Question

Solid Metal is a fairly large-sized manufacturing firm which produced unique metal products for households and commercial use. Formed in 1980, the company had performed

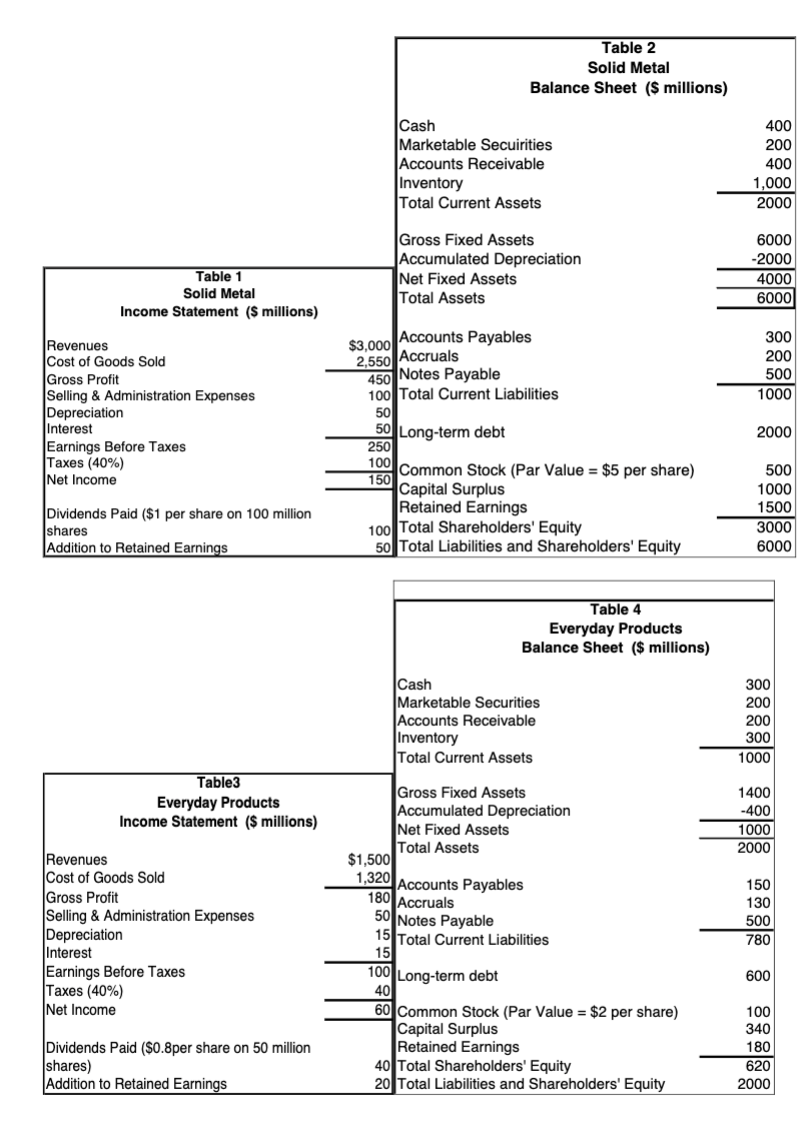

Solid Metal is a fairly large-sized manufacturing firm which produced unique metal products for households and commercial use. Formed in 1980, the company had performed better. At the time of its inception, the industry was in its infancy stage and there was virtually no competition. As a result, the firm enjoyed significant growth in the early years and cumulated a significant amount of cash. Over the past few years, due to intense competition and an economic downturn, the firms growth has dried up. Managers were in pursuit of alternative ways of growth. The companys stock price had recently dropped to $45 per share. The company decided to look for suitable acquisition opportunities to better utilize its assets and diversify its risk.

After a considerable search, the firm decided on a potential acquisition candidate: Everyday Products. Everyday Products was a mid-sized company with assets of $2 billion. The firms earnings per share had been steadily increasing and were currently at $1.20. Surprisingly, although this firm has a diversified customer base, its P/E ratio was rather low at 12.5, much lower than its industry peers. The management at Solid Metal believed that one reason for every days low P/E ratio might have been the recent retirement of the CEO. This CEO led every day from being a small local company to becoming a medium-sized growing consumer products firm with a solid presence in the Midwest. The market saw the retirement of Everydays CEO as a negative signal and stock price suffered because of this. Managers at Solid Metal believed that, with their expertise on technical and marketing, they can achieve significant reductions in the production and marketing costs for every day. Solid Metal estimated that the incremental net cash flows of the combined firm were estimated to be at least $45 million per year for the foreseeable future. Also, since the every day is in a totally different industry, Solid Metal will be able to obtain significant diversification benefits through this acquisition

Using the free cash flow method of valuation calculate the maximum offer price that Solid Metal would be justified in making for Everyday Products. (Hint: For this question, use WACC=16% to discount the incremental net cash flows of $45M/year as a constant perpetuity.)

Please show work thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started