Solve and explain

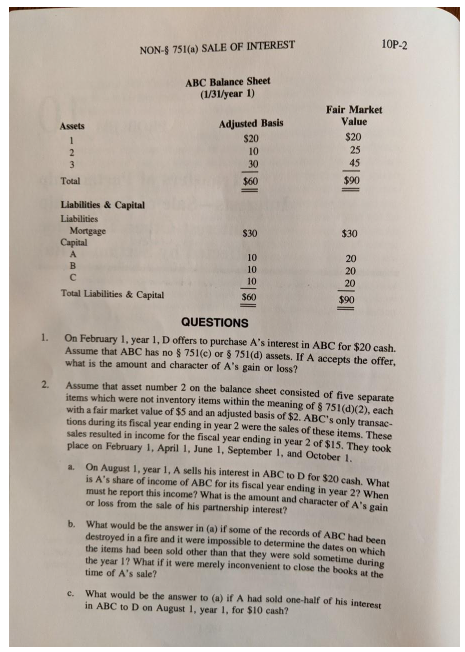

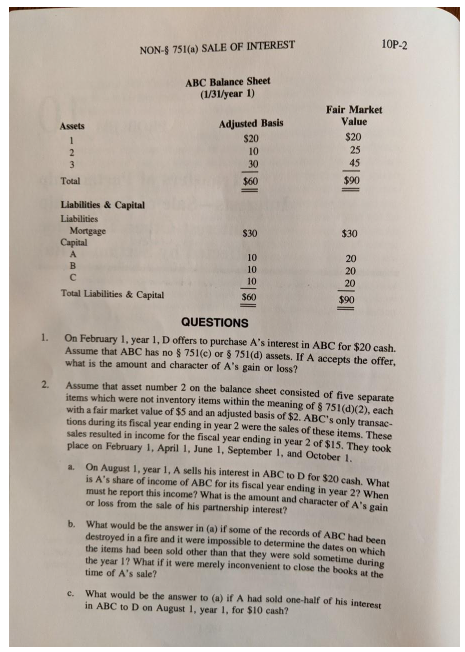

Interest Other Than One Affected by Section 751(a) Code References: SS 741, 742, 752(d), 705(a), 706(a), 706(c) Regulations: SS 1.705-1(a), 1.706-1(a), 1.706-1(c)(2), 1.706-1(c)(4), 1.741-1, 1.742-1, and 1.752- 1(h) Reading Assignment: Student Edition (Vol. 2) 11 12.01(1)-12.01[5] and 9.06[6)-9.06[8] FACTS A, B, and C are the original members of the cash method, January 31 fiscal year, ABC general partnership. Each partner has a one-third interest in capital, profits, and losses of ABC. Each contributed $10 in cash to the partnership. The partnership has had no income to date. 10P-2 NON-$ 751(a) SALE OF INTEREST ABC Balance Sheet (1/31/year 1) Assets 1 2 3 Total Adjusted Basis $20 10 30 Fair Market Value $20 25 45 $90 $60 $30 $30 Liabilities & Capital Liabilities Mortgage Capital A B 10 10 10 20 20 20 $90 Total Liabilities & Capital $60 1. QUESTIONS On February 1, year 1, D offers to purchase A's interest in ABC for $20 cash. Assume that ABC has no $ 751(e) or $ 751(d) assets. If A accepts the offer, what is the amount and character of A's gain or loss? 2. Assume that asset number 2 on the balance sheet consisted of five separate items which were not inventory items within the meaning of $ 751(d)(2), each with a fair market value of $5 and an adjusted basis of $2. ABC's only transac- tions during its fiscal year ending in year 2 were the sales of these items. These sales resulted in income for the fiscal year ending in year 2 of $15. They took place on February 1, April 1, June 1, September 1, and October 1 On August 1 year 1, A sells his interest in ABC to D for $20 cash. What is A's share of income of ABC for its fiscal year ending in year 2? When must he report this income? What is the amount and character of A's gain or loss from the sale of his partnership interest? b. What would be the answer in (a) if some of the records of ABC had been destroyed in a fire and it were impossible to determine the dates on which the items had been sold other than that they were sold sometime during the year I? What if it were merely inconvenient to close the books at the time of A's sale? What would be the answer to (a) if A had sold one-half of his interest in ABC to D on August 1, year 1, for $10 cash? c. Interest Other Than One Affected by Section 751(a) Code References: SS 741, 742, 752(d), 705(a), 706(a), 706(c) Regulations: SS 1.705-1(a), 1.706-1(a), 1.706-1(c)(2), 1.706-1(c)(4), 1.741-1, 1.742-1, and 1.752- 1(h) Reading Assignment: Student Edition (Vol. 2) 11 12.01(1)-12.01[5] and 9.06[6)-9.06[8] FACTS A, B, and C are the original members of the cash method, January 31 fiscal year, ABC general partnership. Each partner has a one-third interest in capital, profits, and losses of ABC. Each contributed $10 in cash to the partnership. The partnership has had no income to date. 10P-2 NON-$ 751(a) SALE OF INTEREST ABC Balance Sheet (1/31/year 1) Assets 1 2 3 Total Adjusted Basis $20 10 30 Fair Market Value $20 25 45 $90 $60 $30 $30 Liabilities & Capital Liabilities Mortgage Capital A B 10 10 10 20 20 20 $90 Total Liabilities & Capital $60 1. QUESTIONS On February 1, year 1, D offers to purchase A's interest in ABC for $20 cash. Assume that ABC has no $ 751(e) or $ 751(d) assets. If A accepts the offer, what is the amount and character of A's gain or loss? 2. Assume that asset number 2 on the balance sheet consisted of five separate items which were not inventory items within the meaning of $ 751(d)(2), each with a fair market value of $5 and an adjusted basis of $2. ABC's only transac- tions during its fiscal year ending in year 2 were the sales of these items. These sales resulted in income for the fiscal year ending in year 2 of $15. They took place on February 1, April 1, June 1, September 1, and October 1 On August 1 year 1, A sells his interest in ABC to D for $20 cash. What is A's share of income of ABC for its fiscal year ending in year 2? When must he report this income? What is the amount and character of A's gain or loss from the sale of his partnership interest? b. What would be the answer in (a) if some of the records of ABC had been destroyed in a fire and it were impossible to determine the dates on which the items had been sold other than that they were sold sometime during the year I? What if it were merely inconvenient to close the books at the time of A's sale? What would be the answer to (a) if A had sold one-half of his interest in ABC to D on August 1, year 1, for $10 cash? c