Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solution to part ii Part b Andrew Robertson is 47 , married with three children and is a qualified Quantity Surveyor. Andrew has accumulated a

solution to part ii

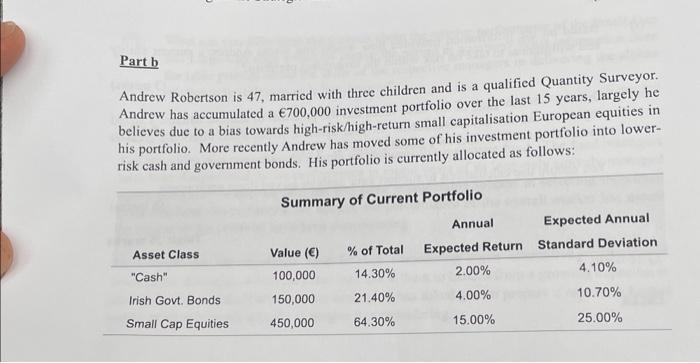

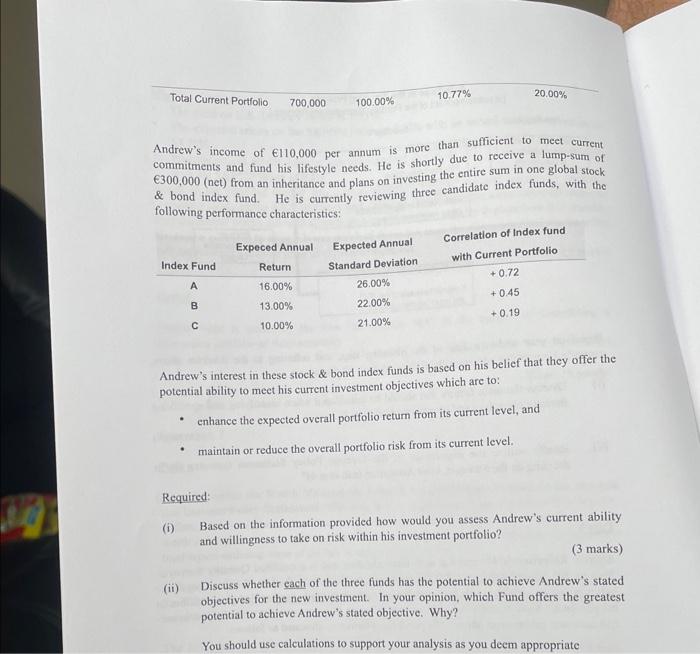

Part b Andrew Robertson is 47 , married with three children and is a qualified Quantity Surveyor. Andrew has accumulated a 700,000 investment portfolio over the last 15 years, largely he believes due to a bias towards high-risk/high-return small capitalisation European equities in his portfolio. More recently Andrew has moved some of his investment portfolio into lowerrisk cash and government bonds. His portfolio is currently allocated as follows: Andrew's income of 6110,000 per annum is more than sufficient to meet current commitments and fund his lifestyle needs. He is shortly due to receive a lump-sum of 300,000 (net) from an inheritance and plans on investing the entire sum in one global stock & bond index fund. He is currently reviewing three candidate index funds, with the following performance characteristics: Andrew's interest in these stock \& bond index funds is based on his belief that they offer the potential ability to meet his current investment objectives which are to: - enhance the expected overall portfolio return from its current level, and - maintain or reduce the overall portfolio risk from its current level. Required: (i) Based on the information provided how would you assess Andrew's current ability and willingness to take on risk within his investment portfolio? (3 marks) (ii) Discuss whether each of the three funds has the potential to achieve Andrew's stated objectives for the new investment. In your opinion, which Fund offers the greatest potential to achieve Andrew's stated objective. Why? You should use calculations to support your analysis as you deem appropriate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started