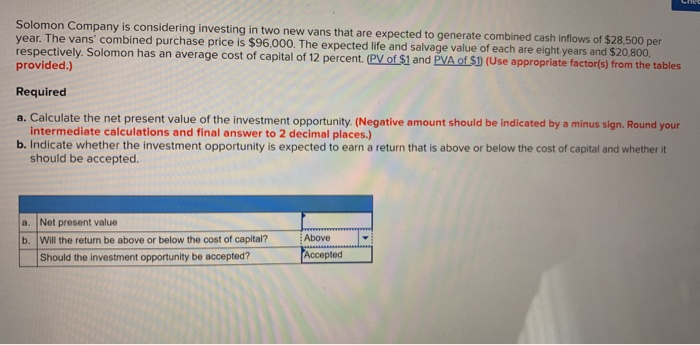

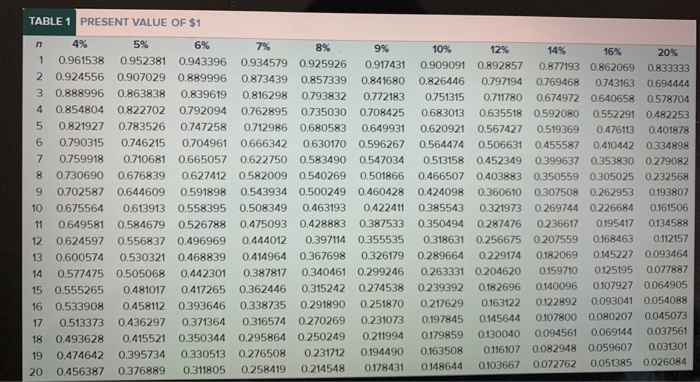

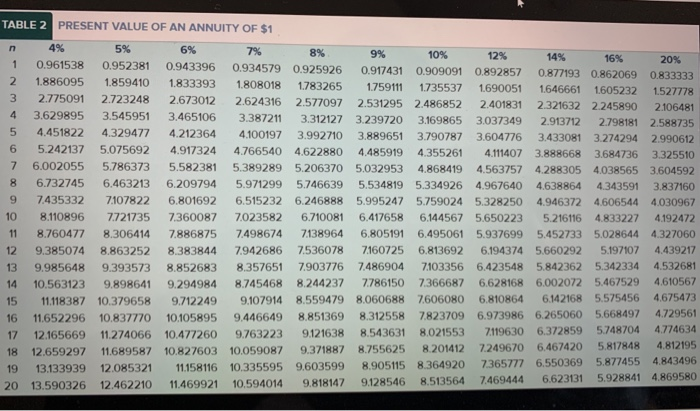

Solomon Company is considering investing in two new vans that are expected to generate combined cash inflows of year. The vans' combined purchase price is $96,000. The expected life and salvage value of each are eight years and $20,800. respectively Solomon has an average cost of capital of 12 percent. (PV of $1 and PVA ofS0 (Use appropriate $28,500 per factorts) from the provided.) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted. a. Net present value b.|Will the return be above or below the cost of capital? Above Should the investment opportunity be accepte? Accepte TABLE 1 PRESENT VALUE OF $1 4% 6% 5% 7% 8% 9% 10% 12% 14% 16% 20% 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0769468 0743163 0.694444 3 0.888996 0.863838 0839619 0.816298 0793832 0.772183 0751315 0711780 0.674972 0.640658 0.578704 4 0.854804 0.822702 0792094 0762895 0.735030 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0.7129860.680583 0.649931 0.620921 0.567427 0.519369 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 0.564474 0.506631 0.455587 0410442 0.3348 0.476113 0.4018 0.759918 0.710681 0.665057 0.622750 0.583490 0.547034 0.513158 0.452349 0.399637 0.353830 0.279082 8 0.730690 0.676839 0627412 0.582009 0.540269 0.501866 0.466507 0403883 0.350559 0.305025 0.232568 9 0.702587 0.644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0.193807 10 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 0.385543 0.321973 0.269744 0.226684 0.161506 11 0649581 0.584679 0.526788 0.475093 0.428883 0.387533 0.350494 0.287476 0236617 0195417 0134588 12 0624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.207559 0.168463 0112157 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 0.289664 0.229174 0182069 0.145227 0093464 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0159710 0125195 0.077887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0274538 0.239392 0182696 0140096 0107927 0.064905 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.217629 0.163122 0122892 0.093041 005408 17 0.513373 0.436297 0.371364 0.316574 0.270269 0231073 0.197845 0145644 0107800 0.080207 0045073 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 0179859 0.130040 0094561 0069144 19 0.474642 0.395734 0.330513 0.276508 0.231712 0194490 0163508 0116107 0082948 0059607 20 