Answered step by step

Verified Expert Solution

Question

1 Approved Answer

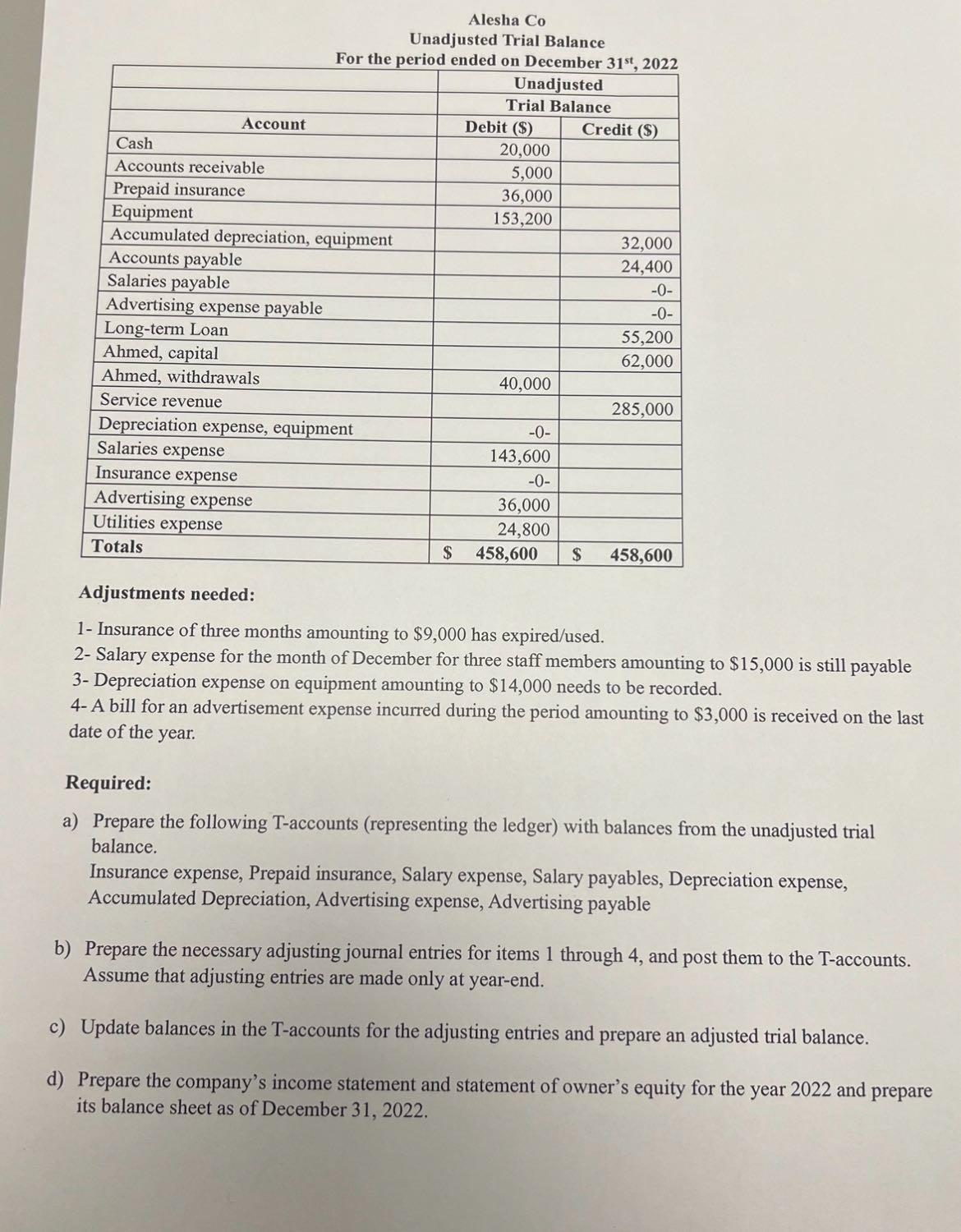

Account Cash Accounts receivable Prepaid insurance Equipment Accumulated depreciation, equipment Accounts payable Salaries payable Alesha Co Unadjusted Trial Balance For the period ended on

Account Cash Accounts receivable Prepaid insurance Equipment Accumulated depreciation, equipment Accounts payable Salaries payable Alesha Co Unadjusted Trial Balance For the period ended on December 31st, 2022 Unadjusted Trial Balance Advertising expense payable Long-term Loan Ahmed, capital Ahmed, withdrawals Service revenue Depreciation expense, equipment Salaries expense Insurance expense Advertising expense Utilities expense Totals Debit ($) 20,000 5,000 36,000 153,200 40,000 -0- 143,600 -0- 36,000 24,800 $ 458,600 Credit (S) $ 32,000 24,400 -0- -0- 55,200 62,000 285,000 458,600 Adjustments needed: 1- Insurance of three months amounting to $9,000 has expired/used. 2- Salary expense for the month of December for three staff members amounting to $15,000 is still payable 3- Depreciation expense on equipment amounting to $14,000 needs to be recorded. 4- A bill for an advertisement expense incurred during the period amounting to $3,000 is received the last date of the year. Required: a) Prepare the following T-accounts (representing the ledger) with balances from the unadjusted trial balance. Insurance expense, Prepaid insurance, Salary expense, Salary payables, Depreciation expense, Accumulated Depreciation, Advertising expense, Advertising payable b) Prepare the necessary adjusting journal entries for items 1 through 4, and post them to the T-accounts. Assume that adjusting entries are made only at year-end. c) Update balances in the T-accounts for the adjusting entries and prepare an adjusted trial balance. d) Prepare the company's income statement and statement of owner's equity for the year 2022 and prepare its balance sheet as of December 31, 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Here are the Taccounts with balances from the unadjusted trial balance TAccounts 1 Insurance Expense Debit 0 Credit 0 2 Prepaid Insurance Debit 9000 Credit 0 3 Salary Expense Debit 0 Credit 0 4 Sala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started