Answered step by step

Verified Expert Solution

Question

1 Approved Answer

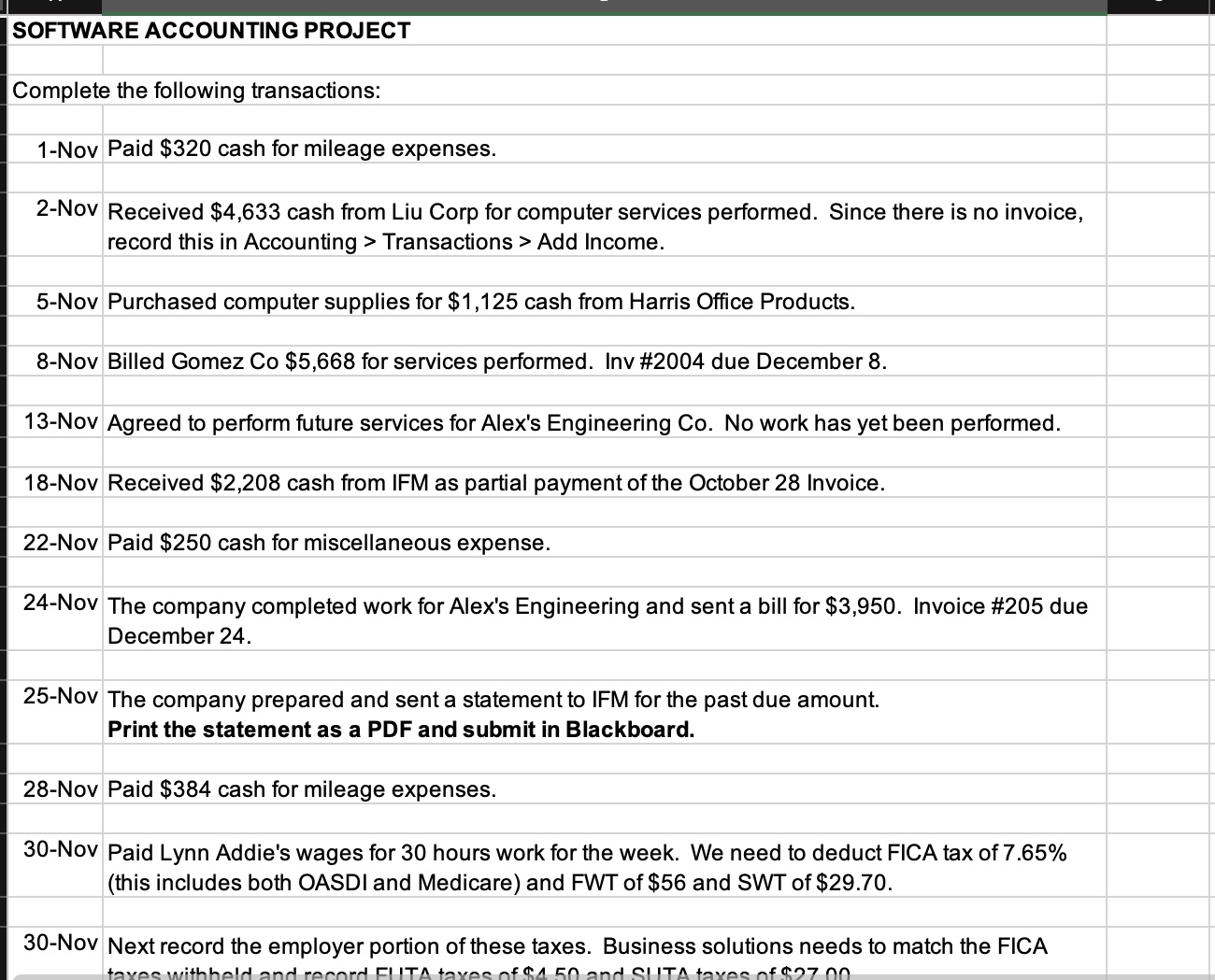

SOFTWARE ACCOUNTING PROJECT Complete the following transactions: 1-Nov Paid $320 cash for mileage expenses. 2-Nov Received $4,633 cash from Liu Corp for computer services

