Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solution COMPREHENSIVE REVIEW PROBLEM I FRED HAYES PHOTOGRAPHY STUDIO wer have reached the end of the first section of this book. ife following problem is

solution

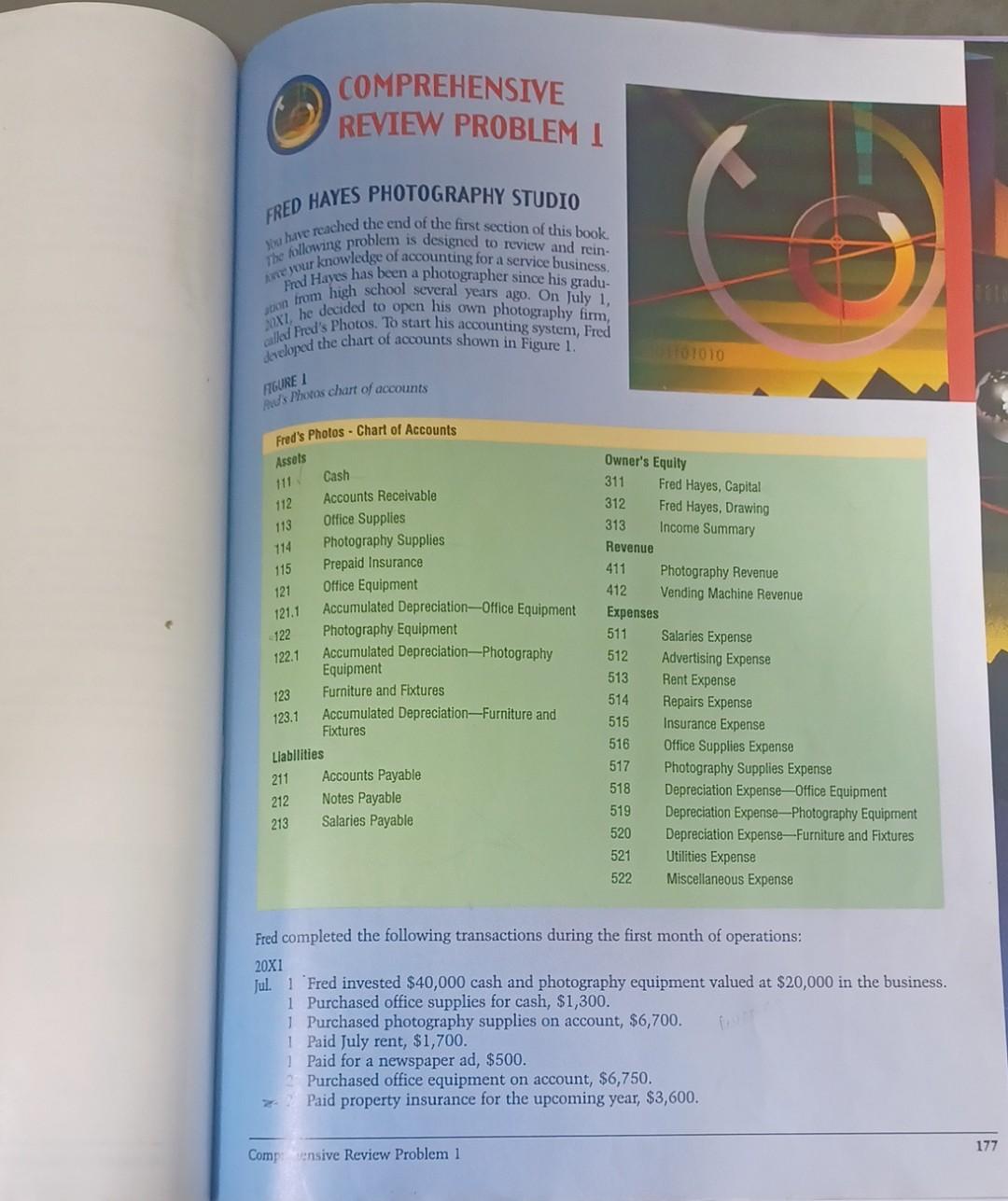

COMPREHENSIVE REVIEW PROBLEM I FRED HAYES PHOTOGRAPHY STUDIO wer have reached the end of the first section of this book. ife following problem is designed to review and rein- pare yur knowledge of accounting for a service business. Frod Hayes has been a photographer since his gradufrom high school several years ago. On July 1, 1. he decided to open his own photography firm, illd Fred's Photos. To start his accounting system, Fred jacloped the chart of accounts shown in Figure 1 . FGUUE I Hive. Photos chart of accounts Fred completed the following transactions during the first month of operations: 201 [ul. 1 Fred invested $40,000 cash and photography equipment valued at $20,000 in the business. 1 Purchased office supplies for cash, \$1,300. 1 Purchased photography supplies on account, $6,700. 1 Paid July rent, $1,700. 1 Paid for a newspaper ad, $500. Purchased office equipment on account, $6,750. *. Paid property insurance for the upcoming year, $3,600. Comp: ensive Review Problem 1 17 1ul 3 Purchased a mucrocomputer system and soltware, $3,200, by issutigg a note payable 5 Pad for promotional handouts, $150. - Pad muscellancous cepenes, $175 7 Pad walanes of employecs, 51,400 - Recorded weck's cash receipts for photo work $1,350 8. Fid for carpet cleaning (Miscellancous Exjcnse), $75. 9 Recorded photo work done for a customer on account, 5855 . 4 Rurchased additional photograplyy supplics on account, 53,200 . 10 Purchased additional photography equipment for cash, $3,500. 10 Entered into a contract with Southside Food Vendors to place vending machines in the waiting room. Fred is to reccive 10% of all sales, with a minimum of $200 monthly Received $200 as an advance payment. 11 Purchased turniture for the lobby area, $1,700, Paid cash in full. 12 Paid cash for the installation of overhcad lighting fixtures, $900. 15 Recorded sccond weck's cash receipts for photo work, $2,170. is Ruid weckly salaries, $1,400. 17 Fred withdrew cash for personal use, $500. is Pad for TV ad, $710. 19 Pad for repair to equipment, $80. 19 Collected $500 for the photo work done on account on the 9 th. 22 Recorded thiru week's cash receipts for photo work, $2,045, 22 Pad weckly salanes, $1,400. 23 Did a special wedding photo session for a customer on credit, $550. 28 Recorded fourth week's cash receipts for photo work, $1,995. 29 Puid salanes of employees, $1,400. 30 Paid water bill for fuly, $75. 30 Paid power bill for luly, $1,095. 31 Made a $500 payment on the note for the microcomputer purchased on July 3. 31 Made a payment for the office equipment purchased on account, $2,000. 