Answered step by step

Verified Expert Solution

Question

1 Approved Answer

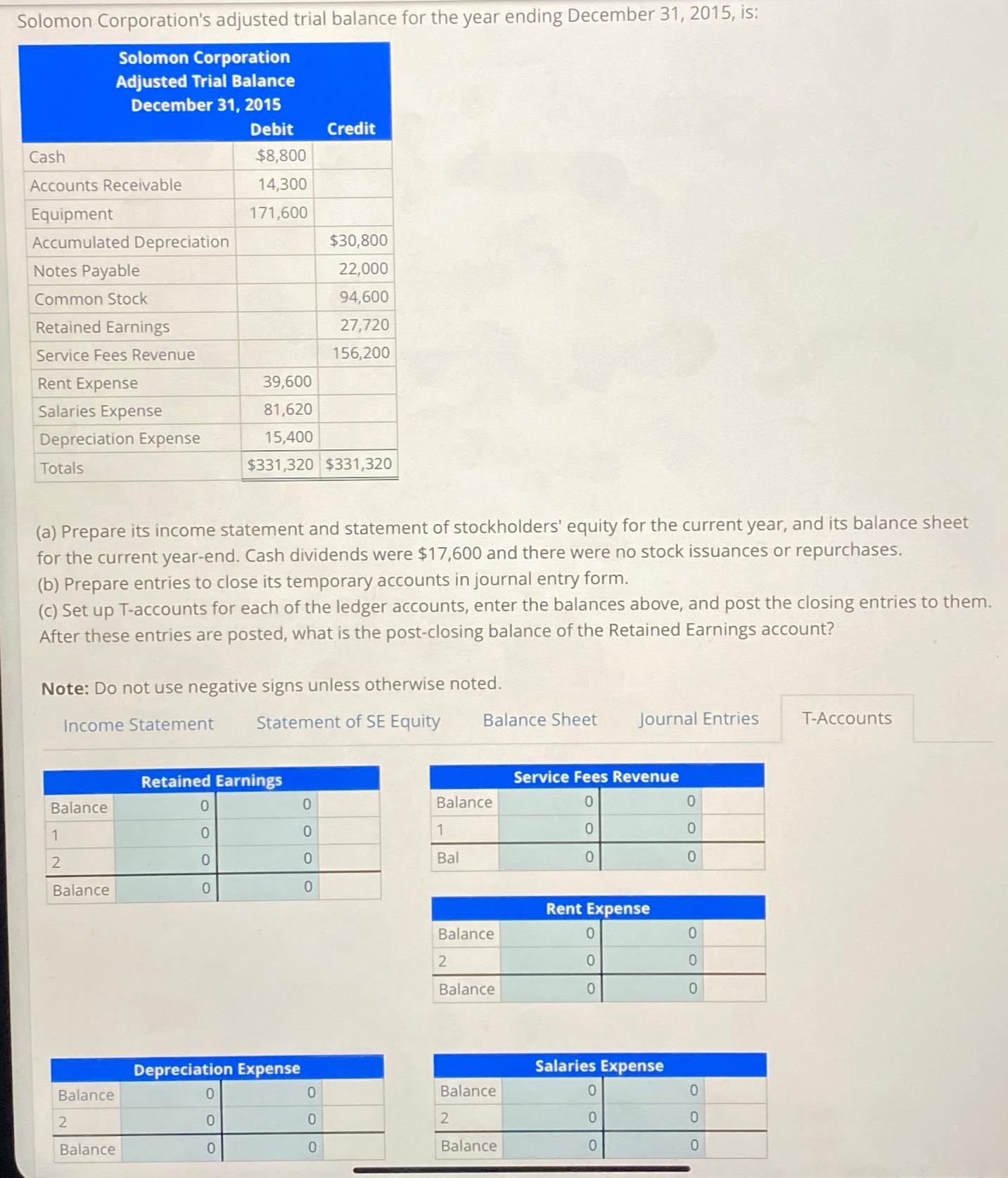

Solomon Corporation's adjusted trial balance for the year ending December 31, 2015, is: Solomon Corporation Adjusted Trial Balance December 31, 2015 Debit Cash Accounts

Solomon Corporation's adjusted trial balance for the year ending December 31, 2015, is: Solomon Corporation Adjusted Trial Balance December 31, 2015 Debit Cash Accounts Receivable Equipment Accumulated Depreciation Notes Payable Common Stock Retained Earnings Service Fees Revenue Rent Expense Salaries Expense Depreciation Expense Totals Balance 1 2 (a) Prepare its income statement and statement of stockholders' equity for the current year, and its balance sheet for the current year-end. Cash dividends were $17,600 and there were no stock issuances or repurchases. (b) Prepare entries to close its temporary accounts in journal entry form. (c) Set up T-accounts for each of the ledger accounts, enter the balances above, and post the closing entries to them. After these entries are posted, what is the post-closing balance of the Retained Earnings account? Balance Note: Do not use negative signs unless otherwise noted. Income Statement Statement of SE Equity Balance 2 Balance $8,800 14,300 171,600 0 0 0 0 Retained Earnings 0 0 39,600 81,620 15,400 $331,320 $331,320 Depreciation Expense 0 Credit $30,800 22,000 94,600 27,720 156,200 0 0 0 0 0 0 0 Balance 1 Bal Balance Sheet Balance 2 Balance Balance 2 Balance Service Fees Revenue 0 0 0 Rent Expense 0 0 0 Salaries Expense OOO Journal Entries 0 0 0 0 0 0 0 COO 0 0 OOO 0 0 T-Accounts

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Service Fees Revenue 156200 Rent Expense 39600 Salaries Expense 81620 Depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started