Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sol Limited. reported earnings of $550,000 in 20X8. The company has $95,000 of depreciation expense this year, and claimed CCA of $150,000. The tax

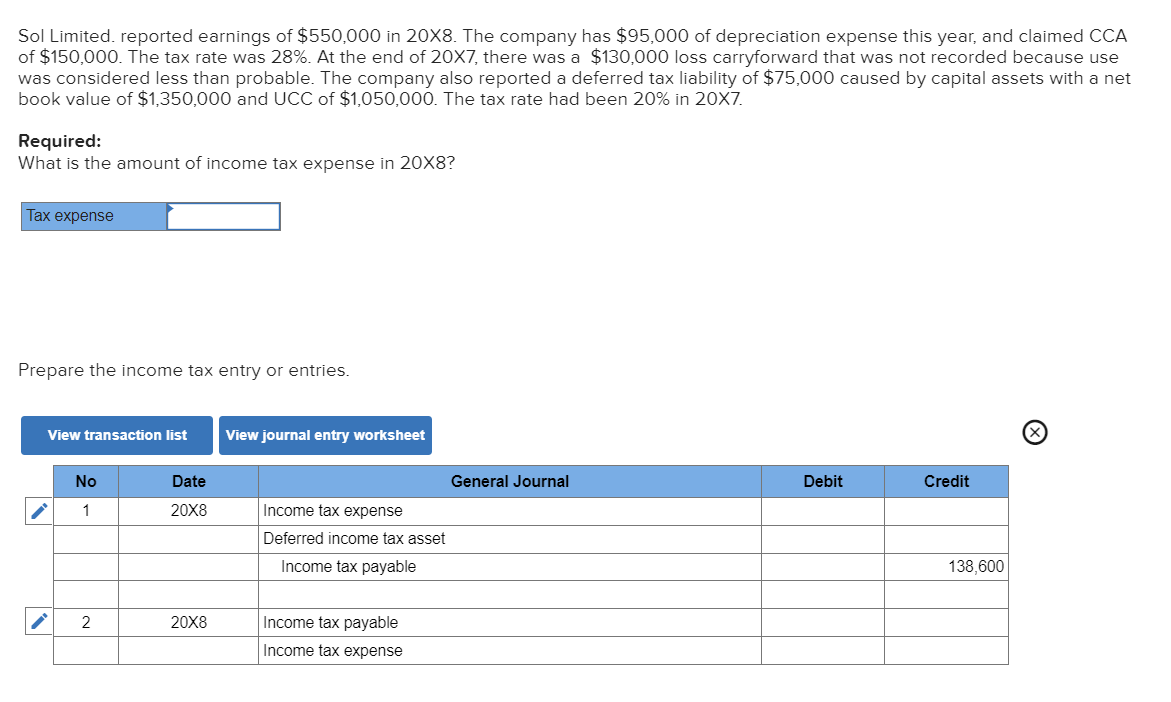

Sol Limited. reported earnings of $550,000 in 20X8. The company has $95,000 of depreciation expense this year, and claimed CCA of $150,000. The tax rate was 28%. At the end of 20X7, there was a $130,000 loss carryforward that was not recorded because use was considered less than probable. The company also reported a deferred tax liability of $75,000 caused by capital assets with a net book value of $1,350,000 and UCC of $1,050,000. The tax rate had been 20% in 20X7. Required: What is the amount of income tax expense in 20X8? Tax expense Prepare the income tax entry or entries. View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 20X8 Income tax expense Deferred income tax asset Income tax payable 138,600 2 20X8 Income tax payable Income tax expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the income tax expense for 20X8 we need to determine the taxable income which is the ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started