Solve and explain

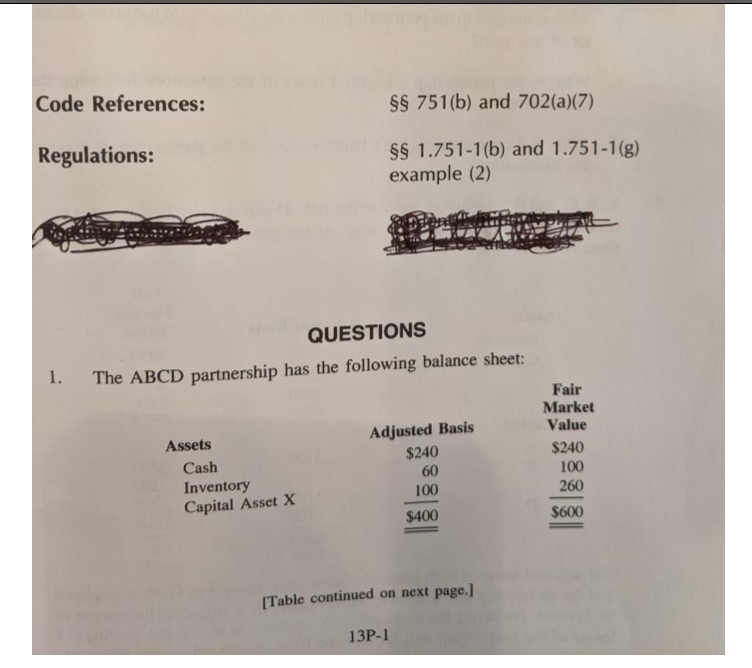

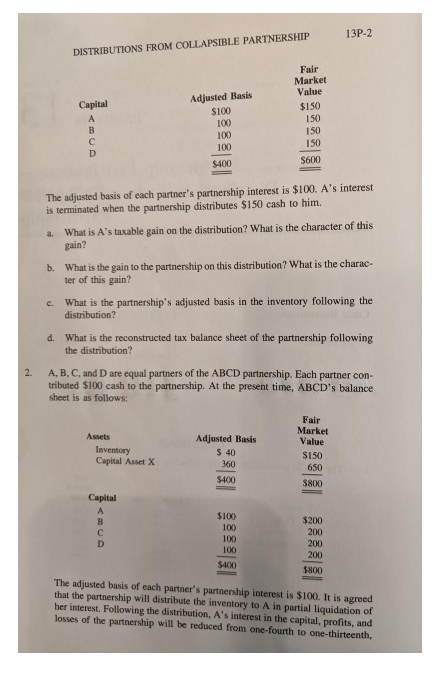

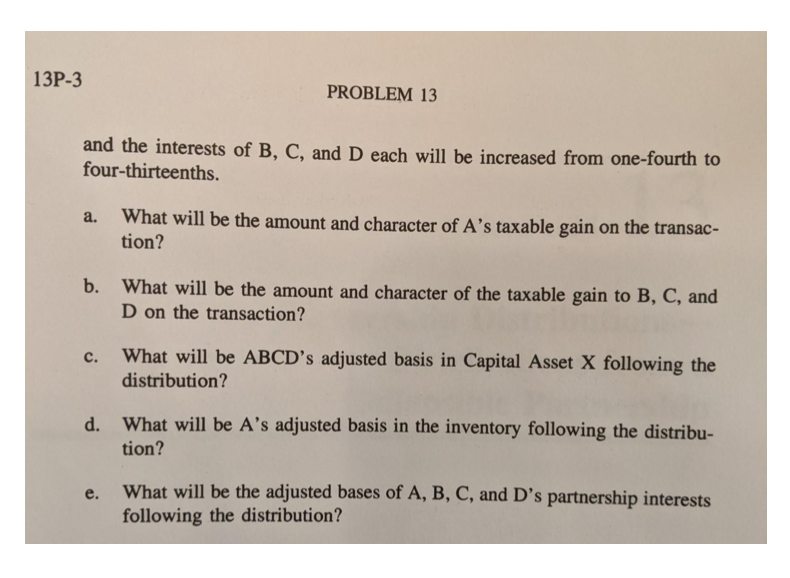

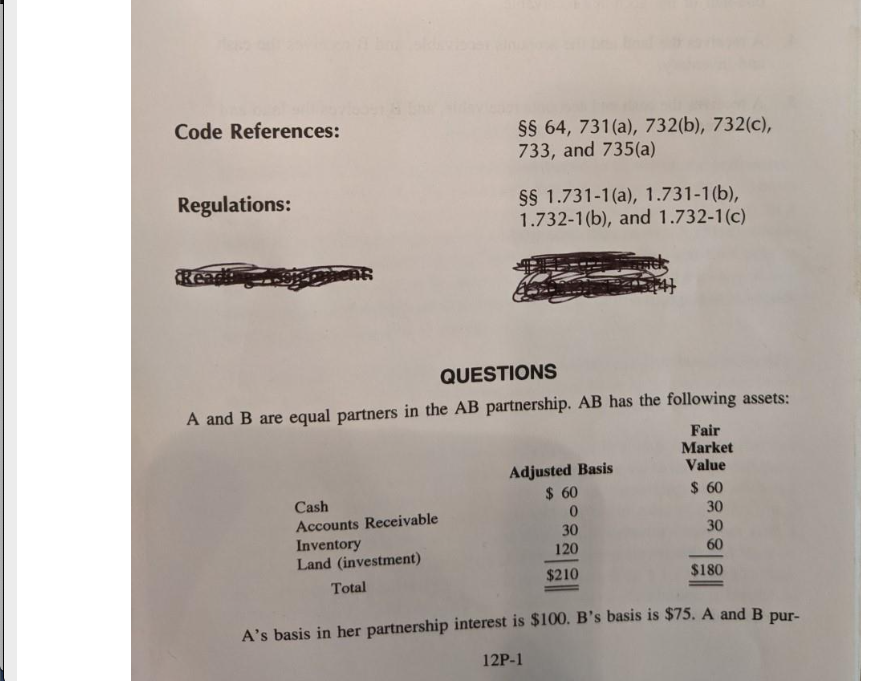

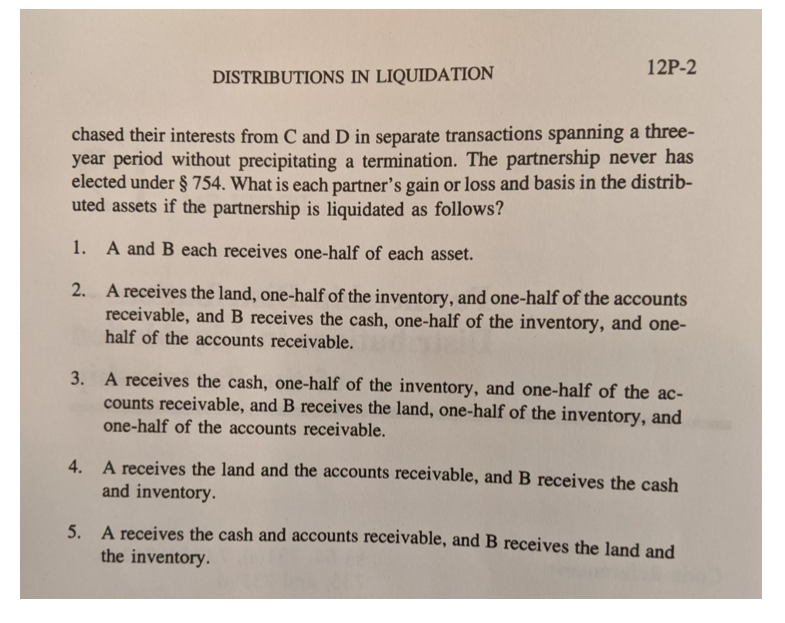

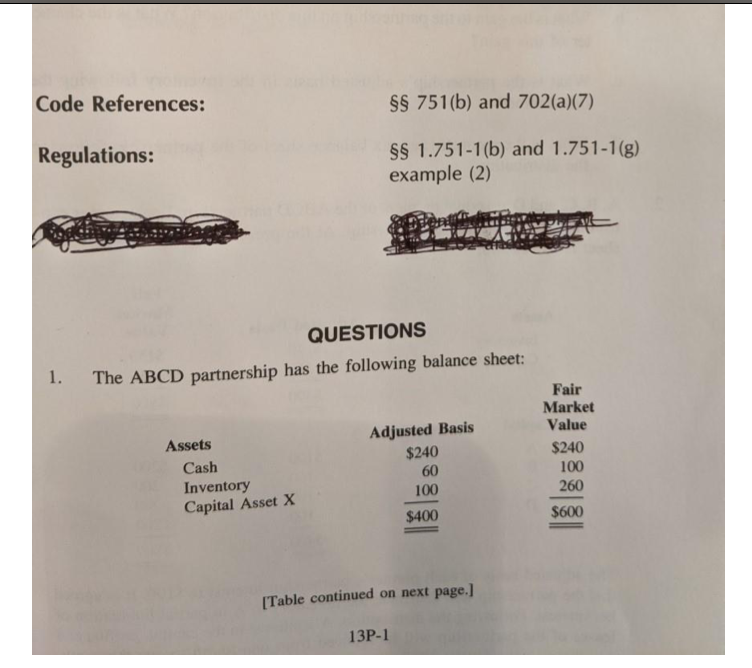

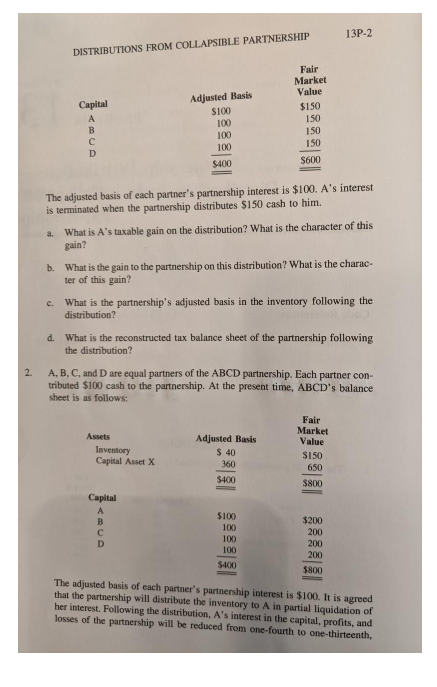

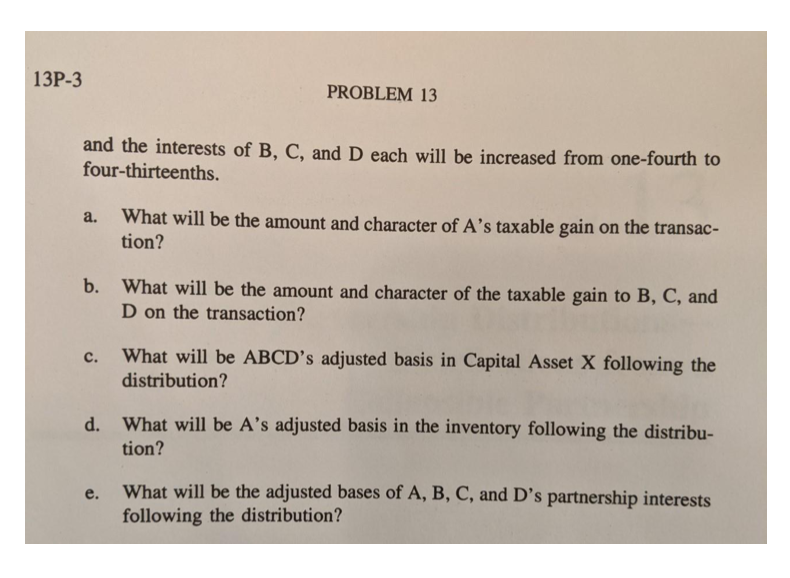

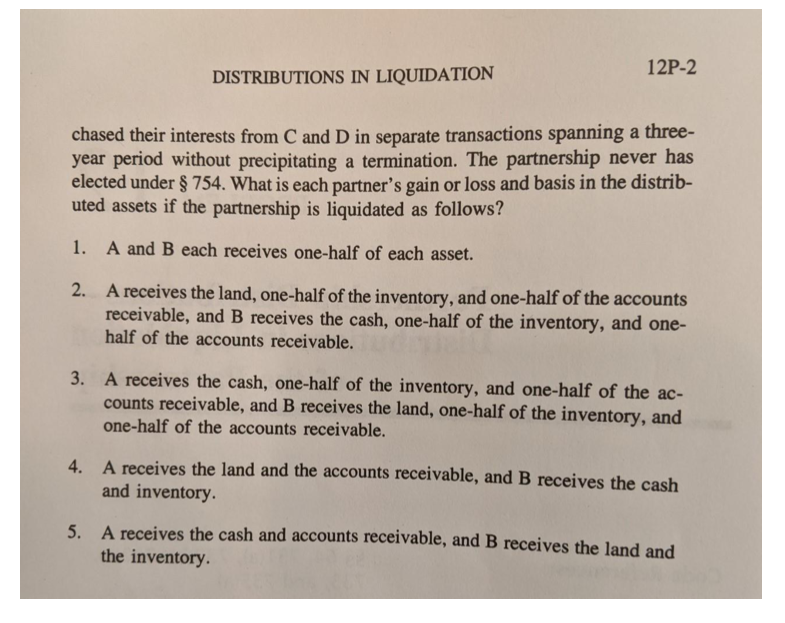

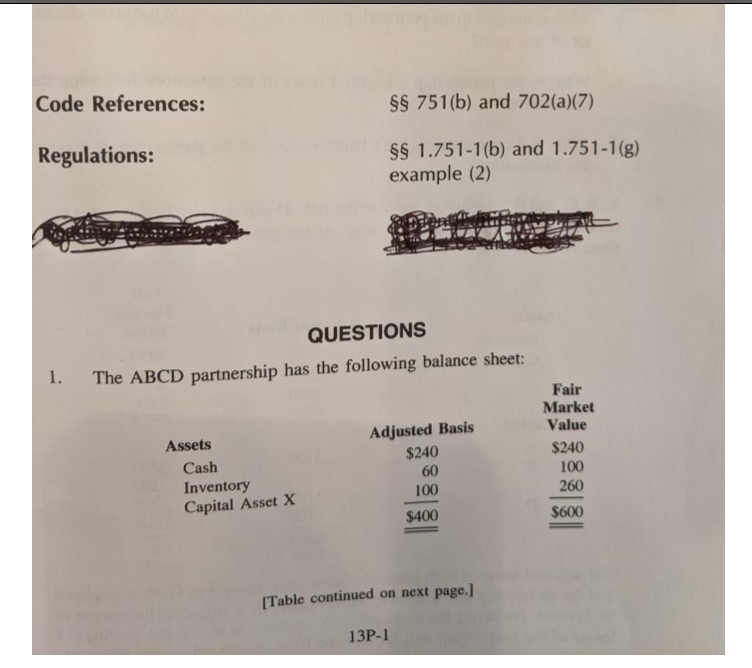

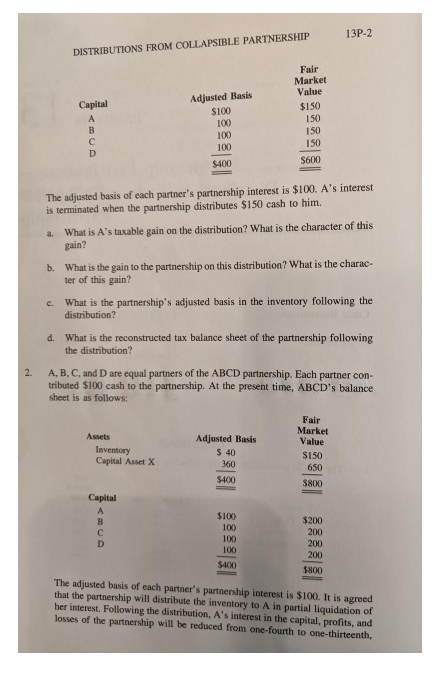

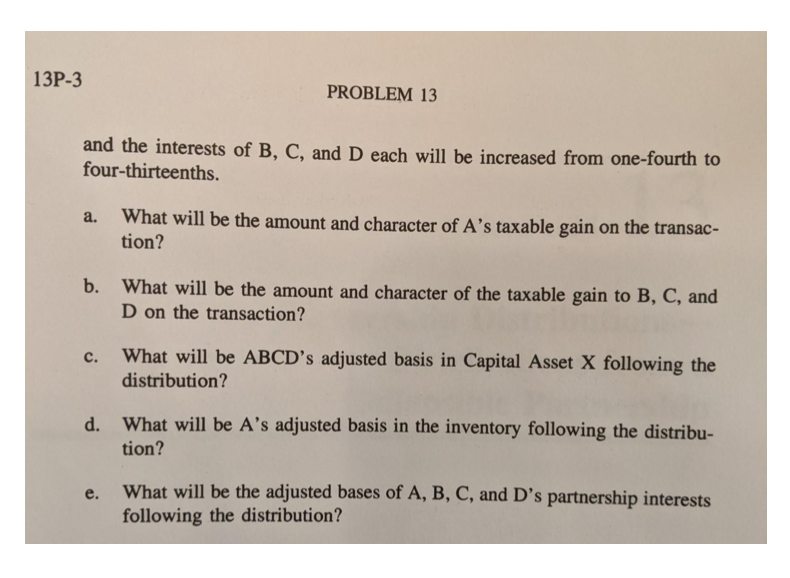

Code References: SS 64, 731(a), 732(b), 732(c), 733, and 735(a) Regulations: SS 1.731-1(a), 1.731-1(b), 1.732-1(b), and 1.732-1(c) Read QUESTIONS A and B are equal partners in the AB partnership. AB has the following assets: Fair Market Adjusted Basis Value Cash $ 60 $ 60 Accounts