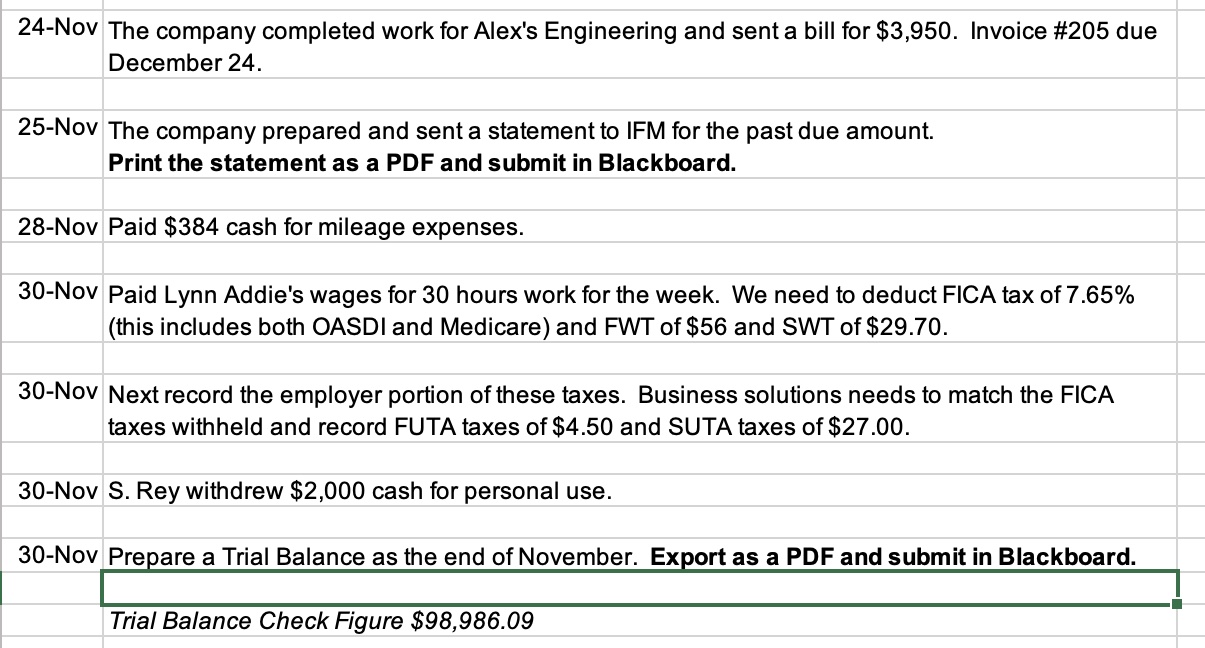

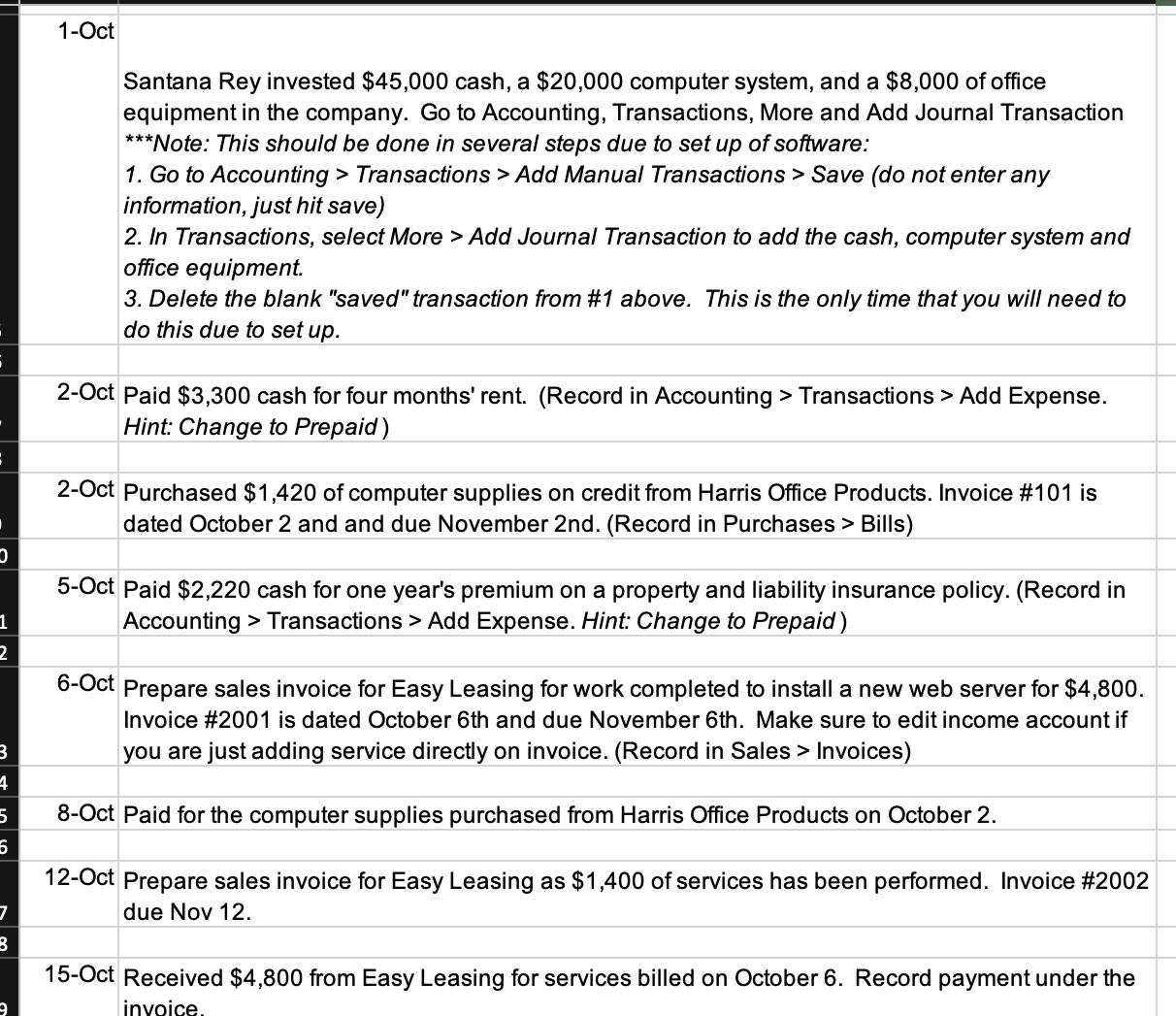

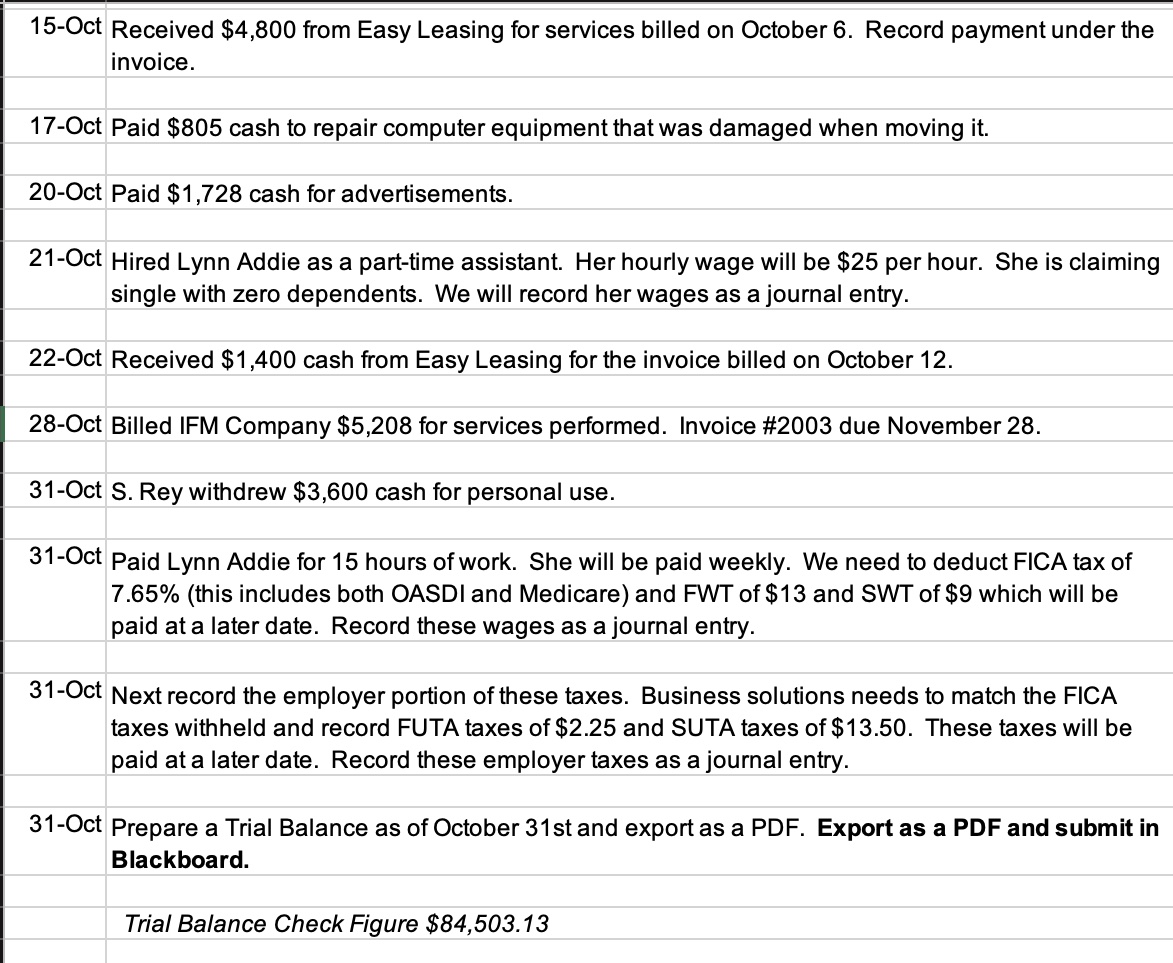

SOFTWARE ACCOUNTING PROJECT Complete the following transactions: 1-Nov Paid $320 cash for mileage expenses. 2-Nov Received $4,633 cash from Liu Corp for computer services performed. Since there is no invoice, record this in Accounting > Transactions > Add Income. 5-Nov Purchased computer supplies for $1,125 cash from Harris Office Products. 8-Nov Billed Gomez Co $5,668 for services performed. Inv #2004 due December 8. 13-Nov Agreed to perform future services for Alex's Engineering Co. No work has yet been performed. 18-Nov Received $2,208 cash from IFM as partial payment of the October 28 Invoice. 22-Nov Paid $250 cash for miscellaneous expense. 24-Nov The company completed work for Alex's Engineering and sent a bill for $3,950. Invoice #205 due December 24. 25-Nov The company prepared and sent a statement to IFM for the past due amount. Print the statement as a PDF and submit in Blackboard. 28-Nov Paid $384 cash for mileage expenses. 30-Nov Paid Lynn Addie's wages for 30 hours work for the week. We need to deduct FICA tax of 7.65% (this includes both OASDI and Medicare) and FWT of $56 and SWT of $29.70. 