31 Made a payment on the photography supplies purchased on account, $1,000, 31 Wrote a business check to pay for Fred's home phone bill, $310. 31 Southside Food Vendors reported a total of $2,800 of vending machine sales for luly, Ten percent of these sales is $280. Since $200 had already been received and recorded in July, Fred was owed $80. Recerved the $80 check. Directions: 1. Open an account in the ledger for each account shown in the chart of accounts. 2. Journalise each of the transactions for July, beginning on page 1 of the general journal. 3. Post the journal entries to the lediger, 4. Prepare a trial balance of the ledger in the first two columns of a ten-column work sheet. 5. Complete the ten-column work sheet. Assume for the purposes of this problem that Fred has a onc-month accounting period. Data for adjustments are as follows: (a) Oifice supplics on hand, $850. (b) Photography supplies on hand, $6,550. (c) Insurance expired, $300. (d) Salaries unpaid, two days of a five-day week, weekly salaries are $1,400. (c) Depreciation of office equipment, $190. (f) Depreciation of photography equipment, $275. (i) Depreciation of furniture and fixtures, $75. 6 Prepare an income statement for the month ended July 31. Prepare a statement of owner's equity for the month ended July 31 . Propare a balance sheet as of luly 31. lournalize adjusting entries from the completed work shect. Journalize closing entries. Post adjusting and closing entries to the ledger. Propare a post-closing trial balance. COMPREHENSIVE REVIEW PROBLEM I FRED HAYES PHOTOGRAPHY STUDIO wer have reached the end of the first section of this book. ife following problem is designed to review and rein- pare yur knowledge of accounting for a service business. Frod Hayes has been a photographer since his gradufrom high school several years ago. On July 1, 1. he decided to open his own photography firm, illd Fred's Photos. To start his accounting system, Fred jacloped the chart of accounts shown in Figure 1 . FGUUE I Hive. Photos chart of accounts Fred completed the following transactions during the first month of operations: 201 [ul. 1 Fred invested $40,000 cash and photography equipment valued at $20,000 in the business. 1 Purchased office supplies for cash, \$1,300. 1 Purchased photography supplies on account, $6,700. 1 Paid July rent, $1,700. 1 Paid for a newspaper ad, $500. Purchased office equipment on account, $6,750. *. Paid property insurance for the upcoming year, $3,600. Comp: ensive Review Problem 1 17 1ul 3 Purchased a mucrocomputer system and soltware, $3,200, by issutigg a note payable 5 Pad for promotional handouts, $150. - Pad muscellancous cepenes, $175 7 Pad walanes of employecs, 51,400 - Recorded weck's cash receipts for photo work $1,350 8. Fid for carpet cleaning (Miscellancous Exjcnse), $75. 