Answered step by step

Verified Expert Solution

Question

1 Approved Answer

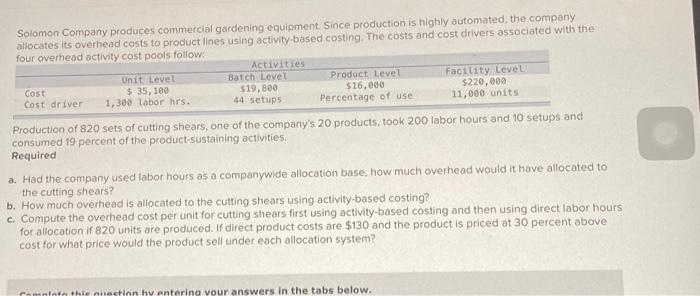

Solomon Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs

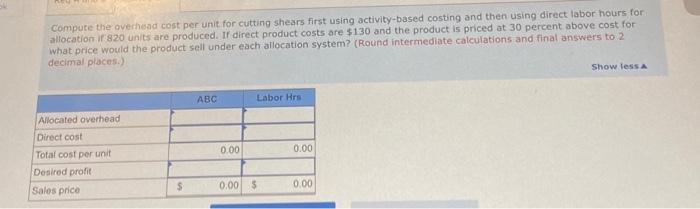

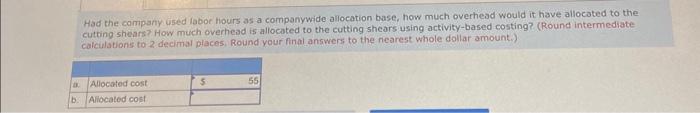

Solomon Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Cost Cost driver Unit Level $ 35,100 1,300 labor hrs. Activities Batch Level $19,800 44 setups Product Level $16,000 Percentage of use Facility Level $220,000 11,000 units Production of 820 sets of cutting shears, one of the company's 20 products, took 200 labor hours and 10 setups and consumed 19 percent of the product-sustaining activities. Required a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct labor hours for allocation if 820 units are produced. If direct product costs are $130 and the product is priced at 30 percent above cost for what price would the product sell under each allocation system?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started