated using straight line method. It has a salvage value of $500 and is expected to last 8 years. c) The Equipment is depreciated using declining balance at a rate of 10%. It has a salvage value of $250. d) The Truck is depreciated at a rate of 20%. e) The insurance policy is for 12 months. Calculate adjustment for 1 month. f) Interest on the loan is 6.0%. g) The month end was 1 week in to a two week pay period. No wages have been paid yet, but the pay is $600 every 2 weeks. The employee is owed 1 week wages. h) In the first week of May, received April invoices for: - Telephone $150 plus HST - Deliveries $250 plus HST - Truck Repairs $749 plus HST 2. Complete the worksheet. You will need to add the missing accounts. (T, C) 3. Produce an Income Statement (A, C) 4. Produce a Classified Balance Sheet (A, C) Journalize the closing entries (A, C)TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET ACCOUNTS DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Bank $ 7,100.68 $ 7,100.68 Accounts Receivable 1,600.00 1,600.00 Prepaid Insurance 1,800.00 150.00 1,650.00 Supplies 1,064.21 1,061.21 2,125.42 Equipment 3,898.21 3,898.21 Accumulated Depreciation - Equipment 390.00 364.82 25.18 Truck 16,000.00 846.37 15,153.63 Accumulated Depreciation - Truck 3,200.00 3,200.00 Trailer 4,700.00 4,700.00 Accumulated Depreciation - Trailer 525.00 525.00 Bank Loan (current portion 4800) 20,000.00 12,000.00 8,000.00 Accounts Payable 3,468.41 3,468.41 HST Payable 2,162.83 149.37 2,013.46 HST Recoverable 573.99 573.99 O. Andrews, Capital 14,969.27 14,969.27O. Andrews. Drawings 6,400.00 6,400.00 Fees Earned 30,89?.55 30,89?.55 Advertising Expense 4,421.54 4,421.54 Bank Charges Expense 9?.00 9?.00 General Expense 330.66 282.50 613.16 Insurance Expense 1,485.00 1,485.00 Rent Expense 3,200.00 3,200.00 Telephone Expense 289.64 169.50 459.14 Utilities Expense 481.37 481.3? Wages Expense 15.44535 300.00 18,?45.?6 Total \"88.06 ?1.888.06 Prepaid Insurance Expense 150.00 Supplies Expense 1,061.21 Depreciation- TmcI-c 4,046.3? Depreciation- Trailer 525.00 General Expense 282.50 Telephone Expense 169.50 Wages Expense 300.00