Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solution 257 orders could be filled from a Toronto Warehouse rather than from a European location. In 2010, Albert retired and turned over his business

solution

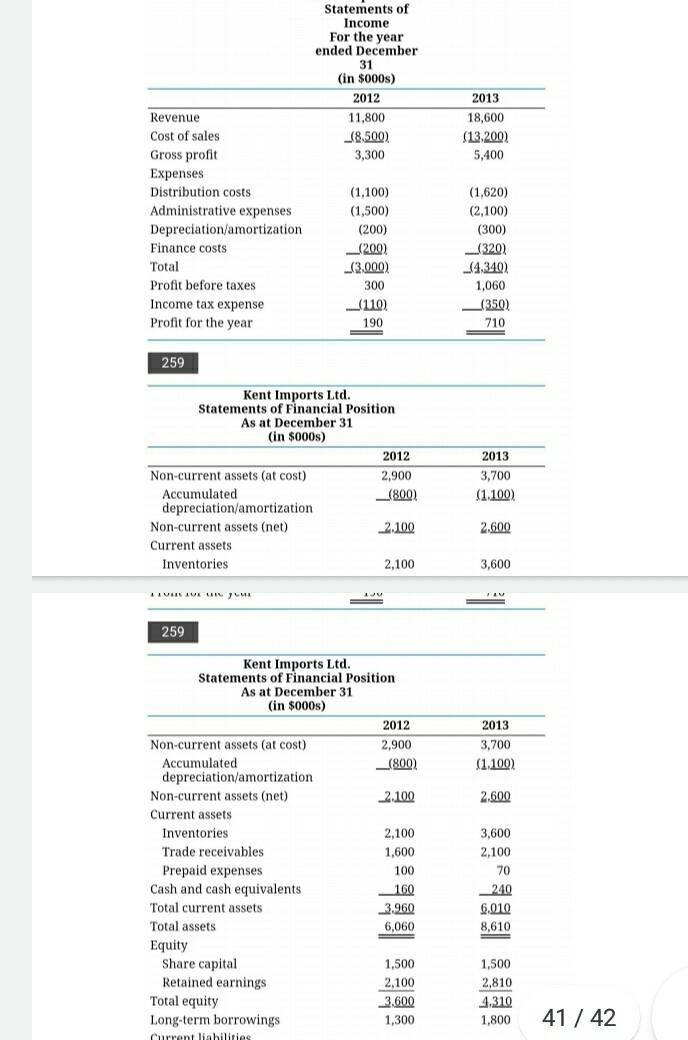

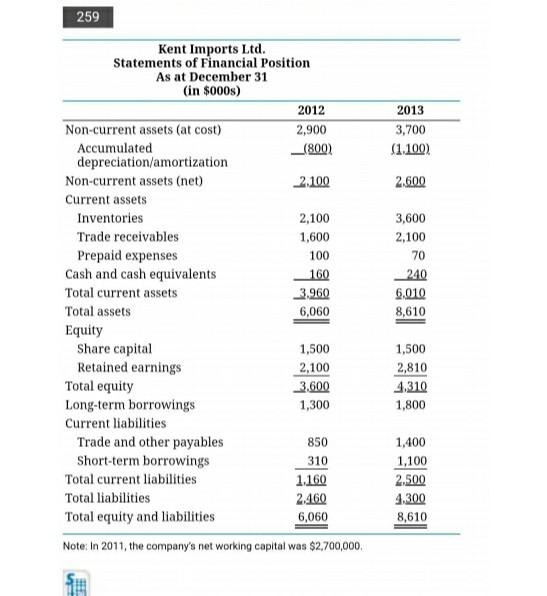

257 orders could be filled from a Toronto Warehouse rather than from a European location. In 2010, Albert retired and turned over his business to his son, David. At that time, revenue had reached $13 million a year and profit for the year was in excess of $400,000 By late 2012, David could see that revenue for the year was going to be less than $12 million and that profit would be about $200,000. He decided to hire a marketing manager who could boost revenue quickly. David contacted an executive placement firm, which recommended Ross Belman. Belman had a record of frequent job changes but had produced very rapid revenue increases in each position. He stayed with Kent Imports Ltd. for only 12 months (leaving in November 2013). In that short time, Belman was able to increase revenue from $12 million to more than $18 million. Furthermore, profit for the year soared by 273%. Even when Belman announced his resignation to take another position with a larger company, David felt the decision to hire him had been a good one. David contacted the executive placement firm once again. This time the firm recommended Helen Tang, a dynamic woman who was currently a district sales manager for another import manufacturer. Helen was very interested in the job because it would give her greater marketing responsibilities. Helen asked David what policy changes Ross Belman had implemented to increase revenue so dramatically. David explained Belman's belief that merchandise availability was the key to medical equipment import sales. Belman had insisted on increases in the amount of inventories carried by Kent Imports and had encouraged medical equipment retailers to carry more by extending more generous credit terms. Specifically, he established an unofficial policy of not pressing for collection as long as the merchandise was still in a store's inventories. The sales representativeswho were paid a commission at the time of sale-were responsible for reporting what inventories the stores actually held. In addition, Belman changed the credit standards so that the company could approve more new stores for credit. He felt that the old policy was biased against these new retail stores because they did not have a track record. Willingness to sell to this group had accounted for nearly half of the total revenue increase Helen asked if this policy had weakened the company's trade receivables, particularly the cash flow position. David responded that he had been monitoring the average collection period very closely and there had been only a very slight change. Helen told David that although she was very interested in the position, she could not make a decision until she had looked at the company's financial statements. David was hesitant to show this information to an outsider, but he finally agreed to let her look at the records in the office. He allowed Helen to look at the statements of income and the statements of financial position. She did her own analysis of the company's financial statements in addition to determining to what extent the working capital policies actually helped improve Kent Imports' overall finan performance. 