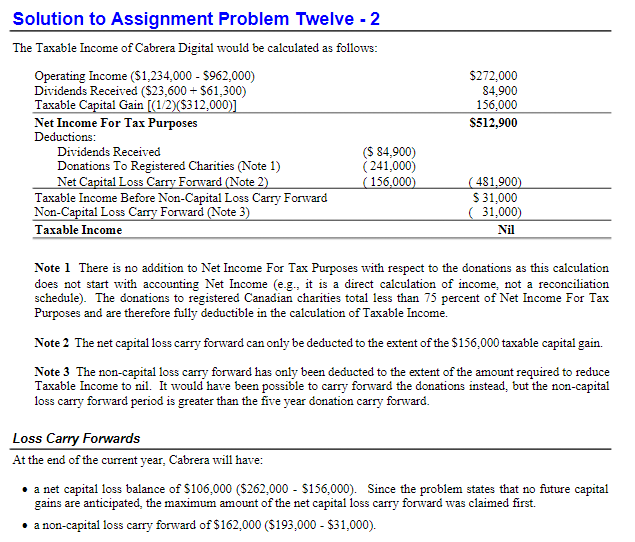

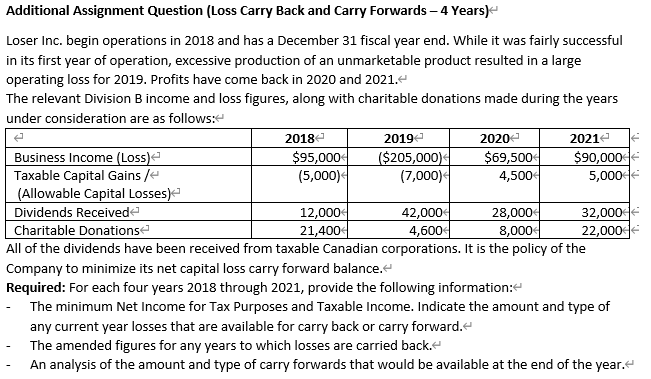

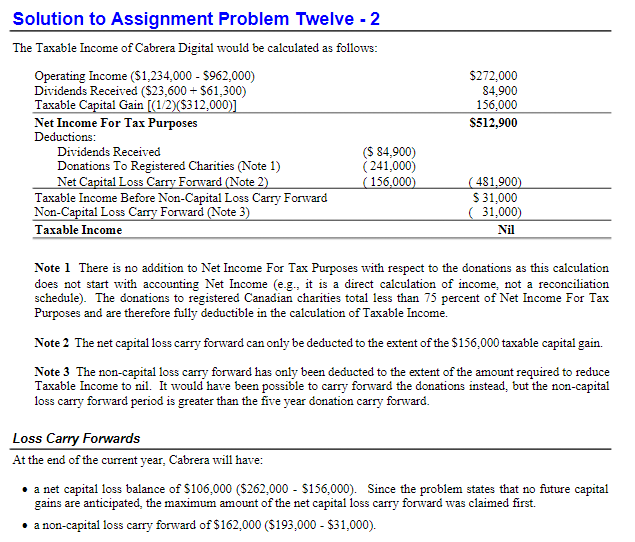

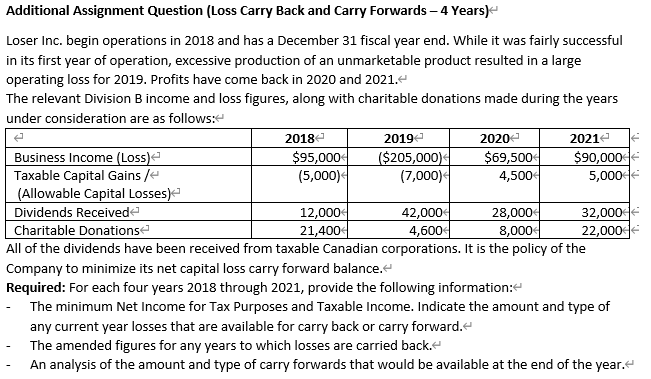

Solution to Assignment Problem Twelve - 2 The Taxable Income of Cabrera Digital would be calculated as follows: Operating Income (51.234.000 - 5962,000) Dividends Received ($23,600 + $61,300) Taxable Capital Gain [(1/2)($312.000)) Net Income For Tax Purposes Deductions: Dividends Received ($ 84,900) Donations To Registered Charities (Note 1) (241,000) Net Capital Loss Carry Forward (Note 2) (156,000) Taxable Income Before Non-Capital Loss Carry Forward Non-Capital Loss Carry Forward (Note 3) Taxable Income $272,000 84,900 156,000 $512,900 ( 481,900) $ 31,000 ( 31,000) Nil Note 1 There is no addition to Net Income For Tax Purposes with respect to the donations as this calculation does not start with accounting Net Income (eg., it is a direct calculation of income, not a reconciliation schedule). The donations to registered Canadian charities total less than 75 percent of Net Income For Tax Purposes and are therefore fully deductible in the calculation of Taxable Income. Note 2 The net capital loss carry forward can only be deducted to the extent of the $156,000 taxable capital gain. Note 3 The non-capital loss carry forward has only been deducted to the extent of the amount required to reduce Taxable Income to nil. It would have been possible to carry forward the donations instead, but the non-capital loss carry forward period is greater than the five year donation carry forward. Loss Carry Forwards At the end of the current year, Cabrera will have: a net capital loss balance of $106.000 ($262.000 - $156,000). Since the problem states that no future capital gains are anticipated, the maximum amount of the net capital loss carry forward was claimed first. . a non-capital loss carry forward of $162.000 (5193,000 - $31,000). 2018 Additional Assignment Question (Loss Carry Back and Carry Forwards - 4 Years) Loser Inc. begin operations in 2018 and has a December 31 fiscal year end. While it was fairly successful in its first year of operation, excessive production of an unmarketable product resulted in a large operating loss for 2019. Profits have come back in 2020 and 2021.- The relevant Division B income and loss figures, along with charitable donations made during the years under consideration are as follows: 2019 2020 2021 Business Income (Loss) $95,000 ($ 205,000): $69,500 $90,000 Taxable Capital Gains/ (5,000) (7,000) 4,500 5,000 (Allowable Capital Losses) Dividends Received 12,000 42,000 28,000 32,000 Charitable Donations 21,400 4,600 8,000 22,000 All of the dividends have been received from taxable Canadian corporations. It is the policy of the Company to minimize its net capital loss carry forward balance. Required: For each four years 2018 through 2021, provide the following information: - The minimum Net Income for Tax Purposes and Taxable income. Indicate the amount and type of any current year losses that are available for carry back or carry forward. The amended figures for any years to which losses are carried back. An analysis of the amount and type of carry forwards that would be available at the end of the year. Solution to