Answered step by step

Verified Expert Solution

Question

1 Approved Answer

so working Your task is to use the price to earnings valuation method to value the stock of Kellogg Company (ticker: K). Define the appropriate

so working

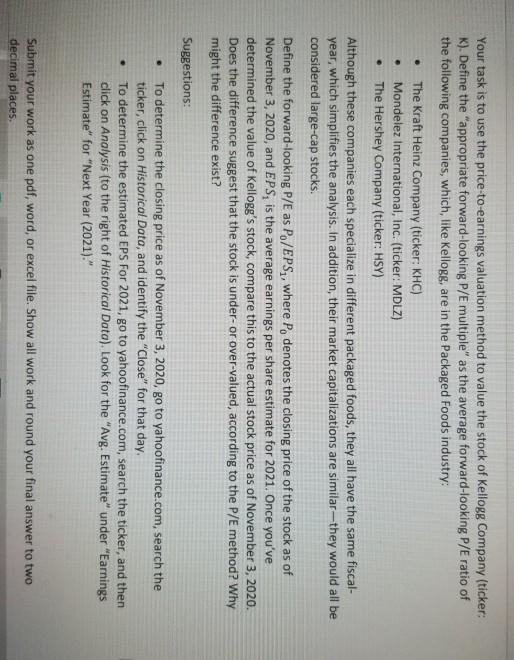

Your task is to use the price to earnings valuation method to value the stock of Kellogg Company (ticker: K). Define the appropriate forward-looking P/E multiple" as the average forward-looking P/E ratio of the following companies, which, like Kellogg, are in the Packaged Foods industry: The Kraft Heinz Company (ticker: KHC) Mondelez International, Inc. (ticker: MDLZ) The Hershey Company (ticker: HSY) Although these companies each specialize in different packaged foods, they all have the same fiscal- year, which simplifies the analysis. In addition, their market capitalizations are similar--they would all be considered large-cap stocks. Define the forward-looking P/E as Po/EPS,, where P, denotes the closing price of the stock as of November 3, 2020, and EPS, is the average earnings per share estimate for 2021. Once you've determined the value of Kellogg's stock, compare this to the actual stock price as of November 3, 2020. Does the difference suggest that the stock is under-or over-valued, according to the P/E method? Why might the difference exist? Suggestions: To determine the closing price as of November 3, 2020, go to yahoofinance.com, search the ticker, click on Historical Data, and identify the "Close" for that day. To determine the estimated EPS For 2021, go to yahoofinance.com, search the ticker, and then click on Analysis (to the right of Historical Data). Look for the "Avg. Estimate" under "Earnings Estimate" for "Next Year (2021)." . Submit your work as one pdf, word, or excel file. Show all work and round your final answer to two decimal places Your task is to use the price to earnings valuation method to value the stock of Kellogg Company (ticker: K). Define the appropriate forward-looking P/E multiple" as the average forward-looking P/E ratio of the following companies, which, like Kellogg, are in the Packaged Foods industry: The Kraft Heinz Company (ticker: KHC) Mondelez International, Inc. (ticker: MDLZ) The Hershey Company (ticker: HSY) Although these companies each specialize in different packaged foods, they all have the same fiscal- year, which simplifies the analysis. In addition, their market capitalizations are similar--they would all be considered large-cap stocks. Define the forward-looking P/E as Po/EPS,, where P, denotes the closing price of the stock as of November 3, 2020, and EPS, is the average earnings per share estimate for 2021. Once you've determined the value of Kellogg's stock, compare this to the actual stock price as of November 3, 2020. Does the difference suggest that the stock is under-or over-valued, according to the P/E method? Why might the difference exist? Suggestions: To determine the closing price as of November 3, 2020, go to yahoofinance.com, search the ticker, click on Historical Data, and identify the "Close" for that day. To determine the estimated EPS For 2021, go to yahoofinance.com, search the ticker, and then click on Analysis (to the right of Historical Data). Look for the "Avg. Estimate" under "Earnings Estimate" for "Next Year (2021)." . Submit your work as one pdf, word, or excel file. Show all work and round your final answer to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started