Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SOLVE. ALL WRONG ANSWERSWILL BE DELETED AND DOWNVOTED. 1.a. Leonardo, who is married but files separately, earns $63,000 of taxable income. He also has $16,400

SOLVE. ALL WRONG ANSWERSWILL BE DELETED AND DOWNVOTED.

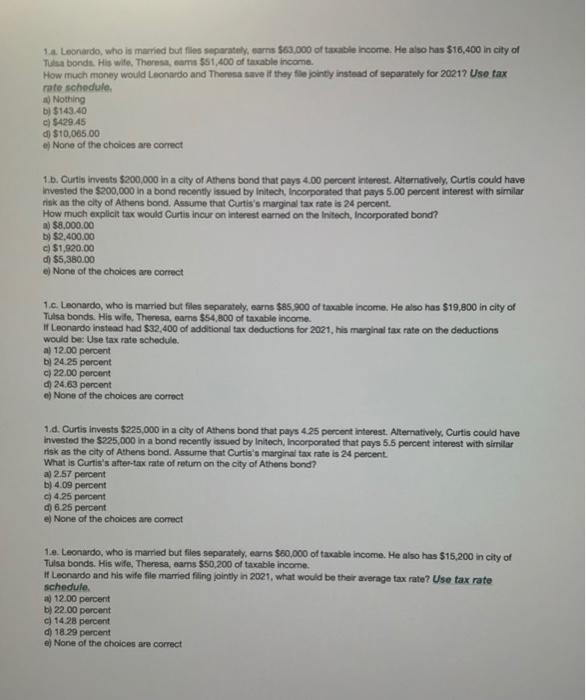

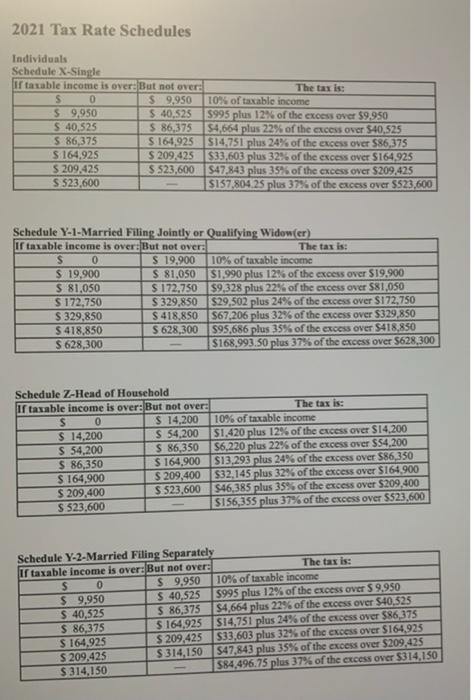

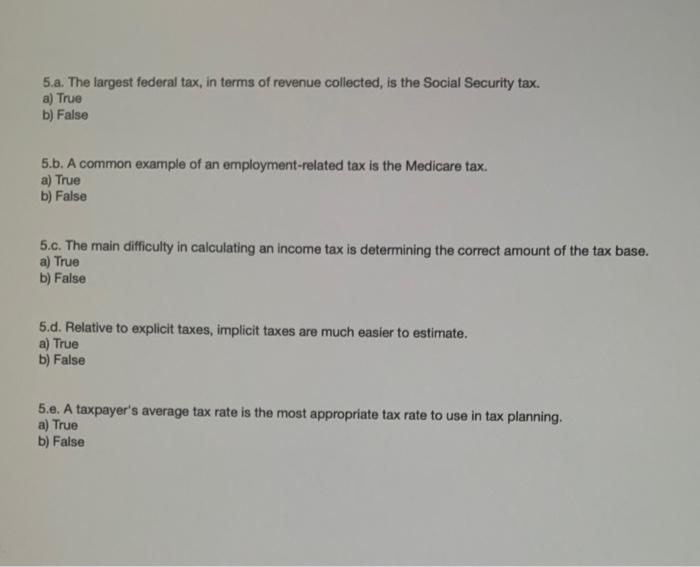

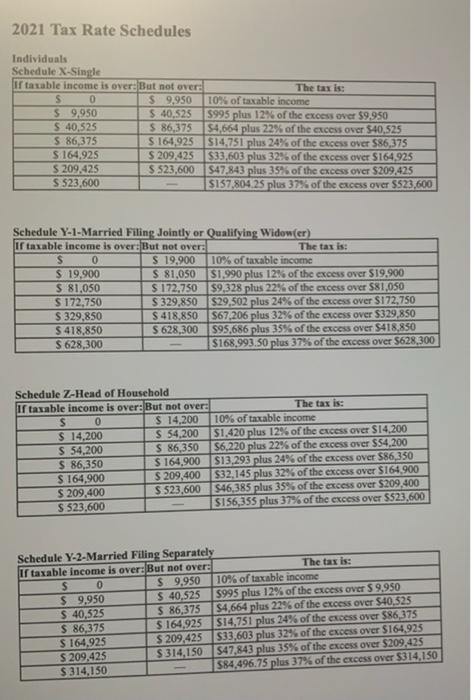

1.a. Leonardo, who is married but files separately, earns $63,000 of taxable income. He also has $16,400 in city of Tulsa bonds. His wife, Theresa, eams $51,400 of taxable income. How much money would Leonardo and Theresa save if they file jointly instead of separately for 2021? Use tax rate schedule. a) Nothing b) $143.40 c) $429.45 d) $10,065.00 e) None of the choices are correct 1.b. Curtis invests $200,000 in a city of Athens bond that pays 4.00 percent interest. Alternatively, Curtis could have invested the $200,000 in a bond recently issued by Initech, Incorporated that pays 5.00 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. How much explicit tax would Curtis incur on interest earned on the Initech, Incorporated bond? a) $8,000.00 b) $2,400.00 c) $1,920.00 d) $5,380.00 e) None of the choices are correct 1.c. Leonardo, who is married but files separately, earns $85,900 of taxable income. He also has $19,800 in city of Tulsa bonds. His wife, Theresa, eams $54,800 of taxable income. If Leonardo instead had $32,400 of additional tax deductions for 2021, his marginal tax rate on the deductions would be: Use tax rate schedule. a) 12.00 percent b) 24.25 percent c) 22.00 percent d) 24.63 percent e) None of the choices are correct 1.d. Curtis invests $225,000 in a city of Athens bond that pays 4.25 percent interest. Alternatively, Curtis could have invested the $225,000 in a bond recently issued by Initech, Incorporated that pays 5.5 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. What is Curtis's after-tax rate of return on the city of Athens bond? a) 2.57 percent b) 4.09 percent c) 4.25 percent d) 6.25 percent e) None of the choices are correct 1.e. Leonardo, who is married but files separately, earns $60,000 of taxable income. He also has $15,200 in city of Tulsa bonds. His wife, Theresa, earns $50,200 of taxable income. If Leonardo and his wife file married filing jointly in 2021, what would be their average tax rate? Use tax rate schedule. a) 12.00 percent b) 22.00 percent c) 14.28 percent d) 18.29 percent e) None o the choices are correct 2021 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: S 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $ 86,375 $164,925 $ 40,525 $ 86,375 $164,925 $209,425 $523,600 $995 plus 12% of the excess over $9.950 $4,664 plus 22% of the excess over $40,525 $14,751 plus 24% of the excess over $86,375 $33,603 plus 32% of the excess over $164,925 $47,843 plus 35% of the excess over $209,425 $157,804.25 plus 37% of the excess over $523,600 $ 209,425 S $23,600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,900 10% of taxable income $ 19,900 $ 81,050 $172,750 $ 81,050 $172,750 $329,850 $418,850 $ 628,300 $1.990 plus 12% of the excess over $19.900 $9,328 plus 22% of the excess over $81,050 $29,502 plus 24% of the excess over $172,750 $67,206 plus 32% of the excess over $329,850 $95,686 plus 35% of the excess over $418,850 $168.993.50 plus 37% of the excess over $628,300 $ 329,850 $418,850 $ 628,300 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: S 0 $ 14,200 10% of taxable income $ 14,200 $ 54,200 S 54,200 $ 86,350 $ 86,350 $164,900 $209,400 S523,600 $1,420 plus 12% of the excess over $14,200 $6,220 plus 22% of the excess over $54,200 $13,293 plus 24% of the excess over $86,350 $32,145 plus 32% of the excess over $164,900 $46,385 plus 35% of the excess over $209,400 $156,355 plus 37% of the excess over $523,600 $164,900 $ 209,400 $ 523,600 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: 10% of taxable income 0 $ 9,950 S $ 9,950 $ 40,525 $ 40,525 $ 86,375 $ 86,375 $995 plus 12% of the excess over $ 9,950 $4,664 plus 22% of the excess over $40,525 $14,751 plus 24% of the excess over $86,375 $33,603 plus 32% of the excess over $164,925 $47,843 plus 35% of the excess over $209,425 $84,496.75 plus 37% of the excess over $314,150 $164,925 $ 209,425 $314,150 $164,925 $ 209,425 $314,150 5.a. The largest federal tax, in terms of revenue collected, is the Social Security tax. a) True b) False 5.b. A common example of an employment-related tax is the Medicare tax. a) True b) False 5.c. The main difficulty in calculating an income tax is determining the correct amount of the tax base. a) True b) False 5.d. Relative to explicit taxes, implicit taxes are much easier to estimate. a) True b) False 5.e. A taxpayer's average tax rate is the most appropriate tax rate to use in tax planning. a) True b) False 1.a. Leonardo, who is married but files separately, earns $63,000 of taxable income. He also has $16,400 in city of Tulsa bonds. His wife, Theresa, eams $51,400 of taxable income. How much money would Leonardo and Theresa save if they file jointly instead of separately for 2021? Use tax rate schedule. a) Nothing b) $143.40 c) $429.45 d) $10,065.00 e) None of the choices are correct 1.b. Curtis invests $200,000 in a city of Athens bond that pays 4.00 percent interest. Alternatively, Curtis could have invested the $200,000 in a bond recently issued by Initech, Incorporated that pays 5.00 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. How much explicit tax would Curtis incur on interest earned on the Initech, Incorporated bond? a) $8,000.00 b) $2,400.00 c) $1,920.00 d) $5,380.00 e) None of the choices are correct 1.c. Leonardo, who is married but files separately, earns $85,900 of taxable income. He also has $19,800 in city of Tulsa bonds. His wife, Theresa, eams $54,800 of taxable income. If Leonardo instead had $32,400 of additional tax deductions for 2021, his marginal tax rate on the deductions would be: Use tax rate schedule. a) 12.00 percent b) 24.25 percent c) 22.00 percent d) 24.63 percent e) None of the choices are correct 1.d. Curtis invests $225,000 in a city of Athens bond that pays 4.25 percent interest. Alternatively, Curtis could have invested