30-Nov Next record the employer portion of these taxes. Business solutions needs to match the FICA taxes withheld and record FUTA taxes of $4.50 and SUTA taxes of $27.00. 24-Nov The company completed work for Alex's Engineering and sent a bill for $3,950. Invoice #205 due December 24. 25-Nov The company prepared and sent a statement to IFM for the past due amount. Print the statement as a PDF and submit in Blackboard. 28-Nov Paid $384 cash for mileage expenses. 30-Nov Paid Lynn Addie's wages for 30 hours work for the week. We need to deduct FICA tax of 7.65% (this includes both OASDI and Medicare) and FWT of $56 and SWT of $29.70. 30-Nov Next record the employer portion of these taxes. Business solutions needs to match the FICA taxes withheld and record FUTA taxes of $4.50 and SUTA taxes of $27.00. 30-Nov S. Rey withdrew $2,000 cash for personal use. 30-Nov Prepare a Trial Balance as the end of November. Export as a PDF and submit in Blackboard. Trial Balance Check Figure $98,986.09 1-Oct . 1 2 3 4 5 5 7 B 9 Santana Rey invested $45,000 cash, a $20,000 computer system, and a $8,000 of office equipment in the company. Go to Accounting, Transactions, More and Add Journal Transaction ***Note: This should be done in several steps due to set up of software: 1. Go to Accounting > Transactions > Add Manual Transactions > Save (do not enter any information, just hit save) 2. In Transactions, select More > Add Journal Transaction to add the cash, computer system and office equipment. 