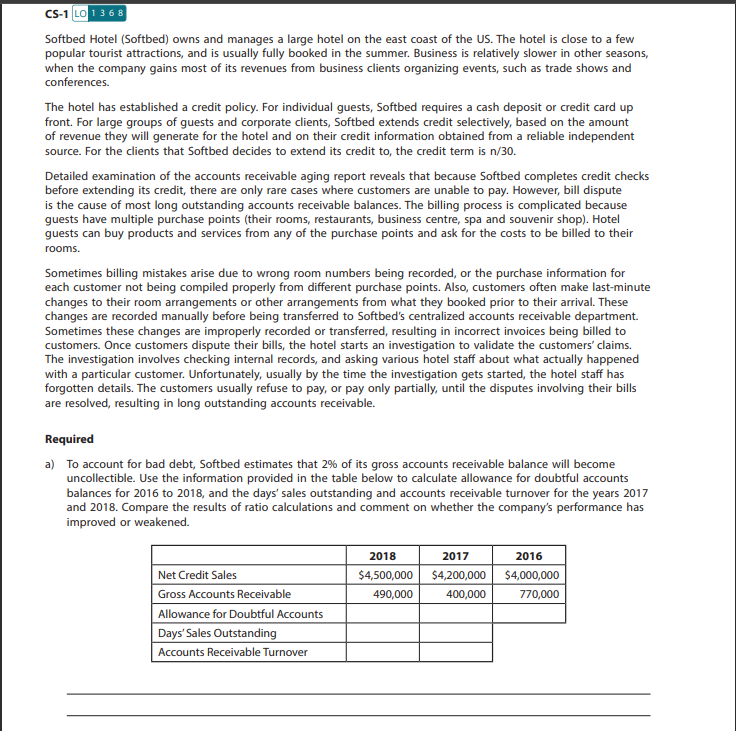

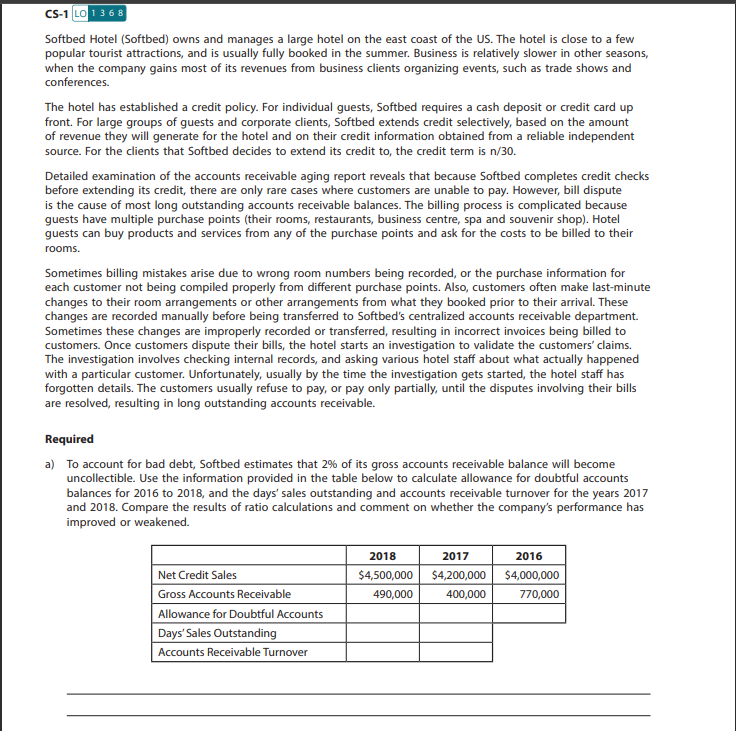

Softbed Hotel (Softbed) owns and manages a large hotel on the east coast of the US. The hotel is close to a few popular tourist attractions, and is usually fully booked in the summer. Business is relatively slower in other seasons, when the company gains most of its revenues from business clients organizing events, such as trade shows and conferences. The hotel has established a credit policy. For individual guests, Softbed requires a cash deposit or credit card up front. For large groups of guests and corporate clients, Softbed extends credit selectively, based on the amount of revenue they will generate for the hotel and on their credit information obtained from a reliable independent source. For the clients that Softbed decides to extend its credit to, the credit term is n/30. Detailed examination of the accounts receivable aging report reveals that because Softbed completes credit checks before extending its credit, there are only rare cases where customers are unable to pay. However, bill dispute is the cause of most long outstanding accounts receivable balances. The billing process is complicated because guests have multiple purchase points (their rooms, restaurants, business centre, spa and souvenir shop). Hotel guests can buy products and services from any of the purchase points and ask for the costs to be billed to their rooms. Sometimes billing mistakes arise due to wrong room numbers being recorded, or the purchase information for each customer not being compiled properly from different purchase points. Also, customers often make last-minute changes to their room arrangements or other arrangements from what they booked prior to their arrival. These changes are recorded manually before being transferred to Softbed's centralized accounts receivable department. Sometimes these changes are improperly recorded or transferred, resulting in incorrect invoices being billed to customers. Once customers dispute their bills, the hotel starts an investigation to validate the customers' claims. The investigation involves checking internal records, and asking various hotel staff about what actually happened with a particular customer. Unfortunately, usually by the time the investigation gets started, the hotel staff has forgotten details. The customers usually refuse to pay, or pay only partially, until the disputes involving their bills are resolved, resulting in long outstanding accounts receivable. Required a) To account for bad debt, Softbed estimates that 2% of its gross accounts receivable balance will become uncollectible. Use the information provided in the table below to calculate allowance for doubtful accounts balances for 2016 to 2018, and the days' sales outstanding and accounts receivable turnover for the years 2017 and 2018. Compare the results of ratio calculations and comment on whether the company's performance has improved or weakened. b) What are other methods that Softbed can use to estimate its bad debt? Which method do you think would be most suitable for Softbed? c) Following Softbed's seasonal business fluctuations, should the company adopt a seasonal credit policy? In other words, should Softbed Hotel use different credit policies for different seasons? Explain. d) Analyze and identify strengths and weaknesses