Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve as soon as possible Extract from balance sheet of Polaris Ltd is given below: Source Description Amount Equity share capital 500 lac shares of

solve as soon as possible

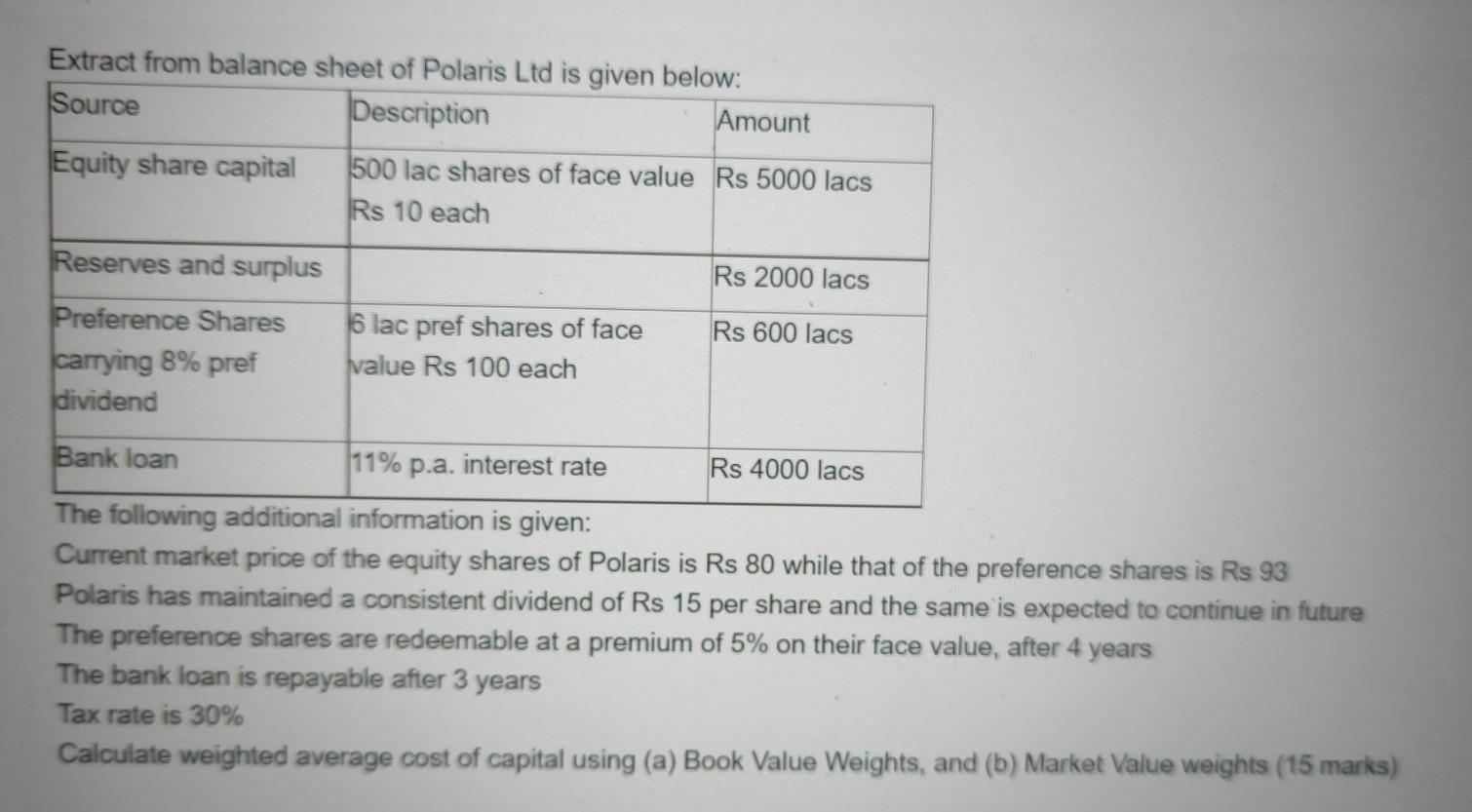

Extract from balance sheet of Polaris Ltd is given below: Source Description Amount Equity share capital 500 lac shares of face value Rs 5000 lacs Rs 10 each Reserves and surplus Rs 2000 lacs Rs 600 lacs Preference Shares carrying 8% pref dividend 6 lac pref shares of face value Rs 100 each Bank loan 11% p.a. interest rate Rs 4000 lacs The following additional information is given: Current market price of the equity shares of Polaris is Rs 80 while that of the preference shares is Rs 93 Polaris has maintained a consistent dividend of Rs 15 per share and the same is expected to continue in future The preference shares are redeemable at a premium of 5% on their face value, after 4 years The bank loan is repayable after 3 years Tax rate is 30% Calculate weighted average cost of capital using (a) Book Value Weights, and (b) Market Value weights (15 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started