0.456387 0.376889 0.311805 0258419 0214548 0178431 0148644 0103667 0072762 0051 0.037561 0.031301 1 TABLE PRESENT VALUE OF AN ANNUITY OF $1 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 10.961538 0.952381 0.943396 0.934579 0925926 0.917431 0.909091 0.892857 0.877193 0862069 0.833333 2 1.886095 1859410 1833393 1808018 1783265 1759111 1735537 1690051 1646661 1605232 1527778 3 2.775091 2.723248 2.673012 2.624316 2.577097 2.531295 2.486852 2.401831 2.321632 2245890 2106481 4 3.629895 3.545951 3.465106 3.387211 3.312127 3.239720 3169865 3.037349 2.913712 2798181 2.588735 5 4.451822 4.329477 4.212364 4100197 3.992710 3.889651 3.790787 3.604776 3.433081 3274294 2.990612 3.992710 3889651 3790787 3.604776 3.433081 3.274294 2.990612 2 4.917324 4766540 4622880 4.485919 4.355261 4.11407 6 5.242137 5.075692 7 3.888668 3684736 3.325510 3.888668 3.684736 3.325510 6.002055 5.786373 5.582381 5.389289 5.206370 5.032953 4.868419 4563757 4.288305 4.038565 3.604592 8 6.732745 6.463213 6.209794 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 4343591 3.837160 9 7.435332 7107822 6.801692 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 4.606544 4.030967 0 8.110896 7.721735 7.360087 7023582 6.710081 6.417658 6.144567 5.650223 5.216116 4.833227 4.192472 1 8.760477 8.306414 7.886875 7498674 7138964 6.805191 6.495061 5.937699 5.452733 5.028644 4.327060 12 9.385074 8.863252 8.383844 7942686 7536078 7160725 6.813692 6.194374 5.660292 5.1971074.439217 13 9.985648 9.393573 7486904 Z103356 6423548 5842362 5.342334 4.532681 14 10.563123 9.898641 9.294984 8.745468 8244237 7786150 7.366687 6628168 6.002072 5.467529 4.610567 36078 7160725 6813692 6194374 5,660292 357651 7903776 8.357651 7903776 1 9 446649 8.851369 8312558 7823709 6.9739 6142168 5575456 4.675473 5 11.118387 10.379658 9.7122499.107914 8.559479 8.060688 7606080 6.810864 6142168 5.575456 4.675473 6 11.652296 10.837770 10.105895 9.446649 8.851369 8.312558 7823709 6.973986 6.265060 5.668497 4.729561 17 12.165669 11.274066 10.477260 9.763223 9121638 8.543631 8.021553 7119630 6.372859 5748704 4774634 18 12.659297 1689587 10.827603 10.059087 9.371887 8.755625 8.201412 7249670 6.467420 5.817848 4.812195 19 13.133939 12.085321 11.158116 10.335595 9603599 8.9051158364920 7365777 6.550369 5.877455 4.843496 8147 9128546 8.513564 7.469444 6.623131 5.928841 4.869580 16 11.652296 10.837770 10105895 20 13.590326 12.462210 11.469921 10.594014 9.81