Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assignment Detail: CASE STUDY: Robot Limited Robot Limited is a UK subsidiary of the Pullover Group inc. The company has been operating in the

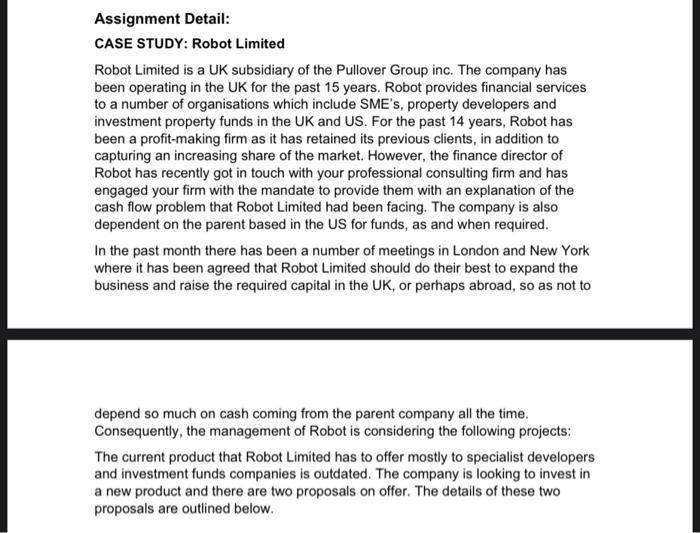

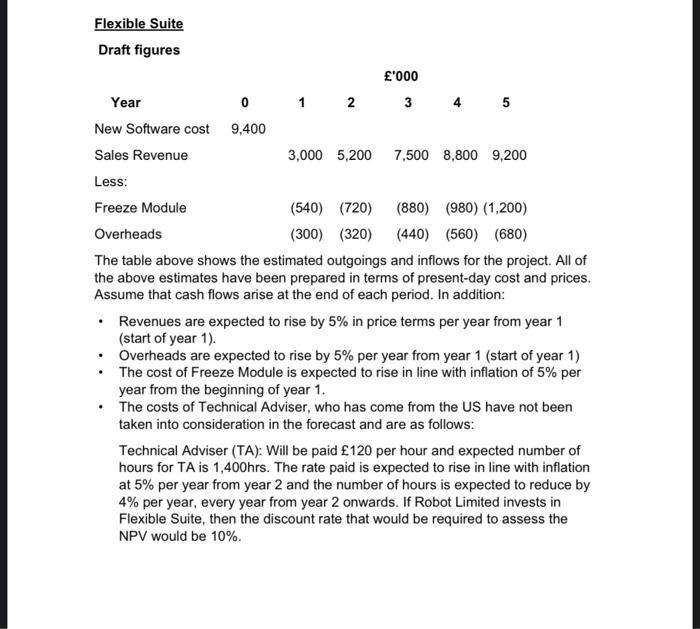

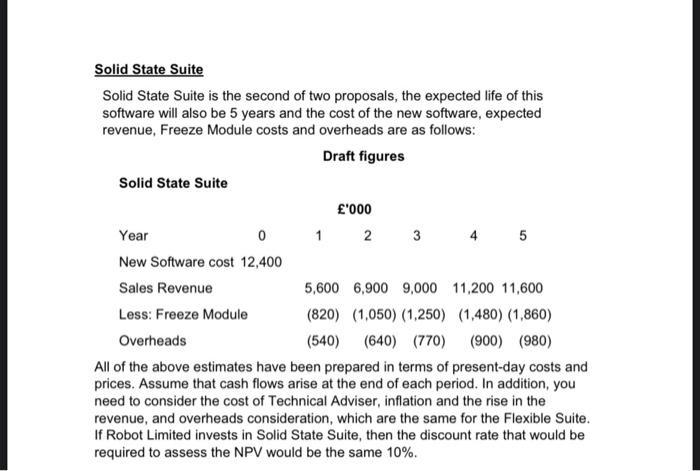

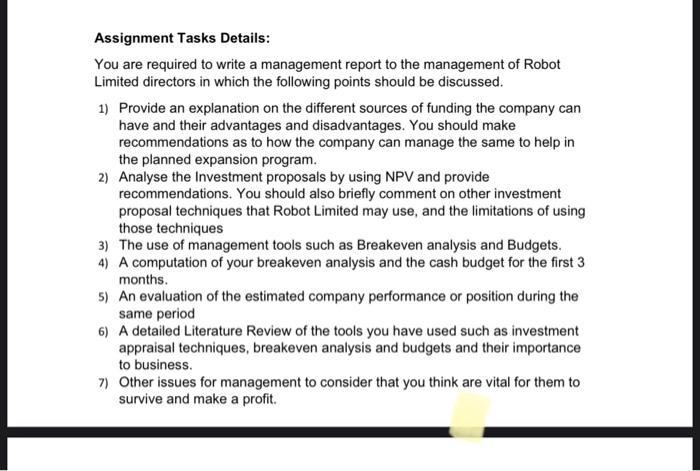

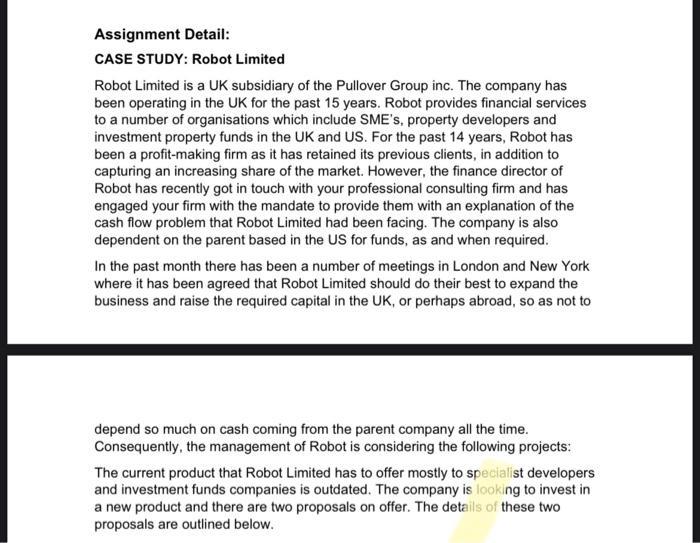

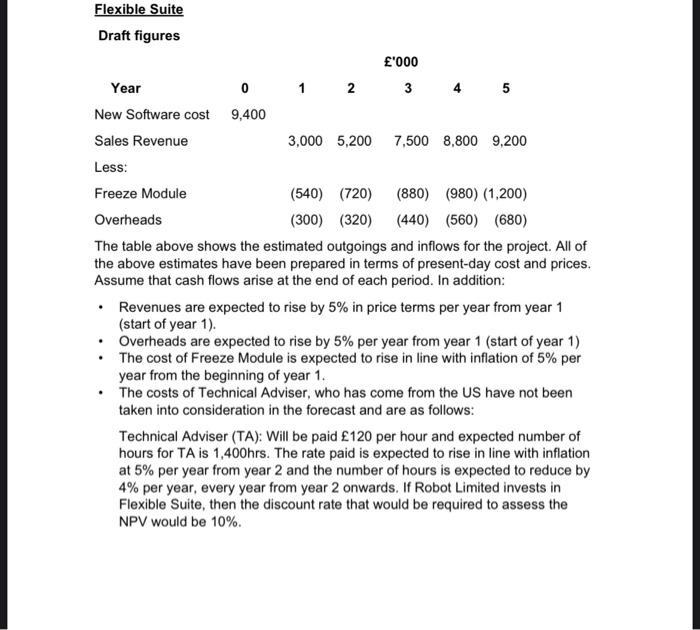

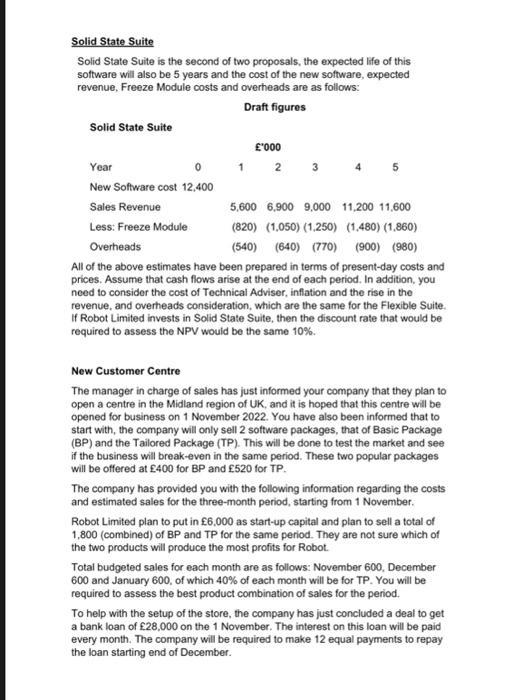

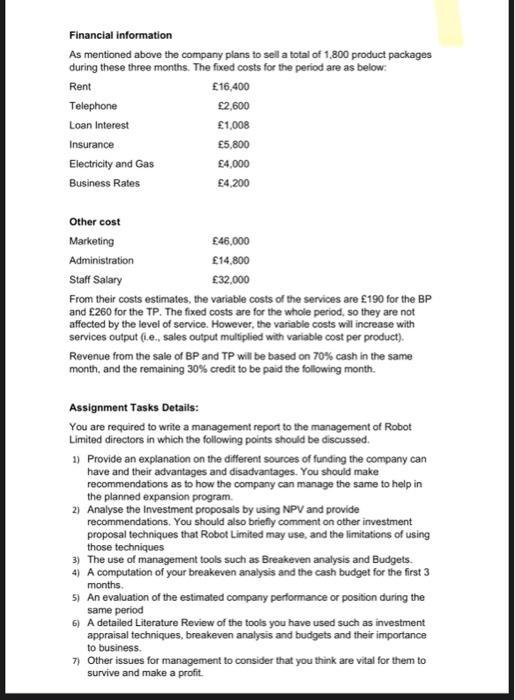

Assignment Detail: CASE STUDY: Robot Limited Robot Limited is a UK subsidiary of the Pullover Group inc. The company has been operating in the UK for the past 15 years. Robot provides financial services to a number of organisations which include SME's, property developers and investment property funds in the UK and US. For the past 14 years, Robot has been a profit-making firm as it has retained its previous clients, in addition to capturing an increasing share of the market. However, the finance director of Robot has recently got in touch with your professional consulting firm and has engaged your firm with the mandate to provide them with an explanation of the cash flow problem that Robot Limited had been facing. The company is also dependent on the parent based in the US for funds, as and when required. In the past month there has been a number of meetings in London and New York where it has been agreed that Robot Limited should do their best to expand the business and raise the required capital in the UK, or perhaps abroad, so as not to depend so much on cash coming from the parent company all the time. Consequently, the management of Robot is considering the following projects: The current product that Robot Limited has to offer mostly to specialist developers and investment funds companies is outdated. The company is looking to invest in a new product and there are two proposals on offer. The details of these two proposals are outlined below. Flexible Suite Draft figures Year New Software cost 9,400 Sales Revenue Less: Freeze Module '000 0 1 2 3 . . 3,000 5,200 4 5 (540) (720) Overheads (300) (320) The table above shows the estimated outgoings and inflows for the project. All of the above estimates have been prepared in terms of present-day cost and prices. Assume that cash flows arise at the end of each period. In addition: 7,500 8,800 9,200 (880) (980) (1,200) (440) (560) (680) Revenues are expected to rise by 5% in price terms per year from year 1 (start of year 1). Overheads are expected to rise by 5% per year from year 1 (start of year 1) The cost of Freeze Module is expected