Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solar Salt has determined that its total manufacturing cost of $700,000 is a mixture of unit-level costs, batch-level costs, and product line costs. Solar Salt

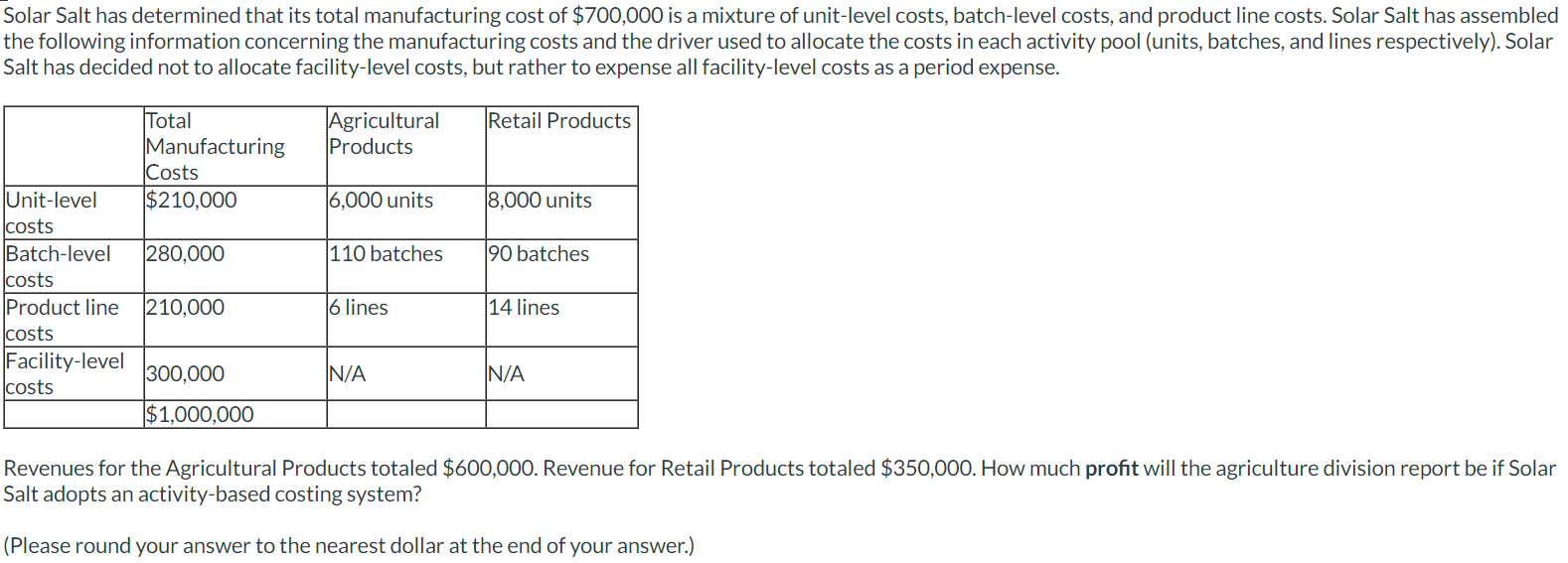

Solar Salt has determined that its total manufacturing cost of $700,000 is a mixture of unit-level costs, batch-level costs, and product line costs. Solar Salt has assembled he following information concerning the manufacturing costs and the driver used to allocate the costs in each activity pool (units, batches, and lines respectively). Solar Salt has decided not to allocate facility-level costs, but rather to expense all facility-level costs as a period expense. Revenues for the Agricultural Products totaled $600,000. Revenue for Retail Products totaled $350,000. How much profit will the agriculture division report be if Solar Salt adopts an activity-based costing system? Please round your answer to the nearest dollar at the end of your answer.)

Solar Salt has determined that its total manufacturing cost of $700,000 is a mixture of unit-level costs, batch-level costs, and product line costs. Solar Salt has assembled he following information concerning the manufacturing costs and the driver used to allocate the costs in each activity pool (units, batches, and lines respectively). Solar Salt has decided not to allocate facility-level costs, but rather to expense all facility-level costs as a period expense. Revenues for the Agricultural Products totaled $600,000. Revenue for Retail Products totaled $350,000. How much profit will the agriculture division report be if Solar Salt adopts an activity-based costing system? Please round your answer to the nearest dollar at the end of your answer.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started