Answered step by step

Verified Expert Solution

Question

1 Approved Answer

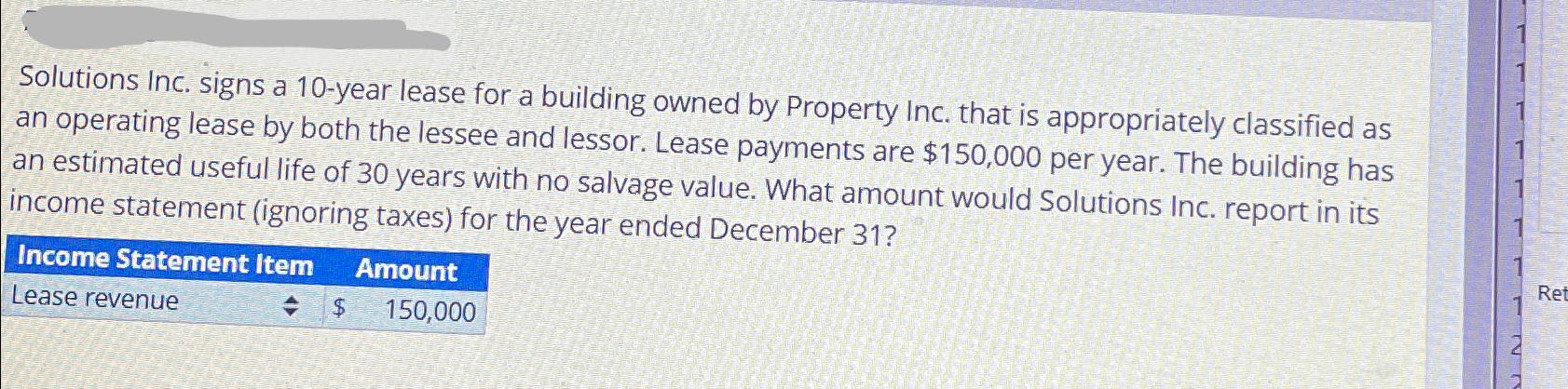

Solutions Inc. signs a 10-year lease for a building owned by Property Inc. that is appropriately classified as an operating lease by both the

Solutions Inc. signs a 10-year lease for a building owned by Property Inc. that is appropriately classified as an operating lease by both the lessee and lessor. Lease payments are $150,000 per year. The building has an estimated useful life of 30 years with no salvage value. What amount would Solutions Inc. report in its income statement (ignoring taxes) for the year ended December 31? Income Statement Item Lease revenue Amount $ 150,000 Ret

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solutions Incs Income Statement Lease expense 150000 Explanation Since Solutions Inc class...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663ddbb669c16_961576.pdf

180 KBs PDF File

663ddbb669c16_961576.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started