Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve a and b please AMT, Inc., is considering the purchase of a digital camera for maintenance of design specifications by feeding digital pictures directly

solve a and b please

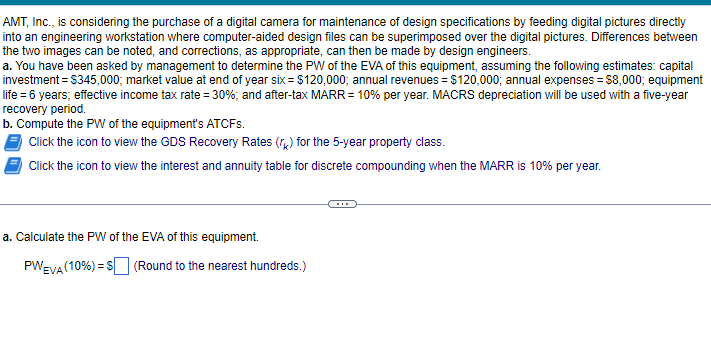

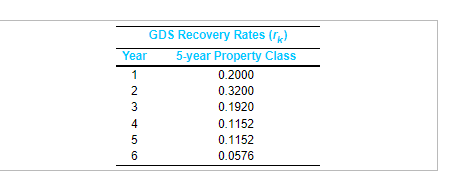

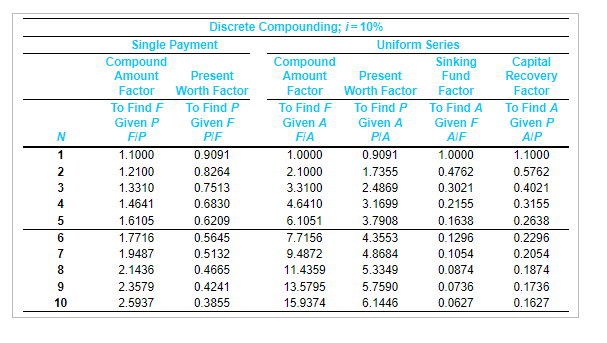

AMT, Inc., is considering the purchase of a digital camera for maintenance of design specifications by feeding digital pictures directly into an engineering workstation where computer-aided design files can be superimposed over the digital pictures. Differences between the two images can be noted, and corrections, as appropriate, can then be made by design engineers. a. You have been asked by management to determine the PW of the EVA of this equipment, assuming the following estimates: capital investment =$345,000; market value at end of year six =$120,000; annual revenues =$120,000; annual expenses =$8,000; equipment life =6 years; effective income tax rate =30%; and after-tax MARR =10% per year. MACRS depreciation will be used with a five-year recovery period. b. Compute the PW of the equipment's ATCFs. Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year. a. Calculate the PW of the EVA of this equipment. PWEVA(10%)=$(Roundtothenearesthundreds.) \begin{tabular}{cc} \hline \multicolumn{2}{c}{ GDS Recovery Rates (rk)} \\ \hline Year & 5-year Property Class \\ \hline 1 & 0.2000 \\ 2 & 0.3200 \\ 3 & 0.1920 \\ 4 & 0.1152 \\ 5 & 0.1152 \\ 6 & 0.0576 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Discrete Compounding; i=10%} \\ \hline & \multicolumn{2}{|c|}{ Single Payment } & \multicolumn{4}{|c|}{ Uniform Series } \\ \hline & \begin{tabular}{c} Compound \\ Amount \\ Factor \end{tabular} & \begin{tabular}{c} Present \\ Worth Factor \end{tabular} & \begin{tabular}{l} Compound \\ Amount \\ Factor \end{tabular} & \begin{tabular}{c} Present \\ Worth Factor \end{tabular} & \begin{tabular}{l} Sinking \\ Fund \\ Factor \end{tabular} & \begin{tabular}{c} Capital \\ Recovery \\ Factor \\ \end{tabular} \\ \hline N & \begin{tabular}{c} To Find F \\ Given P \\ F/P \end{tabular} & \begin{tabular}{c} To Find P \\ Given F \\ PIF \end{tabular} & \begin{tabular}{c} To Find F \\ Given A \\ FlA \end{tabular} & \begin{tabular}{c} To Find P \\ Given A \\ PIA \end{tabular} & \begin{tabular}{c} To Find A \\ Given F \\ AlF \end{tabular} & \begin{tabular}{c} To Find A \\ Given P \\ A/P \end{tabular} \\ \hline 1 & 1.1000 & 0.9091 & 1.0000 & 0.9091 & 1.0000 & 1.1000 \\ \hline 2 & 1.2100 & 0.8264 & 2.1000 & 1.7355 & 0.4762 & 0.5762 \\ \hline 3 & 1.3310 & 0.7513 & 3.3100 & 2.4869 & 0.3021 & 0.4021 \\ \hline 4 & 1.4641 & 0.6830 & 4.6410 & 3.1699 & 0.2155 & 0.3155 \\ \hline 5 & 1.6105 & 0.6209 & 6.1051 & 3.7908 & 0.1638 & 0.2638 \\ \hline 6 & 1.7716 & 0.5645 & 7.7156 & 4.3553 & 0.1296 & 0.2296 \\ \hline 7 & 1.9487 & 0.5132 & 9.4872 & 4.8684 & 0.1054 & 0.2054 \\ \hline 8 & 2.1436 & 0.4665 & 11.4359 & 5.3349 & 0.0874 & 0.1874 \\ \hline 9 & 2.3579 & 0.4241 & 13.5795 & 5.7590 & 0.0736 & 0.1736 \\ \hline 10 & 2.5937 & 0.3855 & 15.9374 & 6.1446 & 0.0627 & 0.1627 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started