Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve all Answers,I give a positive rating... THANK YOU For the completion of job. 100 skilled workmen, 40 semi-skilled workmen and 60 unskilled workmen worked

Solve all Answers,I give a positive rating... THANK YOU

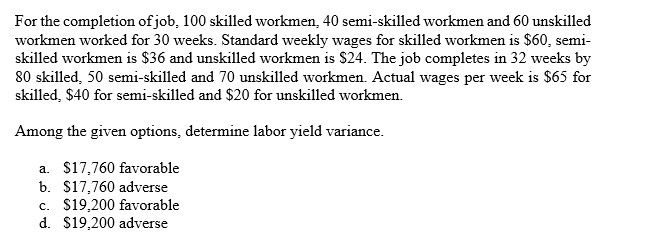

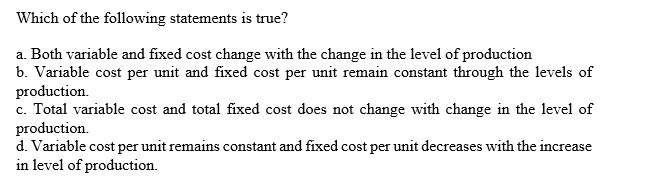

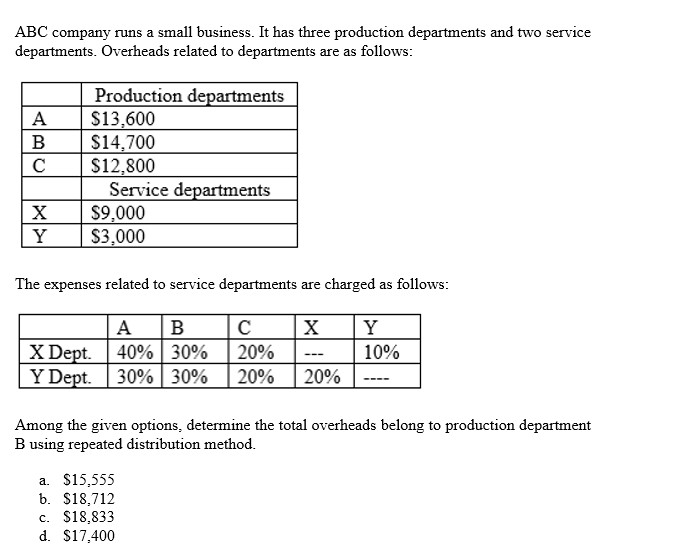

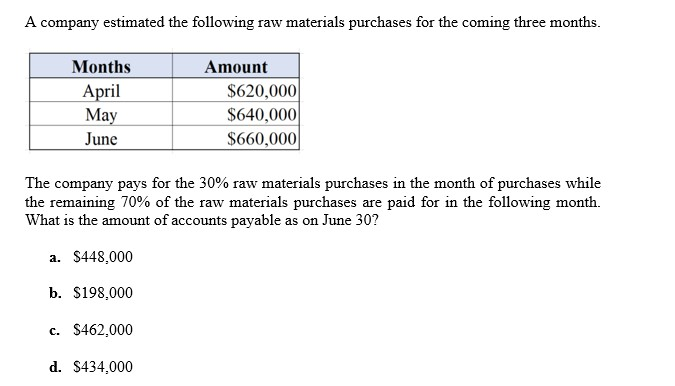

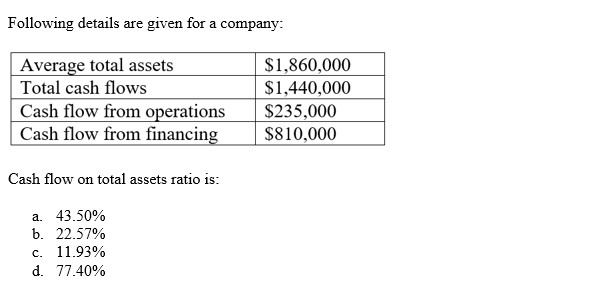

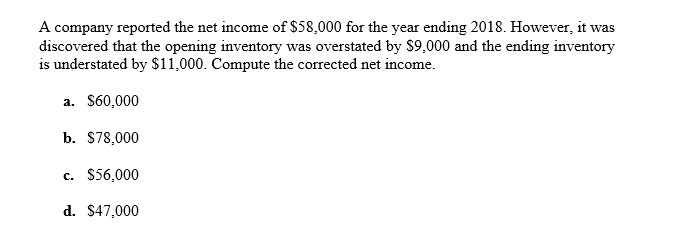

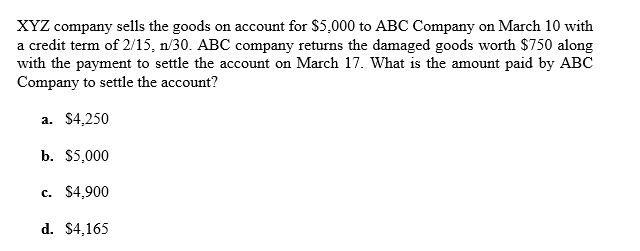

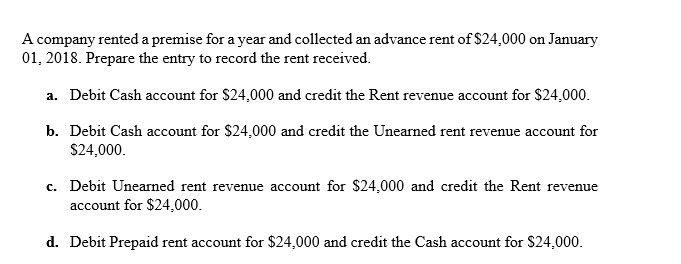

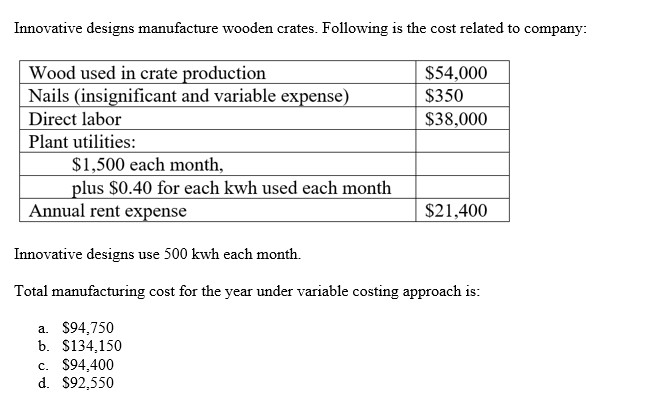

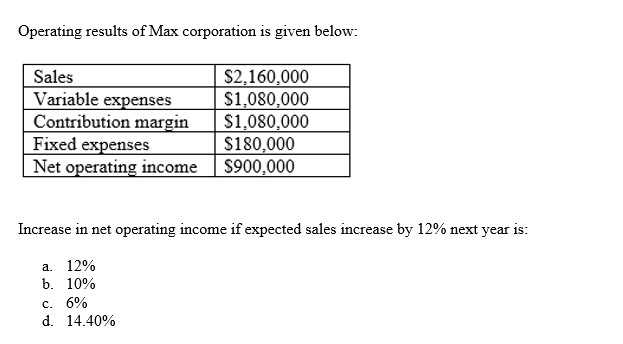

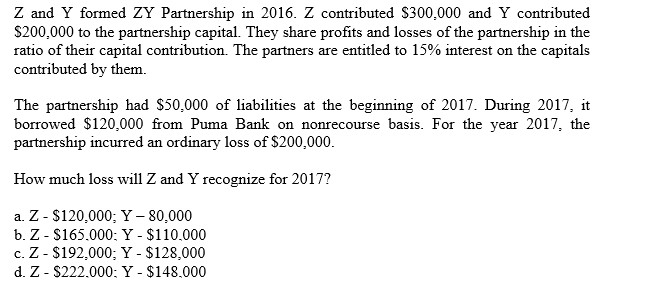

For the completion of job. 100 skilled workmen, 40 semi-skilled workmen and 60 unskilled workmen worked for 30 weeks. Standard weekly wages for skilled workmen is $60, semi- skilled workmen is $36 and unskilled workmen is $24. The job completes in 32 weeks by 80 skilled, 50 semi-skilled and 70 unskilled workmen. Actual wages per week is $65 for skilled, $40 for semi-skilled and $20 for unskilled workmen. Among the given options, determine labor yield variance. a. $17,760 favorable b. $17,760 adverse c. $19,200 favorable d. $19,200 adverse Which of the following statements is true? a. Both variable and fixed cost change with the change in the level of production b. Variable cost per unit and fixed cost per unit remain constant through the levels of production. c. Total variable cost and total fixed cost does not change with change in the level of production d. Variable cost per unit remains constant and fixed cost per unit decreases with the increase in level of production. ABC company runs a small business. It has three production departments and two service departments. Overheads related