258 Questions 1. Do you agree with David Cunningham that the statements of income and the statements of financial position. She did her own analysis of the company's financial statements in addition to determining to what extent the working capital policies actually helped improve Tant Imre Linnerform Statements of Income For the year ended December 31 (in $000s) 2012 2013 Revenue 11,800 _(8,500) 3,300 18,600 (13.200) 5,400 Cost of sales Gross profit Expenses Distribution costs Administrative expenses Depreciation/amortization Finance costs Total Profit before taxes (1,100) (1,500) (200) _(200) (3.000) ) 300 (110) 190 (1,620) (2,100) (300) (320) 14,340) 1,060 _(350) Income tax expense Profit for the year 710 259 Kent Imports Ltd. Statements of Financial Position As at December 31 (in $000s) 2012 2013 2,900 3,700 (1.100) __(800) Non-current assets (at cost) Accumulated depreciation/amortization Non-current assets (net) Current assets Inventories 2.100 2.600 2,100 3,600 HULLUE LI A HI 259 Kent Imports Ltd. Statements of Financial Position As at December 31 (in $000s) 2012 2013 3,700 Non-current assets (at cost) Accumulated depreciation/amortization Non-current assets (net) 2,900 _(800) ( (1.1002 _2.100 2.600 Current assets 3,600 Inventories Trade receivables 2,100 1,600 2,100 100 70 Prepaid expenses Cash and cash equivalents Total current assets 160 3.960 6,060 240 6,010 8,610 Total assets 1,500 1,500 Equity Share capital Retained earnings Total equity Long-term borrowings Current liabilities 2,100 3.600 1,300 2,810 4.310 1,800 41 / 42 259 Kent Imports Ltd. Statements of Financial Position As at December 31 (in $000) 2012 2013 2,900 3,700 Non-current assets (at cost) Accumulated depreciation/amortization Non-current assets (net) _(800) (1.100) 2.100 2.600 Current assets Inventories 3,600 2,100 1,600 Trade receivables 2,100 70 100 160 3.960 6,060 _240 6.010 8,610 1,500 Prepaid expenses Cash and cash equivalents Total current assets Total assets Equity Share capital Retained earnings Total equity Long-term borrowings Current liabilities Trade and other payables Short-term borrowings Total current liabilities Total liabilities Total equity and liabilities 1,500 2,100 3.600 1,300 2,810 4.310 1,800 850 1,400 310 1.160 2.460 6,060 1,100 2.500 4.300 8,610 Note: In 2011, the company's networking capital was $2,700,000 257 orders could be filled from a Toronto Warehouse rather than from a European location. In 2010, Albert retired and turned over his business to his son, David. At that time, revenue had reached $13 million a year and profit for the year was in excess of $400,000 By late 2012, David could see that revenue for the year was going to be less than $12 million and that profit would be about $200,000. He decided to hire a marketing manager who could boost revenue quickly. David contacted an executive placement firm, which recommended Ross Belman. Belman had a record of frequent job changes but had produced very rapid revenue increases in each position. He stayed with Kent Imports Ltd. for only 12 months (leaving in November 2013). In that short time, Belman was able to increase revenue from $12 million to more than $18 million. Furthermore, profit for the year soared by 273%. Even when Belman announced his resignation to take another position with a larger company, David felt the decision to hire him had been a good one. David contacted the executive placement firm once again. This time the firm recommended Helen Tang, a dynamic woman who was currently a district sales manager for another import manufacturer. Helen was very interested in the job because it would give her greater marketing responsibilities. Helen asked David what policy changes Ross Belman had implemented to increase revenue so dramatically. David explained Belman's belief that merchandise availability was the key to medical equipment import sales. Belman had insisted on increases in the amount of inventories carried by Kent Imports and had encouraged medical equipment retailers to carry more by extending more generous credit terms. Specifically, he established an unofficial policy