3. Delete the blank "saved" transaction from #1 above. This is the only time that you will need to do this due to set up. 2-Oct Paid $3,300 cash for four months' rent. (Record in Accounting > Transactions > Add Expense. Hint: Change to Prepaid) 2-Oct Purchased $1,420 of computer supplies on credit from Harris Office Products. Invoice #101 is dated October 2 and and due November 2nd. (Record in Purchases > Bills) 5-Oct Paid $2,220 cash for one year's premium on a property and liability insurance policy. (Record in Accounting > Transactions > Add Expense. Hint: Change to Prepaid) 6-Oct Prepare sales invoice for Easy Leasing for work completed to install a new web server for $4,800. Invoice #2001 is dated October 6th and due November 6th. Make sure to edit income account if you are just adding service directly on invoice. (Record in Sales > Invoices) 8-Oct Paid for the computer supplies purchased from Harris Office Products on October 2. 12-Oct Prepare sales invoice for Easy Leasing as $1,400 of services has been performed. Invoice #2002 due Nov 12. 15-Oct Received $4,800 from Easy Leasing for services billed on October 6. Record payment under the invoice. 15-Oct Received $4,800 from Easy Leasing for services billed on October 6. Record payment under the invoice. 17-Oct Paid $805 cash to repair computer equipment that was damaged when moving it. 20-Oct Paid $1,728 cash for advertisements. 21-Oct Hired Lynn Addie as a part-time assistant. Her hourly wage will be $25 per hour. She is claiming single with zero dependents. We will record her wages as a journal entry. 22-Oct Received $1,400 cash from Easy Leasing for the invoice billed on October 12. 28-Oct Billed IFM Company $5,208 for services performed. Invoice #2003 due November 28. 31-Oct S. Rey withdrew $3,600 cash for personal use. 31-Oct Paid Lynn Addie for 15 hours of work. She will be paid weekly. We need to deduct FICA tax of 7.65% (this includes both OASDI and Medicare) and FWT of $13 and SWT of $9 which will be paid at a later date. Record these wages as a journal entry. 31-Oct Next record the employer portion of these taxes. Business solutions needs to match the FICA taxes withheld and record FUTA taxes of $2.25 and SUTA taxes of $13.50. These taxes will be paid at a later date. Record these employer taxes as a journal entry. 31-Oct Prepare a Trial Balance as of October 31st and export as a PDF. Export as a PDF and submit in Blackboard. Trial Balance Check Figure $84,503.13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started