Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Soled Out is a shoe store, specialising in sneakers. The store only makes credit sales to customers. One of its debtors, The Shoebox, had

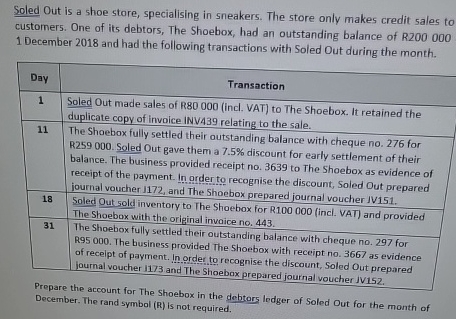

Soled Out is a shoe store, specialising in sneakers. The store only makes credit sales to customers. One of its debtors, The Shoebox, had an outstanding balance of R200 000 1 December 2018 and had the following transactions with Soled Out during the month. Day 1 Transaction 11 18 31 Soled Out made sales of R80 000 (incl. VAT) to The Shoebox. It retained the duplicate copy of invoice INV439 relating to the sale. The Shoebox fully settled their outstanding balance with cheque no. 276 for R259 000. Soled Out gave them a 7.5% discount for early settlement of their balance. The business provided receipt no. 3639 to The Shoebox as evidence of receipt of the payment. In order to recognise the discount, Soled Out prepared journal voucher 1172, and The Shoebox prepared journal voucher JV151. Soled Out sold inventory to The Shoebox for R100 000 (incl. VAT) and provided The Shoebox with the original invoice no. 443. The Shoebox fully settled their outstanding balance with cheque no. 297 for R95 000. The business provided The Shoebox with receipt no. 3667 as evidence of receipt of payment. In order to recognise the discount, Soled Out prepared journal voucher 1173 and The Shoebox prepared journal voucher JV152. Prepare the account for The Shoebox in the debtors ledger of Soled Out for the month of December. The rand symbol (R) is not required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started