of Softbed's accounts receivable controls. Softbed Hotel (Softbed) owns and manages a large hotel on the east coast of the US. The hotel is close to a few popular tourist attractions, and is usually fully booked in the summer. Business is relatively slower in other seasons, when the company gains most of its revenues from business clients organizing events, such as trade shows and conferences. The hotel has established a credit policy. For individual guests, Softbed requires a cash deposit or credit card up front. For large groups of guests and corporate clients, Softbed extends credit selectively, based on the amount of revenue they will generate for the hotel and on their credit information obtained from a reliable independent source. For the clients that Softbed decides to extend its credit to, the credit term is n/30. Detailed examination of the accounts receivable aging report reveals that because Softbed completes credit checks before extending its credit, there are only rare cases where customers are unable to pay. However, bill dispute is the cause of most long outstanding accounts receivable balances. The billing process is complicated because guests have multiple purchase points (their rooms, restaurants, business centre, spa and souvenir shop). Hotel guests can buy products and services from any of the purchase points and ask for the costs to be billed to their rooms. Sometimes billing mistakes arise due to wrong room numbers being recorded, or the purchase information for each customer not being compiled properly from different purchase points. Also, customers often make last-minute changes to their room arrangements or other arrangements from what they booked prior to their arrival. These changes are recorded manually before being transferred to Softbed's centralized accounts receivable department. Sometimes these changes are improperly recorded or transferred, resulting in incorrect invoices being billed to customers. Once customers dispute their bills, the hotel starts an investigation to validate the customers' claims. The investigation involves checking internal records, and asking various hotel staff about what actually happened with a particular customer. Unfortunately, usually by the time the investigation gets started, the hotel staff has forgotten details. The customers usually refuse to pay, or pay only partially, until the disputes involving their bills are resolved, resulting in long outstanding accounts receivable. Required a) To account for bad debt, Softbed estimates that 2% of its gross accounts receivable balance will become uncollectible. Use the information provided in the table below to calculate allowance for doubtful accounts balances for 2016 to 2018, and the days' sales outstanding and accounts receivable turnover for the years 2017 and 2018. Compare the results of ratio calculations and comment on whether the company's performance has improved or weakened. b) What are other methods that Softbed can use to estimate its bad debt? Which method do you think would be most suitable for Softbed? c) Following Softbed's seasonal business fluctuations, should the company adopt a seasonal credit policy? In other words, should Softbed Hotel use different credit policies for different seasons? Explain. d) Analyze and identify strengths and weaknesses of Softbed's accounts receivable controls