Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve a-d please. Recording a Change in Estimate, an Error Correction, and a Change in Accounting Principle On December 31, Year 4. Alexa Company is

Solve a-d please.

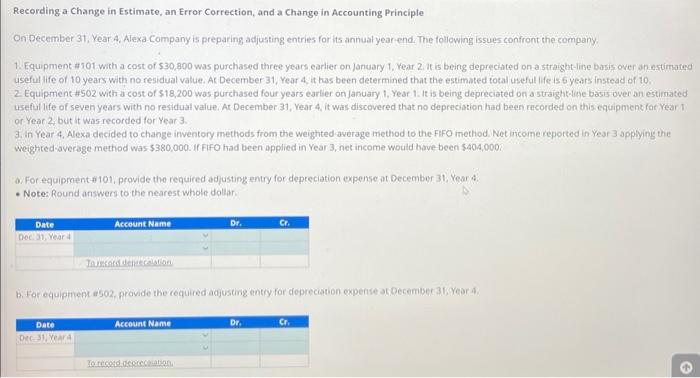

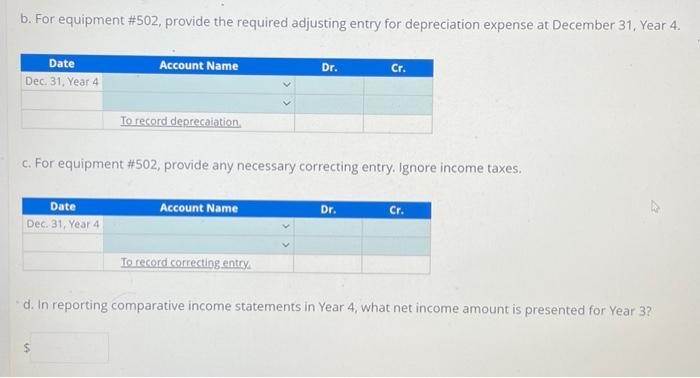

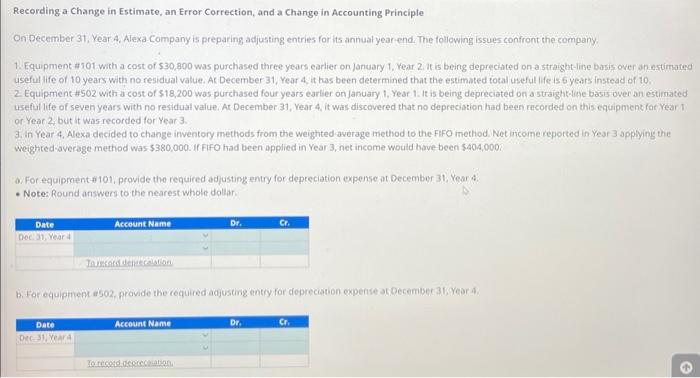

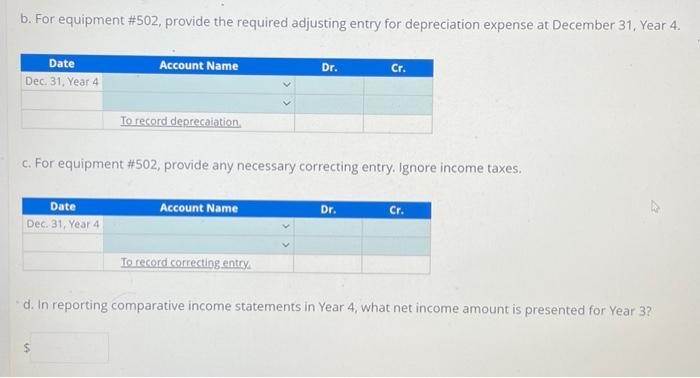

Recording a Change in Estimate, an Error Correction, and a Change in Accounting Principle On December 31, Year 4. Alexa Company is preparing adjusting entries for its annual year-end. The following issues confront the company. 1. Equipment #101 with a cost of 530,800 was purchased three years earlier on jancary 1 , Year 2 , it is being depreciated on a straight-line basis over an estimated useful life of 10 years with no residual value. At December 31 , Year 4 , it has been determined that the estimated total useful ife is 6 years instead of 10 . 2. Equipment 1502 with a cost of $18,200 was purchased four years earlier on january 1, Year 1. It is being depreciated on a straight-line basis over an estimated useful life of seven years with no residual value. At. December 31 , Year 4 , it was discovered that no depreciation had been recorded on this equipment for Year 1 or Year 2 but it was recorded for Year 3. 3. In Year 4, Alexa decided to change inventory methods from the weighted average method to the FIFO method. Net income reported in Year 3 applying the weighted-average method was $380,000. If FIFO had been applied in Year 3 , net income would have been $404,000. a. For equipment * 101, provide the required adjusting entry for depreciation expense at December 31 , Vear 4. - Notea Round answers to the nearest whole dollar. b. For equipment in 502 , provide the required adjusting entry for depreciation expense at December 31, Year i4. b. For equipment #502, provide the required adjusting entry for depreciation expense at December 31 , Year 4 . c. For equipment #502, provide any necessary correcting entry. Ignore income taxes. d. In reporting comparative income statements in Year 4 , what net income amount is presented for Year 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started