to departments are as follows: A Ic Production departments $13,600 $14,700 $12,800 Service departments $9,000 $3.000 X Y The expenses related to service departments are charged as follows: x Dept. Y Dept. A 40% 30% B 30% 30% C 20% 20% X - 20% Y 10% Among the given options, determine the total overheads belong to production department B using repeated distribution method. a. $15,555 b. $18,712 c. $18.833 d. $17.400 A company estimated the following raw materials purchases for the coming three months. Months April May Amount $620,000 $640,000 $660,000 June The company pays for the 30% raw materials purchases in the month of purchases while the remaining 70% of the raw materials purchases are paid for in the following month. What is the amount of accounts payable as on June 30? a. $448,000 b. $198.000 c. $462,000 d. S434,000 Following details are given for a company: Average total assets Total cash flows Cash flow from operations Cash flow from financing $1,860,000 $1,440,000 $235,000 $810,000 Cash flow on total assets ratio is: a. 43.50% b. 22.57% c. 11.93% d. 77.40% A company reported the net income of $58,000 for the year ending 2018. However, it was discovered that the opening inventory was overstated by $9,000 and the ending inventory is understated by $11,000. Compute the corrected net income. a. $60,000 b. $78,000 c. $56.000 d. $47,000 XYZ company sells the goods on account for $5,000 to ABC Company on March 10 with a credit term of 2/15, n/30. ABC company returns the damaged goods worth $750 along with the payment to settle the account on March 17. What is the amount paid by ABC Company to settle the account? a. $4,250 b. $5,000 c. $4,900 d. $4,165 A company rented a premise for a year and collected an advance rent of $24,000 on January 01. 