to rise in line with inflation of 5% per year from the beginning of year 1. The costs of Technical Adviser, who has come from the US have not been taken into consideration in the forecast and are as follows: Technical Adviser (TA): Will be paid 120 per hour and expected number of hours for TA is 1,400hrs. The rate paid is expected to rise in line with inflation at 5% per year from year 2 and the number of hours is expected to reduce by 4% per year, every year from year 2 onwards. If Robot Limited invests in Flexible Suite, then the discount rate that would be required to assess the NPV would be 10%. Solid State Suite Solid State Suite is the second of two proposals, the expected life of this software will also be 5 years and the cost of the new software, expected revenue, Freeze Module costs and overheads are as follows: Draft figures Solid State Suite '000 0 1 2 3 4 5 Year New Software cost 12,400 Sales Revenue 5,600 6,900 9,000 11,200 11,600 (1,480) (1,860) Less: Freeze Module (820) (1,050) (1,250) Overheads (540) (640) (770) (900) (980) All of the above estimates have been prepared in terms of present-day costs and prices. Assume that cash flows arise at the end of each period. In addition, you need to consider the cost of Technical Adviser, inflation and the rise in the revenue, and overheads consideration, which are the same for the Flexible Suite. If Robot Limited invests in Solid State Suite, then the discount rate that would be required to assess the NPV would be the same 10%. Financial information As mentioned above the company plans to sell a total of 1,800 product packages during these three months. The fixed costs for the period are as below: Rent 16,400 2,600 1,008 5,800 4,000 4,200 Telephone Loan Interest Insurance Electricity and Gas Business Rates Other cost Marketing 46,000 Administration 14,800 Staff Salary 32,000 From their costs estimates, the variable costs of the services are 190 for the BP and 260 for the TP. The fixed costs are for the whole period, so they are not affected by the level of service. However, the variable costs will increase with services output (i.e., sales output multiplied with variable cost per product). Revenue from the sale of BP and TP will be based on 70% cash in the same. month, and the remaining 30% credit to be paid the following month. Assignment Tasks Details: You are required to write a management report to the management of Robot Limited directors in which the following points should be discussed. 1) Provide an explanation on the different sources of funding the company can have and their advantages and disadvantages. You should make recommendations as to how the company can manage the same to help in the planned expansion program. 