Answered step by step

Verified Expert Solution

Question

1 Approved Answer

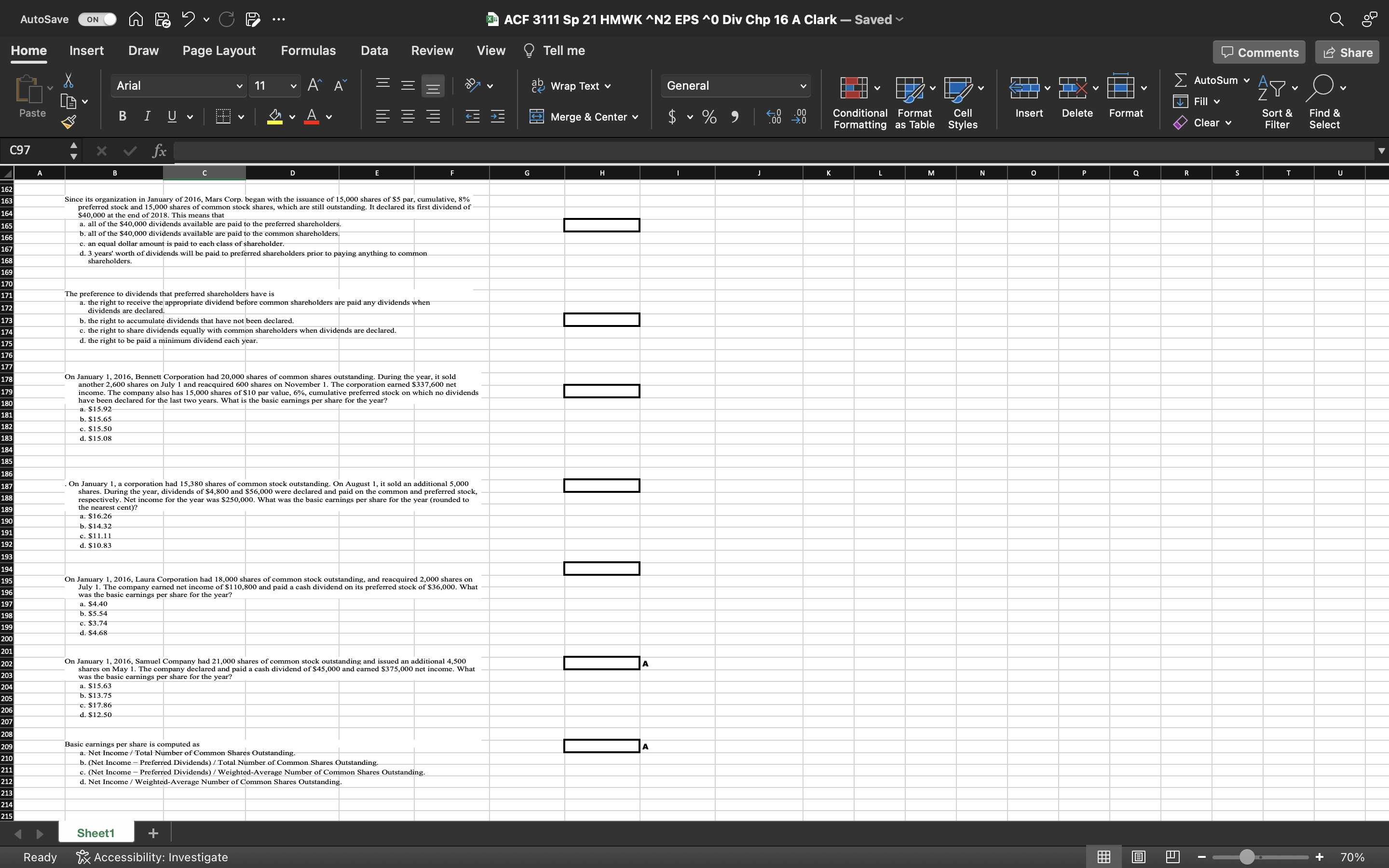

Solve and show work please AutoSave Draw Arial Page Layout v 11 Formulas Data Review ACF 3111 sp 21 HMWK AN2 EPS Div Chp 16

Solve and show work please

AutoSave Draw Arial Page Layout v 11 Formulas Data Review ACF 3111 sp 21 HMWK AN2 EPS Div Chp 16 A Clark View Q Tell me Saved v Home Paste C97 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 181 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 Ready Insert Comments AutoSum v Wrap Text v Merge & Center v General Conditional Formatting Format as Table Cell Styles Insert Format 1.4 Share Find & Select Fill v Clear v - Sort & Filter Since its organization in January of 2016, Mars Corp. began with the issuance of 15,000 shares of $5 par, cumulative, 8% preferred stock and 15 ,OOO shares of common stock shares, which are still outstanding. It declared its first dividend of S40,OOO at the end of 2018. This means that a. all of the $40,000 dividends available are paid the preferred shareholder . all of the S40,OOO dividends available are paid Co the common sharehol sharehol years' w shareholders. The preference to dividends that preferred shareholders have is . the right to receive the appropriate dividend b vidends are dec b. the right to accumulate dividends that have not een declared. c. the right to share dividends equally with common shareholders when divid e right paida nimum dividend each ds are declared. On January 1, 2016, Bennett Corporation had 20,000 shares of common shares outstanding. During the year, it sold another 2,600 shares on July 1 and reacquired 600 shares on November 1. The corporation earned $337,600 net income. The company also has 15,000 shares of $10 par value, 6%, cumulative preferred stock on which no dividends have been declared for the last two years. What is the basic earnings per share for the year? 5. s. c. $15.50 d. $15.08 On January 1 , a corporation had 15,380 shares of common stock outstanding. On August 1 , it sold an additional 5,000 shares. During the year, dividends of $4,800 and $56,000 were declared and paid on the common and preferred stock, respectively. Net income for the year was $250,000. What was the basic earnings per share for the year (rounded to the nearest cent)? 6. . $11. d. $10.83 On January 1, 2016, Laura Corporation had 18,000 shares of common stock outstanding, and reacquired 2,000 shares on July 1. The company earned net income of $110,800 and paid a cash dividend on its preferred stock of $36,000. What was the basic earnin er share for the a. $4.40 b. $5.54 On January 1, 2016, Samuel Company had 21 ,OOO shares of common stock outstanding and issued an additional 4,500 shares on May 1. The company declared and paid a cash dividend of S45,OOO and earned $375,000 net income. What was the basic earnings per share for the year? a. $15.63 Basic earnings per share is computed as et IncomeM40tal Number of Dividends)MTotaV c. (Net Income. Preferred Dividends) / Weighted-Average Number of Common Shares Outstandin d. Net Income / Weighted-Average Number of on Shares Outstandin Sheetl Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started