Receivable 0 30 Inventory 30 30 Land (investment) 120 60 Total $210 $180 A's basis in her partnership interest is $100. B's basis is $75. A and B pur- 12P-112P-2 DISTRIBUTIONS IN LIQUIDATION chased their interests from C and D in separate transactions spanning a three- year period without precipitating a termination. The partnership never has elected under $ 754. What is each partner's gain or loss and basis in the distrib uted assets if the partnership is liquidated as follows? 1. A and B each receives one-half of each asset. 2. A receives the land, one-half of the inventory, and one-half of the accounts receivable, and B receives the cash, one-half of the inventory, and one- half of the accounts receivable. 3. A receives the cash, one-half of the inventory, and one-half of the ac- counts receivable, and B receives the land, one-half of the inventory, and one-half of the accounts receivable. 4. A receives the land and the accounts receivable, and B receives the cash and inventory. 5. A receives the cash and accounts receivable, and B receives the land and the inventory.Code References: SS 751(b) and 702(a)(7) Regulations: SS 1.751-1(b) and 1.751-1(g) example (2) QUESTIONS 1. The ABCD partnership has the following balance sheet: Fair Market Value Assets Adjusted Basis $240 $240 Cash 60 100 Inventory Capital Asset X 100 260 $400 $600 [Table continued on next page.] 13P-113P-2 DISTRIBUTIONS FROM COLLAPSIBLE PARTNERSHIP Fair Market Adjusted Basis Value Capital $100 $150 100 150 100 150 100 150 $400 $600 The adjusted basis of each partner's partnership interest is $100. A's interest is terminated when