2) Analyse the Investment proposals by using NPV and provide recommendations. You should also briefly comment on other investment proposal techniques that Robot Limited may use, and the limitations of using those techniques 3) The use of management tools such as Breakeven analysis and Budgets. 4) A computation of your breakeven analysis and the cash budget for the first 3 months. 5) An evaluation of the estimated company performance or position during the same period 6) A detailed Literature Review of the tools you have used such as investment appraisal techniques, breakeven analysis and budgets and their importance to business. 7) Other issues for management to consider that you think are vital for them to survive and make a profit. Assignment Detail: CASE STUDY: Robot Limited Robot Limited is a UK subsidiary of the Pullover Group inc. The company has been operating in the UK for the past 15 years. Robot provides financial services to a number of organisations which include SME's, property developers and investment property funds in the UK and US. For the past 14 years, Robot has been a profit-making firm as it has retained its previous clients, in addition to capturing an increasing share of the market. However, the finance director of Robot has recently got in touch with your professional consulting firm and has engaged your firm with the mandate to provide them with an explanation of the cash flow problem that Robot Limited had been facing. The company is also dependent on the parent based in the US for funds, as and when required. In the past month there has been a number of meetings in London and New York where it has been agreed that Robot Limited should do their best to expand the business and raise the required capital in the UK, or perhaps abroad, so as not to depend so much on cash coming from the parent company all the time. Consequently, the management of Robot is considering the following projects: The current product that Robot Limited has to offer mostly to specialist developers and investment funds companies is outdated. The company is looking to invest in a new product and there are two proposals on offer. The details of these two proposals are outlined below. Flexible Suite Draft figures '000 0 1 2 3 Year New Software cost 9,400 Sales Revenue Less: Freeze Module 4 5 3,000 5,200 7,500 8,800 9,200 (540) (720) (880) (980) (1,200) Overheads (300) (320) (440) (560) (680) The table above shows the estimated outgoings and inflows for the project. All of the above estimates have been prepared in terms of present-day