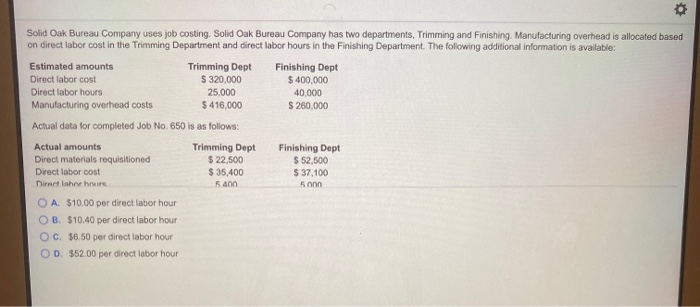

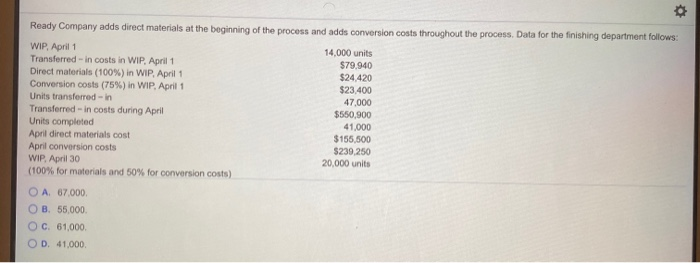

Solid Oak Bureau Company uses job costing. Solid Oak Bureau Company has two departments, Trimming and Finishing. Manufacturing overhead is allocated based on direct labor cost in the Trimming Department and direct labor hours in the Finishing Department. The following additional information is available: Estimated amounts Trimming Dept Finishing Dept Direct labor cost $ 320,000 $ 400,000 Direct labor hours 25,000 40,000 Manufacturing overhead costs $ 416,000 $ 260,000 Actual data for completed Job No. 650 is as follows: Actual amounts Trimming Dept Finishing Dept Direct materials requisitioned $ 22,500 $ 52,500 Direct labor cost $ 35,400 $ 37,100 Direct lahor hours 5400 5000 O A. $10.00 per direct labor hour OB. $10.40 per direct labor hour OC. $6.50 per direct labor hour OD. $52.00 per direct labor hour Ready Company adds direct materials at the beginning of the process and adds conversion costs throughout the process. Data for the finishing department follows: WIP, April 1 14,000 units Transferred - in costs in WIP, April 1 $79.940 Direct materials (100%) in WIP, April 1 $24.420 Conversion costs (75%) in WIP, April 1 $23.400 Units transferred in 47,000 Transferred - in costs during April $550,900 Units completed 41,000 April direct materials cost $155,500 April conversion costs $239,250 WIP, April 30 20,000 units (100% for materials and 50% for conversion costs) A 67.000 OB 55.000 OC 61,000 OD 41,000 Solid Oak Bureau Company uses job costing. Solid Oak Bureau Company has two departments, Trimming and Finishing. Manufacturing overhead is allocated based on direct labor cost in the Trimming Department and direct labor hours in the Finishing Department. The following additional information is available: Estimated amounts Trimming Dept Finishing Dept Direct labor cost $ 320,000 $ 400,000 Direct labor hours 25,000 40,000 Manufacturing overhead costs $ 416,000 $ 260,000 Actual data for completed Job No. 650 is as follows: Actual amounts Trimming Dept Finishing Dept Direct materials requisitioned $ 22,500 $ 52,500 Direct labor cost $ 35,400 $ 37,100 Direct lahor hours 5400 5000 O A. $10.00 per direct labor hour OB. $10.40 per direct labor hour OC. $6.50 per direct labor hour OD. $52.00 per direct labor hour Ready Company adds direct materials at the beginning of the process and adds conversion costs throughout the process. Data for the finishing department follows: WIP, April 1 14,000 units Transferred - in costs in WIP, April 1 $79.940 Direct materials (100%) in WIP, April 1 $24.420 Conversion costs (75%) in WIP, April 1 $23.400 Units transferred in 47,000 Transferred - in costs during April $550,900 Units completed 41,000 April direct materials cost $155,500 April conversion costs $239,250 WIP, April 30 20,000 units (100% for materials and 50% for conversion costs) A 67.000 OB 55.000 OC 61,000 OD 41,000