9 Recorded photo work done for a customer on account, 5855 . 4 Rurchased additional photograplyy supplics on account, 53,200 . 10 Purchased additional photography equipment for cash, $3,500. 10 Entered into a contract with Southside Food Vendors to place vending machines in the waiting room. Fred is to reccive 10% of all sales, with a minimum of $200 monthly Received $200 as an advance payment. 11 Purchased turniture for the lobby area, $1,700, Paid cash in full. 12 Paid cash for the installation of overhcad lighting fixtures, $900. 15 Recorded sccond weck's cash receipts for photo work, $2,170. is Ruid weckly salaries, $1,400. 17 Fred withdrew cash for personal use, $500. is Pad for TV ad, $710. 19 Pad for repair to equipment, $80. 19 Collected $500 for the photo work done on account on the 9 th. 22 Recorded thiru week's cash receipts for photo work, $2,045, 22 Pad weckly salanes, $1,400. 23 Did a special wedding photo session for a customer on credit, $550. 28 Recorded fourth week's cash receipts for photo work, $1,995. 29 Puid salanes of employees, $1,400. 30 Paid water bill for fuly, $75. 30 Paid power bill for luly, $1,095. 31 Made a $500 payment on the note for the microcomputer purchased on July 3. 31 Made a payment for the office equipment purchased on account, $2,000. 31 Made a payment on the photography supplies purchased on account, $1,000, 31 Wrote a business check to pay for Fred's home phone bill, $310. 31 Southside Food Vendors reported a total of $2,800 of vending machine sales for luly, Ten percent of these sales is $280. Since $200 had already been received and recorded in July, Fred was owed $80. Recerved the $80 check. Directions: 1. Open an account in the ledger for each account shown in the chart of accounts. 2. Journalise each of the transactions for July, beginning on page 1 of the general journal. 3. Post the journal entries to the lediger, 4. Prepare a trial balance of the ledger in the first two columns of a ten-column work sheet. 5. Complete the ten-column work sheet. Assume for the purposes of this problem that Fred has a onc-month accounting period. Data for adjustments are as follows: (a) Oifice supplics on hand, $850. (b) Photography supplies on hand, $6,550. (c) Insurance expired, $300. (d) Salaries unpaid, two days of a five-day week, weekly salaries are $1,400. (c) Depreciation of office equipment, $190. (f) Depreciation of photography equipment, $275. (i) Depreciation of furniture and fixtures, $75. 6 Prepare an income statement for the month ended July 31. Prepare a statement of owner's equity for the month ended July 31 . Propare a balance sheet as of luly 31. lournalize adjusting entries from the completed work shect. Journalize closing entries. Post adjusting and closing entries to the ledger. Propare a post-closing trial balanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started