of not pressing for collection as long as the merchandise was still in a store's inventories. The sales representativeswho were paid a commission at the time of sale-were responsible for reporting what inventories the stores actually held. In addition, Belman changed the credit standards so that the company could approve more new stores for credit. He felt that the old policy was biased against these new retail stores because they did not have a track record. Willingness to sell to this group had accounted for nearly half of the total revenue increase Helen asked if this policy had weakened the company's trade receivables, particularly the cash flow position. David responded that he had been monitoring the average collection period very closely and there had been only a very slight change. Helen told David that although she was very interested in the position, she could not make a decision until she had looked at the company's financial statements. David was hesitant to show this information to an outsider, but he finally agreed to let her look at the records in the office. He allowed Helen to look at the statements of income and the statements of financial position. She did her own analysis of the company's financial statements in addition to determining to what extent the working capital policies actually helped improve Kent Imports' overall finan performance. 258 Questions 1. Do you agree with David Cunningham that the statements of income and the statements of financial position. She did her own analysis of the company's financial statements in addition to determining to what extent the working capital policies actually helped improve Tant Imre Linnerform Statements of Income For the year ended December 31 (in $000s) 2012 2013 Revenue 11,800 _(8,500) 3,300 18,600 (13.200) 5,400 Cost of sales Gross profit Expenses Distribution costs Administrative expenses Depreciation/amortization Finance costs Total Profit before taxes (1,100) (1,500) (200) _(200) (3.000) ) 300 (110) 190 (1,620) (2,100) (300) (320) 14,340) 1,060 _(350) Income tax expense Profit for the year 710 259 Kent Imports Ltd. Statements of Financial Position As at December 31 (in $000s) 2012 2013 2,900 3,700 (1.100) __(800) Non-current assets (at cost) Accumulated depreciation/amortization Non-current assets (net) Current assets Inventories 2.100 2.600 2,100 3,600 HULLUE LI A HI 259 Kent Imports Ltd. Statements of Financial Position As at December 31 (in $000s) 2012 2013 3,700 Non-current assets (at cost) Accumulated depreciation/amortization Non-current assets (net) 2,900 _(800) ( (1.1002 _2.100 2.600 Current assets 3,600 Inventories Trade receivables 2,100 1,600 2,100 100 70 Prepaid expenses Cash and cash equivalents Total current assets 160 3.960 6,060 240 6,010 8,610 Total assets 1,500 1,500 Equity Share capital Retained earnings Total equity Long-term borrowings Current liabilities 2,100 3.600 1,300 2,810 4.310 1,800 41 / 42 259 Kent Imports Ltd. Statements of Financial Position As at December 31 (in $000) 2012 2013 2,900 3,700 Non-current assets (at cost) Accumulated depreciation/amortization Non-current assets (net) _(800) (1.100) 2.100 2.600 Current assets Inventories 3,600 2,100 1,600 Trade receivables 2,100 70 100 160 3.960 6,060 _240 6.010 8,610 1,500 Prepaid expenses Cash and cash equivalents Total current assets Total assets Equity Share capital Retained earnings Total equity Long-term borrowings Current liabilities Trade and other payables Short-term borrowings Total current liabilities Total liabilities Total equity and liabilities 1,500 2,100 3.600 1,300 2,810 4.310 1,800 850 1,400 310 1.160 2.460 6,060 1,100 2.500 4.300 8,610 Note: In 2011, the company's networking capital was $2,700,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started