Assignment Problem Twelve - 2 The Taxable Income of Cabrera Digital would be calculated as follows: Operating Income (51.234.000 - 5962,000) Dividends Received ($23,600 + $61,300) Taxable Capital Gain [(1/2)($312.000)) Net Income For Tax Purposes Deductions: Dividends Received ($ 84,900) Donations To Registered Charities (Note 1) (241,000) Net Capital Loss Carry Forward (Note 2) (156,000) Taxable Income Before Non-Capital Loss Carry Forward Non-Capital Loss Carry Forward (Note 3) Taxable Income $272,000 84,900 156,000 $512,900 ( 481,900) $ 31,000 ( 31,000) Nil Note 1 There is no addition to Net Income For Tax Purposes with respect to the donations as this calculation does not start with accounting Net Income (eg., it is a direct calculation of income, not a reconciliation schedule). The donations to registered Canadian charities total less than 75 percent of Net Income For Tax Purposes and are therefore fully deductible in the calculation of Taxable Income. Note 2 The net capital loss carry forward can only be deducted to the extent of the $156,000 taxable capital gain. Note 3 The non-capital loss carry forward has only been deducted to the extent of the amount required to reduce Taxable Income to nil. It would have been possible to carry forward the donations instead, but the non-capital loss carry forward period is greater than the five year donation carry forward. Loss Carry Forwards At the end of the current year, Cabrera will have: a net capital loss balance of $106.000 ($262.000 - $156,000). Since the problem states that no future capital gains are anticipated, the maximum amount of the net capital loss carry forward was claimed first. . a non-capital loss carry forward of $162.000 (5193,000 - $31,000). 2018 Additional Assignment Question (Loss Carry Back and Carry Forwards - 4 Years) Loser Inc. begin operations in 2018 and has a December 31 fiscal year end. While it was fairly successful in its first year of operation, excessive production of an unmarketable product resulted in a large operating loss for 2019. Profits have come back in 2020 and 2021.- The relevant Division B income and loss figures, along with charitable donations made during the years under consideration are as follows: 2019 2020 2021 Business Income (Loss) $95,000 ($ 205,000): $69,500 $90,000 Taxable Capital Gains/ (5,000) (7,000) 4,500 5,000 (Allowable Capital Losses) Dividends Received 12,000 42,000 28,000 32,000 Charitable Donations 21,400 4,600 8,000 22,000 All of the dividends have been received from taxable Canadian corporations. It is the policy of the Company to minimize its net capital loss carry forward balance. Required: For each four years 2018 through 2021, provide the following information: - The minimum Net Income for Tax Purposes and Taxable income. Indicate the amount and type of any current year losses that are available for carry back or carry forward. The amended figures for any years to which losses are carried back. An analysis of the amount and type of carry forwards that would be available at the end of the year

![For Heintz/parrys College Accounting, Chapters 1-15, 22nd Edition, [instant Access]](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/book_images/2022/04/6257c8d15b633_2096257c8d10b1d2.jpg)