Question

SOLVE ALL TABLES BELOW ONLY USING EXCEL! SHOW ALL FORMULAS AND STEPS BELOW. MANY THANKS. QUESTION: A 2000-pound, counterbalanced, propane forklift can be purchased for

SOLVE ALL TABLES BELOW ONLY USING EXCEL! SHOW ALL FORMULAS AND STEPS BELOW. MANY THANKS.

QUESTION:

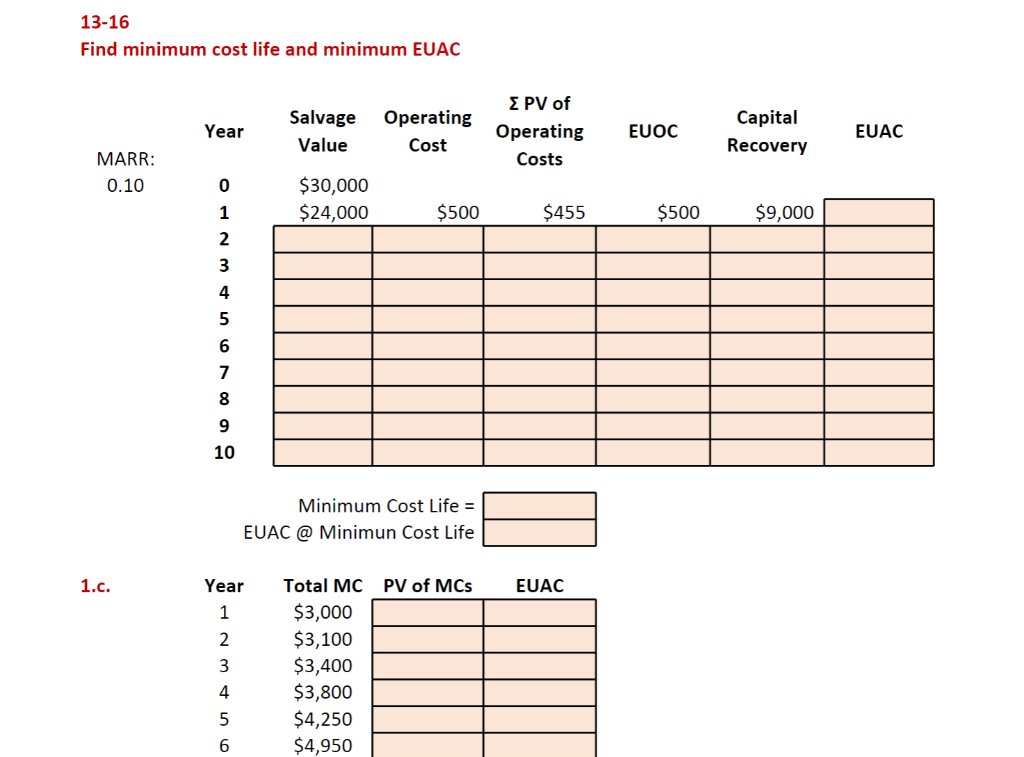

A 2000-pound, counterbalanced, propane forklift can be purchased for $30,000. Due to the intended service use, the forklifts market value drops 20% of its prior years value in Years 1 and 2 and then declines by 15% until Year 10 when it will have a scrap/market value of $1000. Maintenance of the forklift is $500 per year during Years 1 and 2 while the warranty is in place. In Year 3 it jumps to $750 and increases $750 per year thereafter. What is the optimal life of the forklift using i = 10%? Demonstrate how one would calculate the economic life of a truck costing $40,000 initially, and at the end of this and each following year (y) costing OMRy in operation, maintenance and repair costs.

Calculate EUAC for retaining an asset for one to six years if it has the following Total Marginal Costs and the MARR = 10%.

13-16 Find minimum cost life and minimum EUAC Year Salvage Value Operating Cost PV of Operating Costs EUOC Capital Recovery EUAC MARR: 0.10 $30,000 $24,000 $500 $455 $500 $9,000 0 1 2 3 4 5 6 7 8 9 10 Minimum Cost Life = EUAC @ Minimun Cost Life 1.c. Year PV of MCs EUAC 1 UN 2 3 4 5 6 Total MC $3,000 $3,100 $3,400 $3,800 $4,250 $4,950 13-16 Find minimum cost life and minimum EUAC Year Salvage Value Operating Cost PV of Operating Costs EUOC Capital Recovery EUAC MARR: 0.10 $30,000 $24,000 $500 $455 $500 $9,000 0 1 2 3 4 5 6 7 8 9 10 Minimum Cost Life = EUAC @ Minimun Cost Life 1.c. Year PV of MCs EUAC 1 UN 2 3 4 5 6 Total MC $3,000 $3,100 $3,400 $3,800 $4,250 $4,950Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started