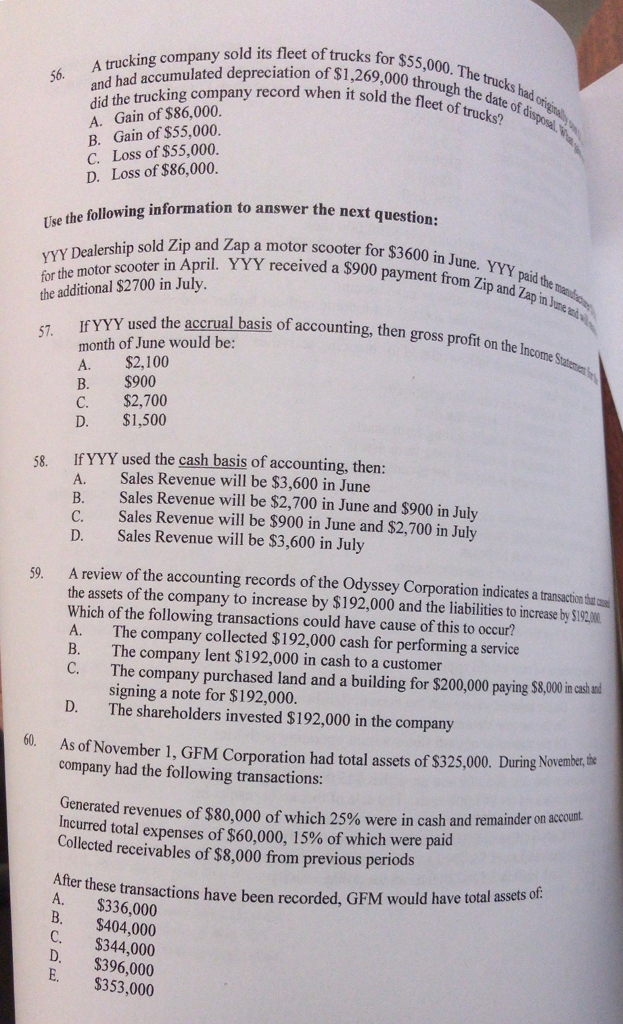

sold its fleet of trucks for $55,000. The depreciation of $1,269,000 through A trucking company sold its fleet of trucks for $s trucks had orginal 56. did the trucking company record when it sold the fleth te lae ad had accumulated it sold the fleet of trucks? A. Gain of $86,000. B. Gain of $55,000 C. Loss of $55,000. D. Loss of $86,000. se the following information to answer the next questiong yY Dealership sor April. YYY received a $900 payment from Zip and Zapt the additional $2700 in July 57. Zip and Zap a motor scooter for $3600 in June YYY paid the ma $900 payment from Zip and Zap in bune IfYYY used the acc crual basis of accounting, then gross profit on the l month of June would be: A. $2,100 B. $900 C. $2,700 D. $1,500 R IfYYY used the cash basis of accounting, then: A. B. C. D. Sales Revenue will be $3,600 in June Sales Revenue will be $2,700 in June and $900 in July Sales Revenue will be $900 in June and $2,700 in July Sales Revenue will be $3,600 in July 59. A review of the accounting records of the Odyssey Corporation indicates a transaction thr the assets of the company to increase by $192,000 and the liabilities to increase by $192.80 Which of the following transactions could have cause of this to occur? A. The company collected $192,000 cash for performing a service B. The company lent $192,000 in cash to a customer C. The company purchased land and a building for $200,000 paying $8,000in cash ad signing a note for $192,000. The shareholders invested $192,000 in the company D. 60. As of November 1, GFM Corporation had total assets of s325,000. During November,to company had the following transactions Generated revenues of $80,000 of which 25% were in cash and remainder on incurred total expenses of $60,000, l 5% of which were paid Collected receivables of $8,000 from previous periods A ertiese transactions have been recorded, GFM would have total asces of A. $336,000 B. $404,000 C. $344,000 D. $396,000 E. $353,000 sold its fleet of trucks for $55,000. The depreciation of $1,269,000 through A trucking company sold its fleet of trucks for $s trucks had orginal 56. did the trucking company record when it sold the fleth te lae ad had accumulated it sold the fleet of trucks? A. Gain of $86,000. B. Gain of $55,000 C. Loss of $55,000. D. Loss of $86,000. se the following information to answer the next questiong yY Dealership sor April. YYY received a $900 payment from Zip and Zapt the additional $2700 in July 57. Zip and Zap a motor scooter for $3600 in June YYY paid the ma $900 payment from Zip and Zap in bune IfYYY used the acc crual basis of accounting, then gross profit on the l month of June would be: A. $2,100 B. $900 C. $2,700 D. $1,500 R IfYYY used the cash basis of accounting, then: A. B. C. D. Sales Revenue will be $3,600 in June Sales Revenue will be $2,700 in June and $900 in July Sales Revenue will be $900 in June and $2,700 in July Sales Revenue will be $3,600 in July 59. A review of the accounting records of the Odyssey Corporation indicates a transaction thr the assets of the company to increase by $192,000 and the liabilities to increase by $192.80 Which of the following transactions could have cause of this to occur? A. The company collected $192,000 cash for performing a service B. The company lent $192,000 in cash to a customer C. The company purchased land and a building for $200,000 paying $8,000in cash ad signing a note for $192,000. The shareholders invested $192,000 in the company D. 60. As of November 1, GFM Corporation had total assets of s325,000. During November,to company had the following transactions Generated revenues of $80,000 of which 25% were in cash and remainder on incurred total expenses of $60,000, l 5% of which were paid Collected receivables of $8,000 from previous periods A ertiese transactions have been recorded, GFM would have total asces of A. $336,000 B. $404,000 C. $344,000 D. $396,000 E. $353,000