Answered step by step

Verified Expert Solution

Question

1 Approved Answer

So my questions is: 1. The 5 with yellow underline is a number for Good State or Expected Return A ? Same question for Green

So my questions is:

So my questions is:

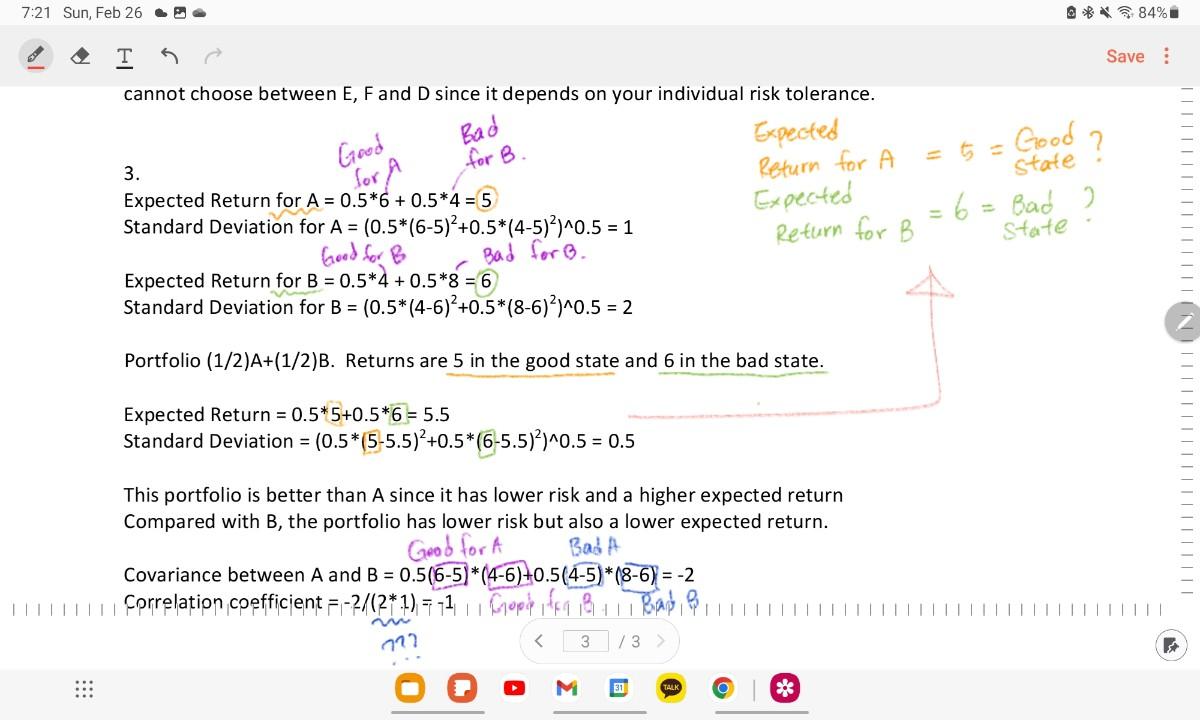

1. The 5 with yellow underline is a number for "Good State" or Expected Return A ? Same question for Green 6.

2. Correlation Coefficient, why -2/ (2*1), why (2*1)??

Thank yoU!

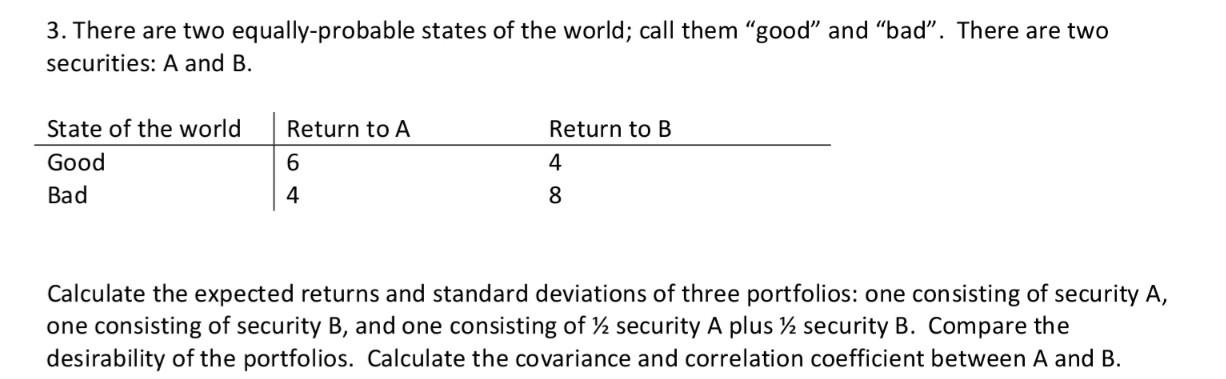

3. There are two equally-probable states of the world; call them "good" and "bad". There are two securities: A and B. Calculate the expected returns and standard deviations of three portfolios: one consisting of security A, one consisting of security B, and one consisting of 1/2 security A plus 1/2 security B. Compare the desirability of the portfolios. Calculate the covariance and correlation coefficient between A and B. cannot choose between E,F and D since it depends on your individual risk tolerance. 3. Standard Deviation for A=(0.5(65)2+0.5(45)2)0.5=1 Expected =b= Bad ? Expected Return for B=0.54+0.58=6 Standard Deviation for B=(0.5(46)2+0.5(86)2)0.5=2 Portfolio (1/2)A+(1/2)B. Returns are 5 in the good state and 6 in the bad state. Expected Return =0.55+0.56=5.5 Standard Deviation =(0.5(55.5)2+0.5(65.5)2)0.5=0.5 This portfolio is better than A since it has lower risk and a higher expected return Compared with B, the portfolio has lower risk but also a lower expected return. GeobforABadA Covariance between A and B=0.5(65)(46)+0.5(45)(86)=2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started