the $225,000 in a bond recently issued by Initech, Incorporated that pays 5.5 percent interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. What is Curtis's after-tax rate of return on the city of Athens bond? a) 2.57 percent b) 4.09 percent c) 4.25 percent d) 6.25 percent e) None of the choices are correct 1.e. Leonardo, who is married but files separately, earns $60,000 of taxable income. He also has $15,200 in city of Tulsa bonds. His wife, Theresa, earns $50,200 of taxable income. If Leonardo and his wife file married filing jointly in 2021, what would be their average tax rate? Use tax rate schedule. a) 12.00 percent b) 22.00 percent c) 14.28 percent d) 18.29 percent e) None o the choices are correct 2021 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: S 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $ 86,375 $164,925 $ 40,525 $ 86,375 $164,925 $209,425 $523,600 $995 plus 12% of the excess over $9.950 $4,664 plus 22% of the excess over $40,525 $14,751 plus 24% of the excess over $86,375 $33,603 plus 32% of the excess over $164,925 $47,843 plus 35% of the excess over $209,425 $157,804.25 plus 37% of the excess over $523,600 $ 209,425 S $23,600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,900 10% of taxable income $ 19,900 $ 81,050 $172,750 $ 81,050 $172,750 $329,850 $418,850 $ 628,300 $1.990 plus 12% of the excess over $19.900 $9,328 plus 22% of the excess over $81,050 $29,502 plus 24% of the excess over $172,750 $67,206 plus 32% of the excess over $329,850 $95,686 plus 35% of the excess over $418,850 $168.993.50 plus 37% of the excess over $628,300 $ 329,850 $418,850 $ 628,300 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: S 0 $ 14,200 10% of taxable income $ 14,200 $ 54,200 S 54,200 $ 86,350 $ 86,350 $164,900 $209,400 S523,600 $1,420 plus 12% of the excess over $14,200 $6,220 plus 22% of the excess over $54,200 $13,293 plus 24% of the excess over $86,350 $32,145 plus 32% of the excess over $164,900 $46,385 plus 35% of the excess over $209,400 $156,355 plus 37% of the excess over $523,600 $164,900 $ 209,400 $ 523,600 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: 10% of taxable income 0 $ 9,950 S $ 9,950 $ 40,525 $ 40,525 $ 86,375 $ 86,375 $995 plus 12% of the excess over $ 9,950 $4,664 plus 22% of the excess over $40,525 $14,751 plus 24% of the excess over $86,375 $33,603 plus 32% of the excess over $164,925 $47,843 plus 35% of the excess over $209,425 $84,496.75 plus 37% of the excess over $314,150 $164,925 $ 209,425 $314,150 $164,925 $ 209,425 $314,150 5.a. The largest federal tax, in terms of revenue collected, is the Social Security tax. a) True b) False 5.b. A common example of an employment-related tax is the Medicare tax. a) True b) False 5.c. The main difficulty in calculating an income tax is determining the correct amount of the tax base. a) True b) False 5.d. Relative to explicit taxes, implicit taxes are much easier to estimate. a) True b) False 5.e. A taxpayer's average tax rate is the most appropriate tax rate to use in tax planning. a) True b) False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started