Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solac Company acquires 30% of the voting stock of Talgo Corporation on January 1, 2020 for $ 25,000,000. The book value of Talgo's stock

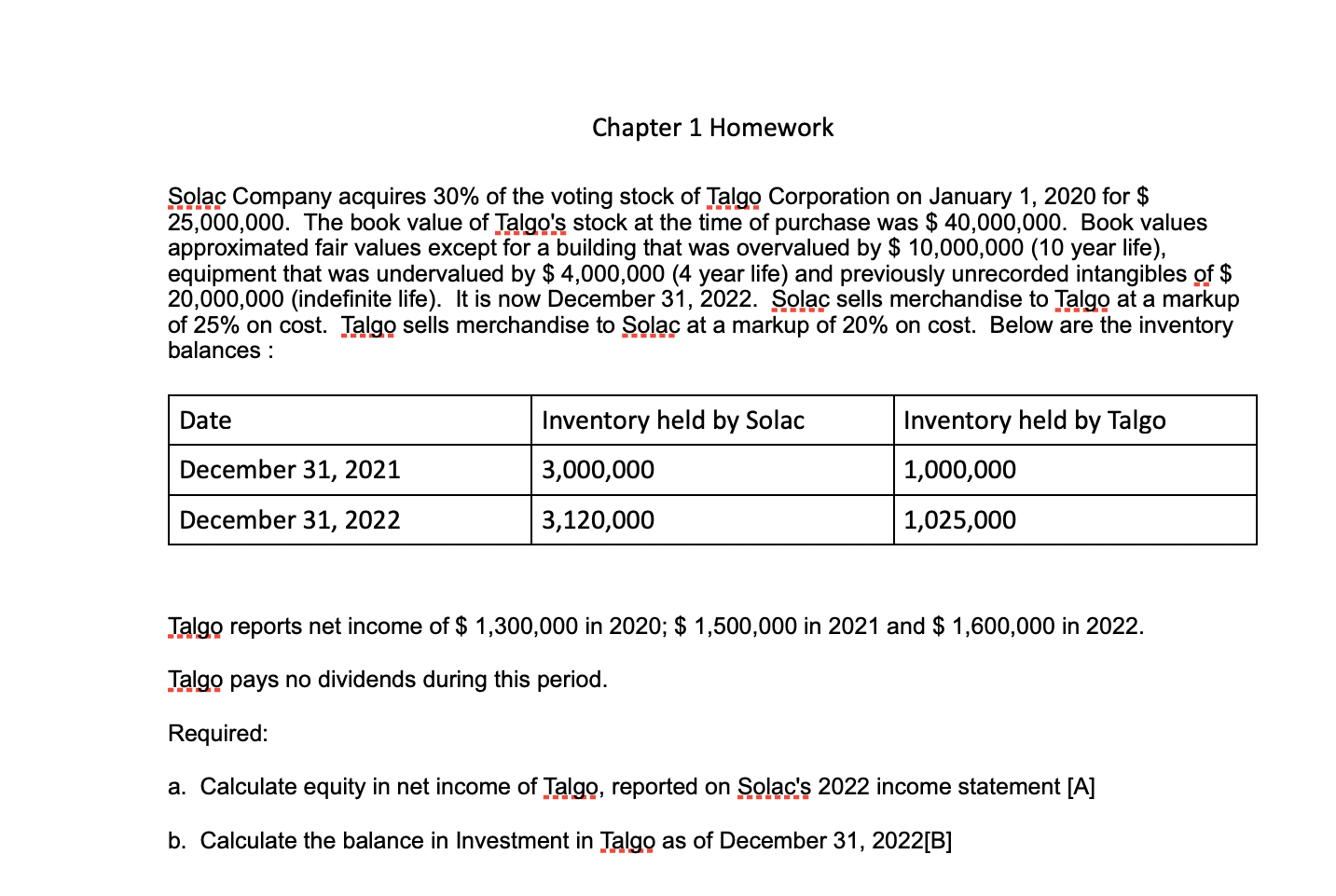

Solac Company acquires 30% of the voting stock of Talgo Corporation on January 1, 2020 for $ 25,000,000. The book value of Talgo's stock at the time of purchase was $ 40,000,000. Book values approximated fair values except for a building that was overvalued by $10,000,000 (10 year life), equipment that was undervalued by $4,000,000 (4 year life) and previously unrecorded intangibles of $ 20,000,000 (indefinite life). It is now December 31, 2022. Solac sells merchandise to Talgo at a markup of 25% on cost. Talgo sells merchandise to Solac at a markup of 20% on cost. Below are the inventory balances : Date Chapter 1 Homework December 31, 2021 December 31, 2022 Inventory held by Solac 3,000,000 3,120,000 Inventory held by Talgo 1,000,000 1,025,000 Talgo reports net income of $ 1,300,000 in 2020; $ 1,500,000 in 2021 and $ 1,600,000 in 2022. Talgo pays no dividends during this period. Required: a. Calculate equity in net income of Talgo, reported on Solac's 2022 income statement [A] b. Calculate the balance in Investment in Talgo as of December 31, 2022[B]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

You have presented an accounting problem related to equity accounting for an investment in an associate Talgo Corporation by an investor Solac Company Lets go through the calculations step by step con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started