2018. Prepare the entry to record the rent received. a. Debit Cash account for $24,000 and credit the Rent revenue account for $24,000. b. Debit Cash account for $24,000 and credit the Unearned rent revenue account for $24,000. c. Debit Unearned rent revenue account for $24,000 and credit the Rent revenue account for $24.000. d. Debit Prepaid rent account for $24,000 and credit the Cash account for $24.000. Innovative designs manufacture wooden crates. Following is the cost related to company: $54,000 $350 $38,000 Wood used in crate production Nails (insignificant and variable expense) Direct labor Plant utilities: $1,500 each month, plus $0.40 for each kwh used each month Annual rent expense $21,400 Innovative designs use 500 kwh each month. Total manufacturing cost for the year under variable costing approach is: a. $94,750 b. $134,150 c. $94.400 d. $92,550 Operating results of Max corporation is given below: Sales Variable expenses Contribution margin Fixed expenses Net operating income $2.160,000 $1,080,000 $1,080,000 $180,000 $900,000 Increase in net operating income if expected sales increase by 12% next year is: a. 12% b. 10% c. 6% d. 14.40% Z and Y formed ZY Partnership in 2016. Z contributed $300,000 and Y contributed $200,000 to the partnership capital. They share profits and losses of the partnership in the ratio of their capital contribution. The partners are entitled to 15% interest on the capitals contributed by them. The partnership had $50,000 of liabilities at the beginning of 2017. During 2017, it borrowed $120,000 from Puma Bank on nonrecourse basis. For the year 2017, the partnership incurred an ordinary loss of $200,000. How much loss will Z and Y recognize for 2017? a. Z - $120,000; Y-80,000 b. Z - $165.000: Y- $110.000 c. Z - $192.000; Y - $128,000 d. Z - $222.000: Y - $148.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started