Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve any 2 questions please urgently ] 5. Imagine that the market yield to maturity for two-year bonds in a particular risk class is 9

solve any 2 questions please urgently

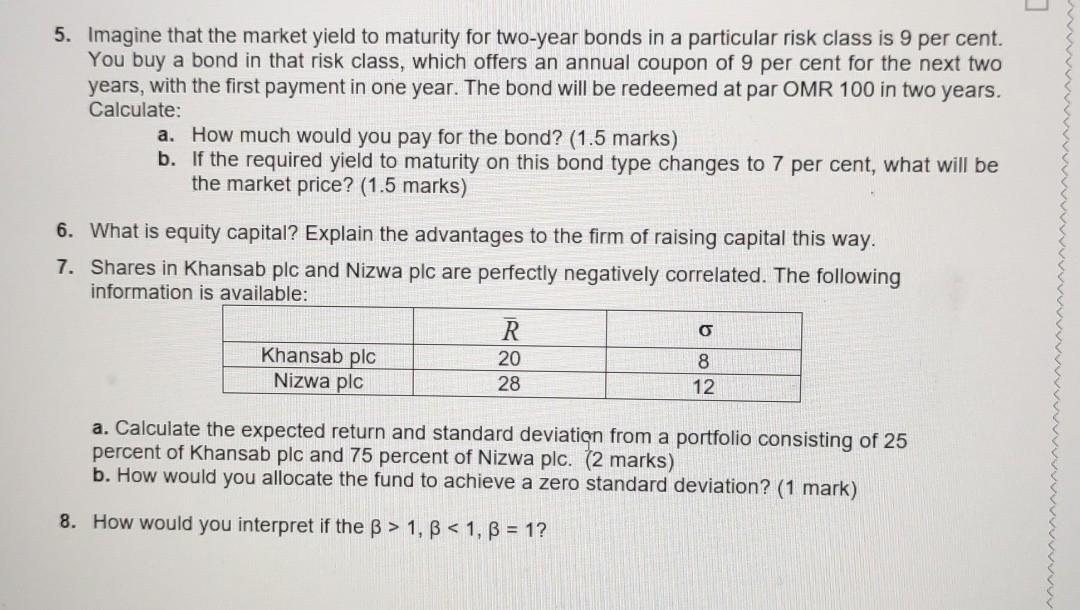

] 5. Imagine that the market yield to maturity for two-year bonds in a particular risk class is 9 per cent. You buy a bond in that risk class, which offers an annual coupon of 9 per cent for the next two years, with the first payment in one year. The bond will be redeemed at par OMR 100 in two years. Calculate: a. How much would you pay for the bond? (1.5 marks) b. If the required yield to maturity on this bond type changes to 7 per cent, what will be the market price? (1.5 marks) 6. What is equity capital? Explain the advantages to the firm of raising capital this way. 7. Shares in Khansab plc and Nizwa plc are perfectly negatively correlated. The following information is available: R Khansab plc 20 8 Nizwa plc 28 12 a. Calculate the expected return and standard deviation from a portfolio consisting of 25 percent of Khansab plc and 75 percent of Nizwa plc. (2 marks) b. How would you allocate the fund to achieve a zero standard deviation? (1 mark) 8. How would you interpret if the > 1, BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started