Answered step by step

Verified Expert Solution

Question

1 Approved Answer

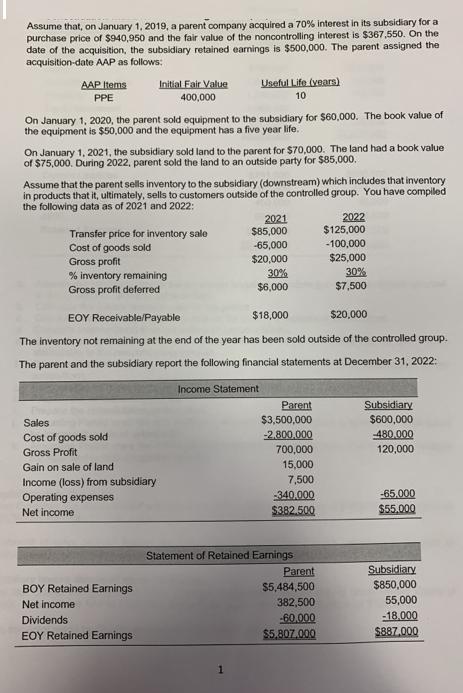

Assume that, on January 1, 2019, a parent company acquired a 70% interest in its subsidiary for a purchase price of $940,950 and the

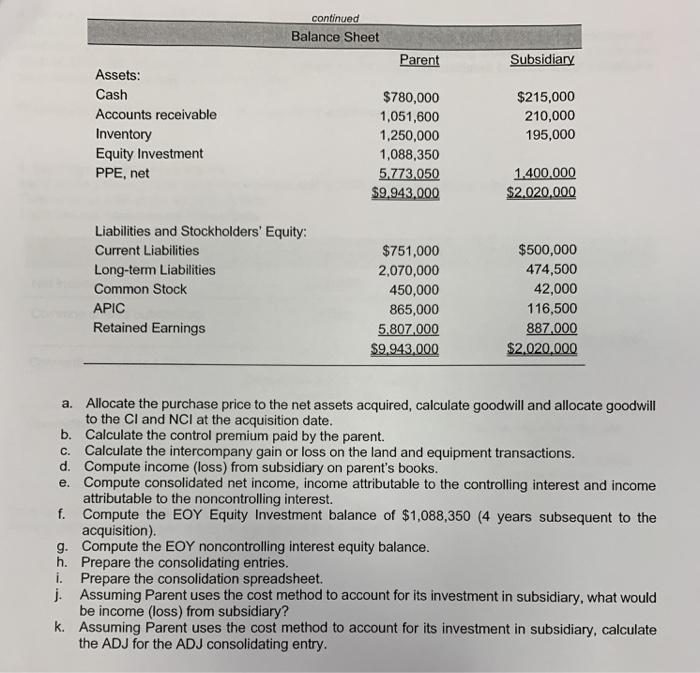

Assume that, on January 1, 2019, a parent company acquired a 70% interest in its subsidiary for a purchase price of $940,950 and the fair value of the noncontrolling interest is $367,550. On the date of the acquisition, the subsidiary retained earnings is $500,000. The parent assigned the acquisition-date AAP as follows: AAP Items PPE Initial Fair Value 400,000 On January 1, 2020, the parent sold equipment to the subsidiary for $60,000. The book value of the equipment is $50,000 and the equipment has a five year life. On January 1, 2021, the subsidiary sold land to the parent for $70,000. The land had a book value of $75,000. During 2022, parent sold the land to an outside party for $85,000. Assume that the parent sells inventory to the subsidiary (downstream) which includes that inventory in products that it, ultimately, sells to customers outside of the controlled group. You have compiled the following data as of 2021 and 2022: Transfer price for inventory sale Cost of goods sold Gross profit % inventory remaining Gross profit deferred Useful Life (years) 10 Sales Cost of goods sold Gross Profit Gain on sale of land Income (loss) from subsidiary Operating expenses Net income BOY Retained Earnings Net income Dividends EOY Retained Earnings 2021 $85,000 1 -65,000 $20,000 EOY Receivable/Payable $18,000 $20,000 The inventory not remaining at the end of the year has been sold outside of the controlled group. The parent and the subsidiary report the following financial statements at December 31, 2022: Income Statement 30% $6,000 Parent $3,500,000 -2,800,000 700,000 15,000 7,500 -340,000 $382.500 Statement of Retained Earnings 2022 $125,000 -100,000 $25,000 30% $7,500 Parent $5,484,500 382,500 -60,000 $5,807,000 Subsidiary $600,000 -480.000 120,000 -65.000 $55,000 Subsidiary $850,000 55,000 -18,000 $887.000 Assets: Cash Accounts receivable Inventory g. h. Equity Investment PPE, net Liabilities and Stockholders' Equity: Current Liabilities Long-term Liabilities Common Stock APIC Retained Earnings continued Balance Sheet Parent $780,000 1,051,600 1,250,000 1,088,350 5.773,050 $9,943,000 $751,000 2,070,000 450,000 865,000 5,807,000 $9.943.000 Subsidiary $215,000 210,000 195,000 1.400.000 $2.020.000 $500,000 474,500 42,000 116,500 887,000 $2,020,000 a. Allocate the purchase price to the net assets acquired, calculate goodwill and allocate goodwill to the CI and NCI at the acquisition date. Calculate the control premium paid by the parent. b. C. Calculate the intercompany gain or loss on the land and equipment transactions. d. Compute income (loss) from subsidiary on parent's books. e. Compute consolidated net income, income attributable to the controlling interest and income attributable to the noncontrolling interest. f. Compute the EOY Equity Investment balance of $1,088,350 (4 years subsequent to the acquisition). Compute the EOY noncontrolling interest equity balance. Prepare the consolidating entries. Prepare the consolidation spreadsheet. i. j. Assuming Parent uses the cost method to account for its investment in subsidiary, what would be income (loss) from subsidiary? k. Assuming Parent uses the cost method to account for its investment in subsidiary, calculate the ADJ for the ADJ consolidating entry.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer 15 Since the asset is part of normal business operations depreciation is considered an operat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started