Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solar Flares Fireworks is considering adding a new line of fireworks called Sparkly Boomers to its product line. Sparkly Boomers are expected to have a

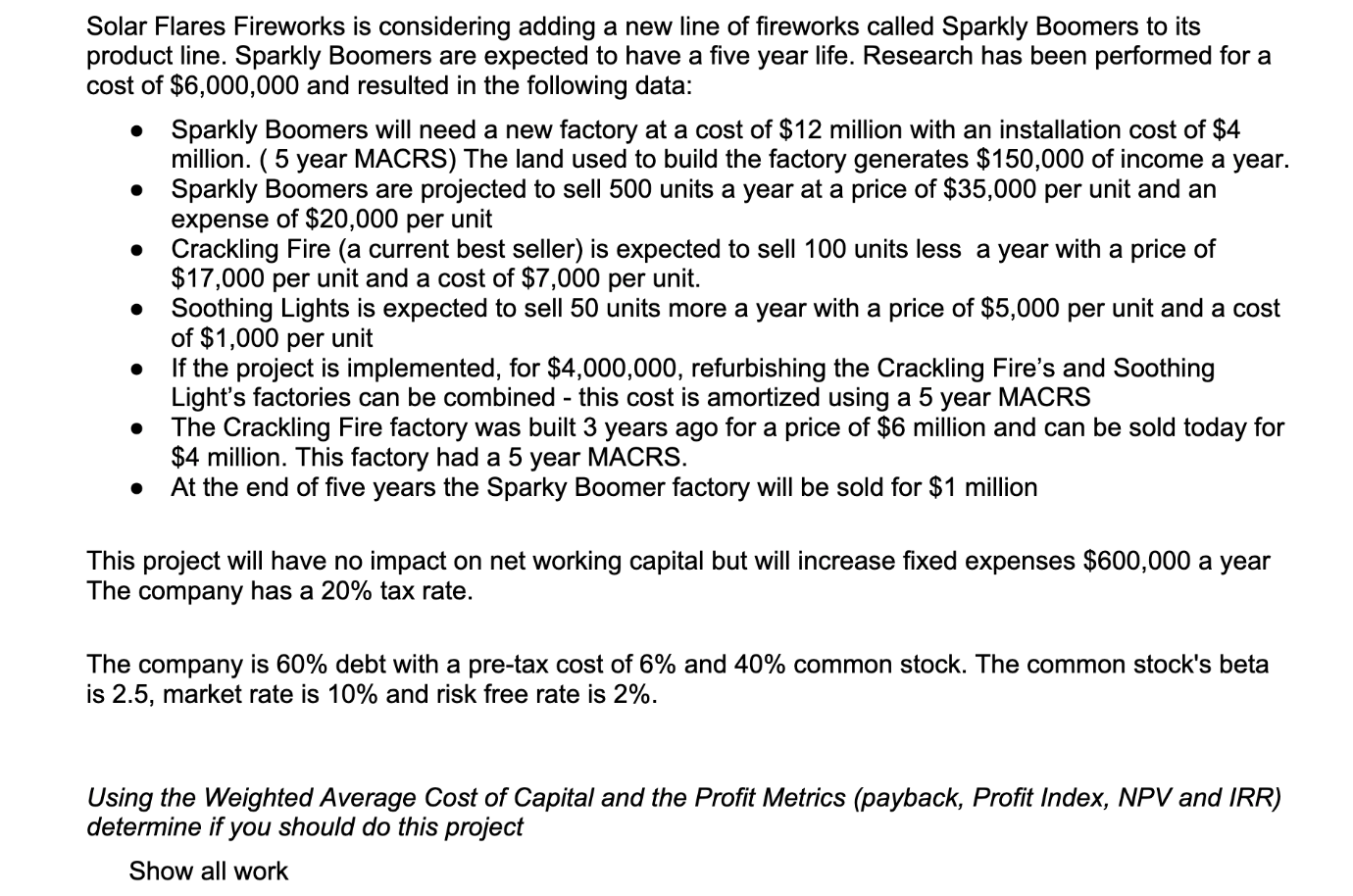

Solar Flares Fireworks is considering adding a new line of fireworks called Sparkly Boomers to its product line. Sparkly Boomers are expected to have a five year life. Research has been performed for a cost of $6,000,000 and resulted in the following data: - Sparkly Boomers will need a new factory at a cost of $12 million with an installation cost of $4 million. ( 5 year MACRS) The land used to build the factory generates $150,000 of income a year. - Sparkly Boomers are projected to sell 500 units a year at a price of $35,000 per unit and an expense of $20,000 per unit - Crackling Fire (a current best seller) is expected to sell 100 units less a year with a price of $17,000 per unit and a cost of $7,000 per unit. - Soothing Lights is expected to sell 50 units more a year with a price of $5,000 per unit and a cost of $1,000 per unit - If the project is implemented, for $4,000,000, refurbishing the Crackling Fire's and Soothing Light's factories can be combined - this cost is amortized using a 5 year MACRS - The Crackling Fire factory was built 3 years ago for a price of $6 million and can be sold today for $4 million. This factory had a 5 year MACRS. - At the end of five years the Sparky Boomer factory will be sold for $1 million This project will have no impact on net working capital but will increase fixed expenses $600,000 a year The company has a 20% tax rate. The company is 60% debt with a pre-tax cost of 6% and 40% common stock. The common stock's beta is 2.5 , market rate is 10% and risk free rate is 2%. Using the Weighted Average Cost of Capital and the Profit Metrics (payback, Profit Index, NPV and IRR) determine if you should do this project Show all work

Solar Flares Fireworks is considering adding a new line of fireworks called Sparkly Boomers to its product line. Sparkly Boomers are expected to have a five year life. Research has been performed for a cost of $6,000,000 and resulted in the following data: - Sparkly Boomers will need a new factory at a cost of $12 million with an installation cost of $4 million. ( 5 year MACRS) The land used to build the factory generates $150,000 of income a year. - Sparkly Boomers are projected to sell 500 units a year at a price of $35,000 per unit and an expense of $20,000 per unit - Crackling Fire (a current best seller) is expected to sell 100 units less a year with a price of $17,000 per unit and a cost of $7,000 per unit. - Soothing Lights is expected to sell 50 units more a year with a price of $5,000 per unit and a cost of $1,000 per unit - If the project is implemented, for $4,000,000, refurbishing the Crackling Fire's and Soothing Light's factories can be combined - this cost is amortized using a 5 year MACRS - The Crackling Fire factory was built 3 years ago for a price of $6 million and can be sold today for $4 million. This factory had a 5 year MACRS. - At the end of five years the Sparky Boomer factory will be sold for $1 million This project will have no impact on net working capital but will increase fixed expenses $600,000 a year The company has a 20% tax rate. The company is 60% debt with a pre-tax cost of 6% and 40% common stock. The common stock's beta is 2.5 , market rate is 10% and risk free rate is 2%. Using the Weighted Average Cost of Capital and the Profit Metrics (payback, Profit Index, NPV and IRR) determine if you should do this project Show all work Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started