cost and prices. Assume that cash flows arise at the end of each period. In addition: Revenues are expected to rise by 5% in price terms per year from year 1 (start of year 1). Overheads are expected to rise by 5% per year from year 1 (start of year 1) The cost of Freeze Module is expected to rise in line with inflation of 5% per year from the beginning of year 1. The costs of Technical Adviser, who has come from the US have not been taken into consideration in the forecast and are as follows: Technical Adviser (TA): Will be paid 120 per hour and expected number of hours for TA is 1,400hrs. The rate paid is expected to rise in line with inflation at 5% per year from year 2 and the number of hours is expected to reduce by 4% per year, every year from year 2 onwards. If Robot Limited invests in Flexible Suite, then the discount rate that would be required to assess the NPV would be 10%. Solid State Suite Solid State Suite is the second of two proposals, the expected life of this software will also be 5 years and the cost of the new software, expected revenue, Freeze Module costs and overheads are as follows: Draft figures Solid State Suite '000 1 2 3 4 5 Year New Software cost 12,400 Sales Revenue 5,600 6,900 9,000 11,200 11,600 (820) (1.050) (1.250) (1,480) (1,860) Less: Freeze Module Overheads (540) (640) (770) (900) (980) All of the above estimates have been prepared in terms of present-day costs and prices. Assume that cash flows arise at the end of each period. In addition, you need to consider the cost of Technical Adviser, inflation and the rise in the revenue, and overheads consideration, which are the same for the Flexible Suite. If Robot Limited invests in Solid State Suite, then the discount rate that would be required to assess the NPV would be the same 10%. New Customer Centre The manager in charge of sales has just informed your company that they plan to open a centre in the Midland region of UK, and it is hoped that this centre will be opened for business on 1 November 2022. You have also been informed that to start with, the company will only sell 2 software packages, that of Basic Package (BP) and the Tailored Package (TP). This will be done to test the market and see if the business will break-even in the same period. These two popular packages will be offered at 400 for BP and 520 for TP. The company has provided you with the following information regarding the costs and estimated sales for the three-month period, starting from 1 November. Robot Limited plan to put in 6,000 as start-up capital and plan to sell a total of 1,800 (combined) of BP and TP for the same period. They are not