the partnership distributes $150 cash to him. A. What is A's taxable gain on the distribution? What is the character of this gain? b. What is the gain to the partnership on this distribution? What is the charac- ter of this gain? c. What is the partnership's adjusted basis in the inventory following the distribution? d. What is the reconstructed tax balance sheet of the partnership following the distribution? 2. A, B, C, and D are equal partners of the ABCD partnership. Each partner con- tributed $100 cash to the partnership. At the present time, ABCD's balance sheet is as follows: Fair Assets Market Adjusted Basis Value Inventory $ 40 Capital Asset X $150 360 650 $400 $800 Capital A $100 $200 100 200 D 100 200 100 200 $400 $800 The adjusted basis of each partner's partnership interest is $100. It is agreed that the partnership will distribute the inventory to A in partial liquidation of her interest. Following the distribution, A's interest in the capital, profits, and losses of the partnership will be reduced from one-fourth to one-thirteenth,13P-3 PROBLEM 13 and the interests of B, C, and D each will be increased from one-fourth to four-thirteenths. a. What will be the amount and character of A's taxable gain on the transac- tion? b. What will be the amount and character of the taxable gain to B, C, and D on the transaction? c. What will be ABCD's adjusted basis in Capital Asset X following the distribution? d. What will be A's adjusted basis in the inventory following the distribu- tion? e. What will be the adjusted bases of A, B, C, and D's partnership interests following the distribution