Answered step by step

Verified Expert Solution

Question

1 Approved Answer

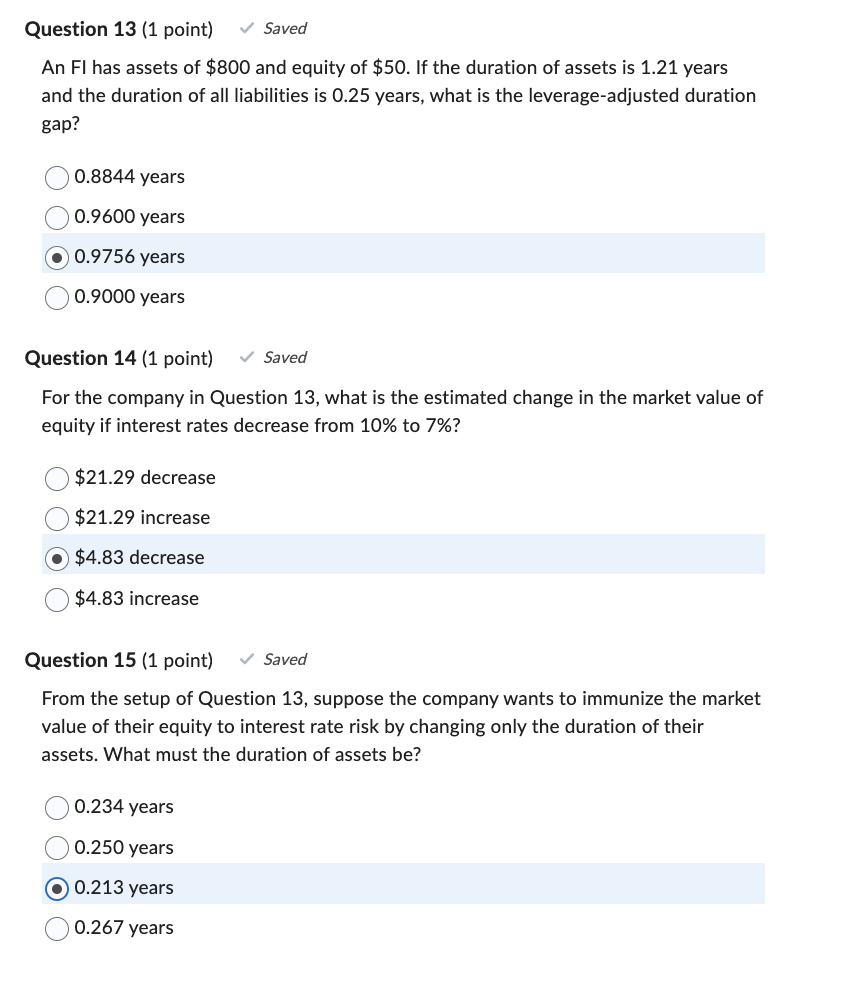

Solve 14 and 15, given the answer to question 13. An FI has assets of $800 and equity of $50. If the duration of assets

Solve 14 and 15, given the answer to question 13.

An FI has assets of $800 and equity of $50. If the duration of assets is 1.21 years and the duration of all liabilities is 0.25 years, what is the leverage-adjusted duration gap? 0.8844 years 0.9600 years 0.9756 years 0.9000 years Question 14 (1 point) Saved For the company in Question 13, what is the estimated change in the market value of equity if interest rates decrease from 10% to 7% ? $21.29 decrease $21.29 increase $4.83 decrease $4.83 increase Question 15 (1 point) Saved From the setup of Question 13, suppose the company wants to immunize the market value of their equity to interest rate risk by changing only the duration of their assets. What must the duration of assets be? 0.234 years 0.250 years 0.213 years 0.267 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started