sure which of the two products will produce the most profits for Robot. Total budgeted sales for each month are as follows: November 600, December 600 and January 600, of which 40% of each month will be for TP. You will be required to assess the best product combination of sales for the period. To help with the setup of the store, the company has just concluded a deal to get a bank loan of 28,000 on the 1 November. The interest on this loan will be paid every month. The company will be required to make 12 equal payments to repay the loan starting end of December. Financial information As mentioned above the company plans to sell a total of 1,800 product packages during these three months. The fixed costs for the period are as below: Rent 16,400 Telephone 2,600 Loan Interest 1,008 Insurance 5,800 Electricity and Gas 4,000 Business Rates 4.200 Other cost Marketing 46,000 Administration 14,800 Staff Salary 32,000 From their costs estimates, the variable costs of the services are 190 for the BP and 260 for the TP. The fixed costs are for the whole period, so they are not affected by the level of service. However, the variable costs will increase with services output (i.e., sales output multiplied with variable cost per product). Revenue from the sale of BP and TP will be based on 70% cash in the same month, and the remaining 30% credit to be paid the following month. Assignment Tasks Details: You are required to write a management report to the management of Robot Limited directors in which the following points should be discussed. 1) Provide an explanation on the different sources of funding the company can have and their advantages and disadvantages. You should make recommendations as to how the company can manage the same to help in the planned expansion program. 2) Analyse the Investment proposals by using NPV and provide recommendations. You should also briefly comment on other investment proposal techniques that Robot Limited may use, and the limitations of using those techniques 3) The use of management tools such as Breakeven analysis and Budgets. 4) A computation of your breakeven analysis and the cash budget for the first 3 months. 5) An evaluation of the estimated company performance or position during the same period 6) A detailed Literature Review of the tools you have used such as investment appraisal techniques, breakeven analysis and budgets and their importance to business. 7) Other issues for management to consider that you think are vital for them to survive and make a profit.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

STEP ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started